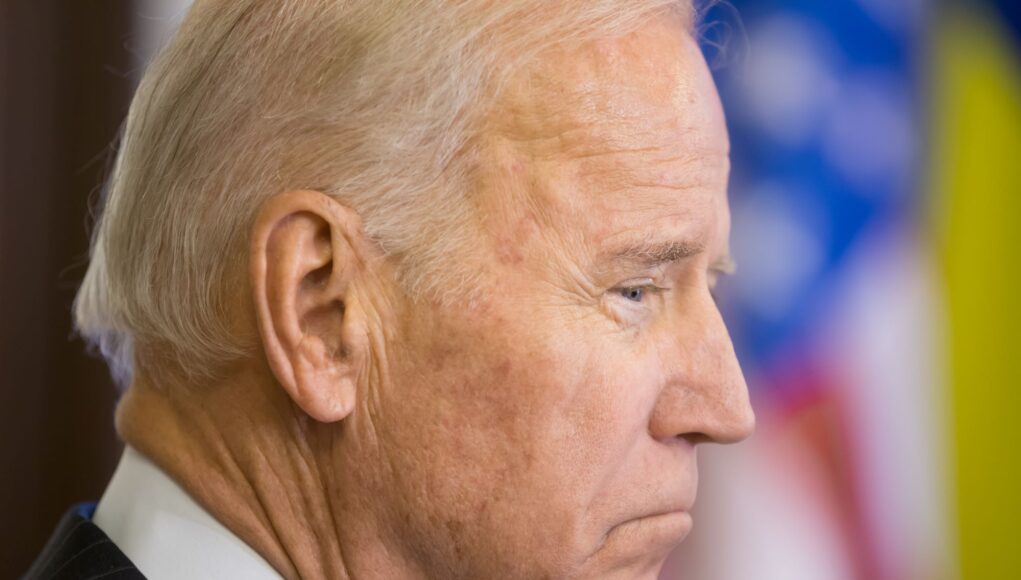

President Joe Biden has vetoed the House Joint Resolution 109, reinforcing the Securities and Exchange Commission’s (SEC) controversial Staff Accounting Bulletin 121 (SAB 121). This decision marks a significant moment in the ongoing debate over how digital assets are handled by financial institutions in the United States.

The Controversy Surrounding SAB 121 and Crypto Assets

SAB 121, introduced by the SEC, mandates that banks and other financial institutions treat crypto assets as liabilities on their balance sheets. Many in the banking and crypto sectors criticized this accounting guidance. It makes it prohibitively expensive and operationally complex for banks to offer crypto custody services. The regulation was intended to provide robust protections for investors and consumers, especially in the wake of high-profile crypto company collapses like FTX.

Biden’s Justification for the Veto

In his veto message, President Biden emphasized the need for “appropriate guardrails” to protect consumers and investors. He argued that rescinding SAB 121 through the Congressional Review Act would undermine the SEC’s authority to set necessary accounting standards and respond to future issues effectively.

Biden’s statement read, “This Republican-led resolution would inappropriately constrain the SEC’s ability to set forth appropriate guardrails and address future issues… My Administration will not support measures that jeopardize the well-being of consumers and investors.”

Implications for the Crypto Industry

The SEC’s SAB 121 has been a contentious issue since its inception. Banking institutions have argued that the guidance makes scaling crypto asset custody services nearly impossible. Proponents, however, assert it is essential for safeguarding investors. The veto means that banks will continue to face significant hurdles in offering crypto custody services. This potentially limits the growth of crypto adoption within traditional financial systems.

Reaction from Lawmakers and Industry

The resolution had garnered substantial bipartisan support, passing the House with 228 votes in favor and the Senate with 60. Many lawmakers, including some Democrats, believed the guidance was overly restrictive. For instance, Senator Ron Wyden expressed concern that SAB 121 creates an unnecessary burden for financial institutions compared to other assets.

Industry groups like the American Bankers Association and the crypto advocacy group Stand With Crypto have been vocal opponents of SAB 121. They argue that the guidance stifles innovation and limits consumer options for secure digital asset storage.

The Path Forward for Crypto Regulation

Despite the veto, President Biden expressed willingness to work with Congress. He demanded to establish a comprehensive and balanced regulatory framework for digital assets. He stated, “My Administration is eager to work with Congress to ensure a comprehensive and balanced regulatory framework for digital assets, building on existing authorities, which will promote the responsible development of digital assets and payment innovation.”.

This signals a potential for future legislative efforts to address the concerns raised by the banking and crypto communities while ensuring consumer protection.

President Biden’s veto of House Resolution H.J.Res. 109 upholds the SEC’s SAB 121. It emphasizes the need for strict accounting standards for crypto assets to protect consumers and investors. The veto faced criticism from various sectors. At the same time, it opens the door for further dialogue on creating a balanced regulatory framework for digital assets in the U.S. The ongoing debate highlights the challenges and opportunities in integrating cryptocurrencies into the traditional financial system.

Read more: Will Crypto Decide the 2024 U.S. election?

[…] cornerstone of the Trump administration’s recent pro-crypto agenda is the repeal of Staff Accounting Bulletin No. 121 (SAB 121) by the Securities and Exchange Commission (SEC). This regulation, introduced in 2022, mandated that […]