Initial Coin Offering (ICO) is a popular method in the cryptocurrency world for raising significant funds. It serves as both an investment opportunity and a fundraising mechanism. An ICO involves a startup or company issuing digital tokens to investors to finance a new business initiative. These tokens represent a unit of value tied to the project, akin to how venture capital or stock market shares work in traditional finance. The key difference lies in using blockchain technology to facilitate these transactions, offering a decentralized and global reach.

What is the difference between ICO and IPO?

The concept of the ICO is indeed quite similar to the Initial Public Offering (IPO). A fundamental difference is that an IPO marks an equity stake in a company; buying one means you own a part of the company. This is not the case with the ICO, though. ICO’s goal is to collect money for a certain business idea and then to become a tradable unit. When the crowd sale is complete, the Offering might become a cryptocurrency as it is the case with Ethereum and its native tokens Ethers, for instance. Another essential difference is that the ICO is tokenized, it is a crypto offering and includes less paperwork and regulations.

How ICOs Work

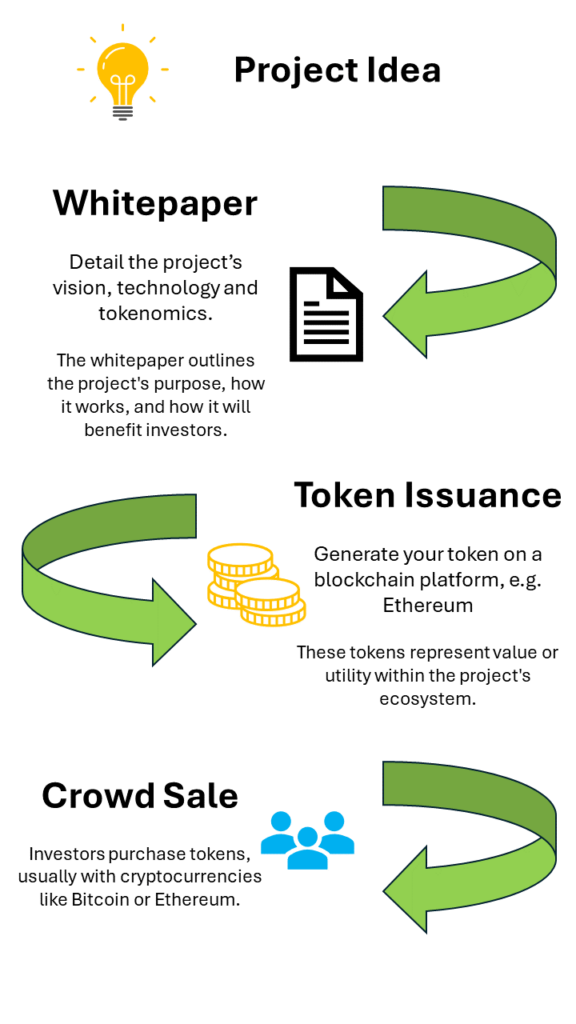

It starts with a company developing a blockchain-based project. They create a detailed whitepaper that outlines the project’s goals, technology, and tokenomics. This document is crucial for attracting potential investors. Once the project is well-defined, the company generates tokens on a blockchain platform like Ethereum. These tokens are then sold to investors in exchange for established cryptocurrencies such as Bitcoin or Ethereum during the ICO event. Effective marketing campaigns, utilizing social media and crypto forums, help to create buzz around the ICO and attract a broader audience. ICOs may have multiple stages, including pre-sales offering tokens at a discount to early investors.

Benefits and Risks

Benefits

ICOs offer several advantages, such as reaching a global pool of investors and providing liquidity, as tokens can often be traded on various cryptocurrency exchanges shortly after the ICO. This democratizes investment opportunities, making them accessible to anyone with internet access and cryptocurrency.

Risks

ICOs, though promising, carry risks. The lack of regulations in the ICO space has resulted in a rise of fraudulent schemes. Investors need to research thoroughly to steer clear of scams. Additionally, the ambiguity surrounding regulations, across countries poses another hurdle. Furthermore, the fluctuating value of tokens can expose investors to financial risks.

Examples of ICOs

Successful ICOs

One of the most notable successful ICOs is Ethereum (ETH), which raised $18 million in 2014. Ethereum introduced the concept of smart contracts, revolutionizing the blockchain space. Another successful ICO is Filecoin (FIL), which raised $257 million in 2017 and aims to create a decentralized storage network.

Cautionary Tales

However, not all ICOs have been successful. BitConnect (BCC), for example, raised over $1 billion before being shut down as a Ponzi scheme in 2018, resulting in significant losses for investors.

How to Participate in an Initial Coin Offering (ICO)

Participating in an ICO involves several steps:

- Research: Thoroughly investigate the project, its team, and its whitepaper to understand the project’s viability and potential.

- Create a Wallet: Set up a cryptocurrency wallet compatible with the ICO tokens.

- Acquire Cryptocurrency: Purchase the required cryptocurrency, e.g. Bitcoin or Ethereum, to participate in the ICO.

- Participate in the Sale: Follow the ICO’s specific instructions to buy tokens during the sale period.

To ensure safe participation, it’s crucial to conduct due diligence by verifying the legitimacy of the project and its team. Utilize secure wallets and be cautious of phishing attacks. Always ensure the website is legitimate before making any transactions.

Regulatory Compliance

Adhering to legal and regulatory requirements is crucial for the legitimacy and success of an ICO. Regulations vary by country, with some jurisdictions having strict rules and others being more lenient. Staying informed about the latest regulatory developments helps navigate this complex landscape.

Recent Regulatory Developments

The SEC has increased scrutiny of ICOs in the United States, classifying many tokens as securities. The European Union is moving towards creating a unified framework for digital assets, while Asian countries like China have banned ICOs, and others like Singapore and Japan have more favorable regulations.

ICOs offer an innovative way for startups to raise capital and investors to engage with new projects. However, the benefits come with significant risks, including regulatory challenges and the potential for scams. Thorough research and due diligence are essential for anyone looking to participate in an ICO.

But this guy talks so engagingly, that I find it useless to continue.

Also, check out these 5 super innovative green ICO’s.

*Video content posted on Crispybull is under the Creative Commons License. Credit goes to Siraj Laval.