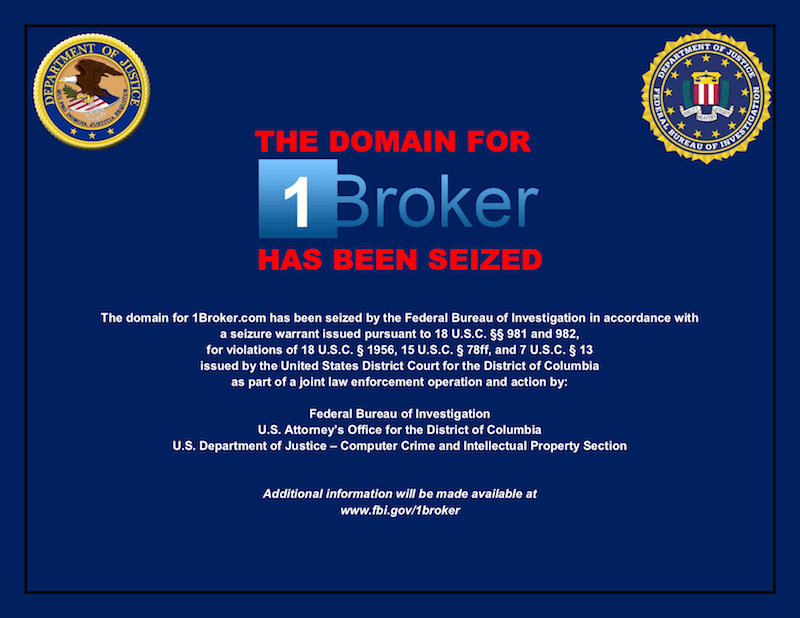

On September 27th the U.S. Securities and Exchange Commission posted an official press release with the news that 1Broker platform was shut due to alleged money laundering accusations and violating the U.S. local regulations on trading operations. The statement says that:

The Securities and Exchange Commission today filed charges against an international securities dealer and its Austria-based CEO for allegedly violating the federal securities laws in connection with security-based swaps funded with bitcoins.

The company 1Pool Ltd. is registered in the Republic of Marshall Islands and supports two exchange platforms – 1Broker and 1Fox. Both of them deal with cryptocurrencies and crypto-related funds and operate as brokers between traders.

The story with the violated regulations dates two years ago. It seems that 1Broker’s verification process did not meet U.S. standard because, according to the release, investors could register only with a name and an email. The Federal Bureau of Investigations nosed the case out and hired a Special agent to chase the deals. He was put under cover and went online to check out the platform’s operations. Despite not compliant with the mandatory investment requirements, the agent could successfully buy security-based swaps funded with Bitcoins.

Although our terms of service explicitly state that customers have to verify that using our service is legal in their country of residence, the domain was closed because a Special Agent with the Federal Bureau of Investigation was able to create trades on 1Broker.

Reads the announcement posted on the 1Pool Ltd. website. Apparently, the company relied on clients’ honesty and awareness to state local security laws and to check if they are even eligible to execute trades on the 1Broker platform.

Now, the firm reassures all their customers that their funds are safe.

This means that the trading panel is not accessible anymore – funds, servers, and databases are not affected. Currently, our top priority is to allow customer withdrawals. The company holds enough funds to cover all withdrawal requests, of course.

At the moment, company’s official speakers say, 1Pool Ltd. works closely with the authorities and received a green light from their attorneys to develop a read-only version of 1Broker where traders and investors can track their assets. Open positions are frozen at the prices of the prior moment on 28th of September when the site was finally seized. The Marshall-Islands based firm says it works primarily on users’ withdrawals, but the process might take a few days.

Updates are to be posted on 1Pool Ltd. official website: https://1pool.ltd/