It was supposed to be another routine Friday. Then, in the span of a few chaotic hours, the crypto market collapsed into what traders now call Crypto’s Black Friday, a sudden crypto flash crash erasing over $550 billion in market value before staging a dramatic rebound over the weekend.

Bitcoin dropped below $110,000, while Ethereum and altcoins tumbled by double digits. Nearly $19 billion in leveraged positions were wiped out. By Monday morning, the market had clawed back almost half those losses, leaving analysts divided. Was this a coordinated attack, a technical glitch, or simply the price of too much leverage?

How the panic started

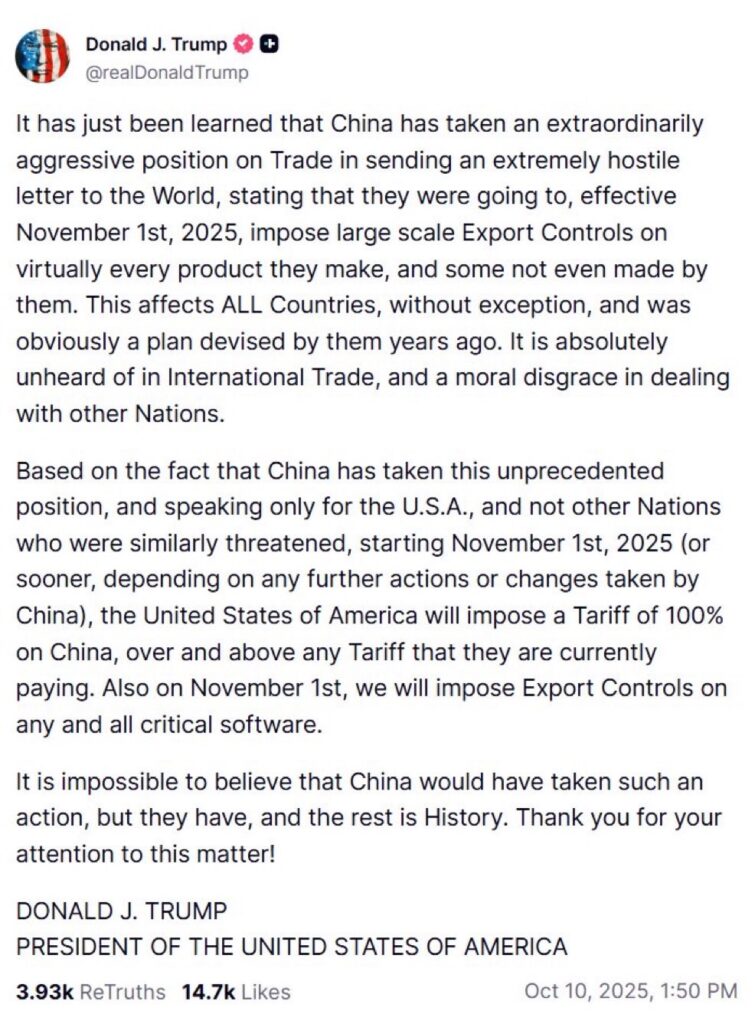

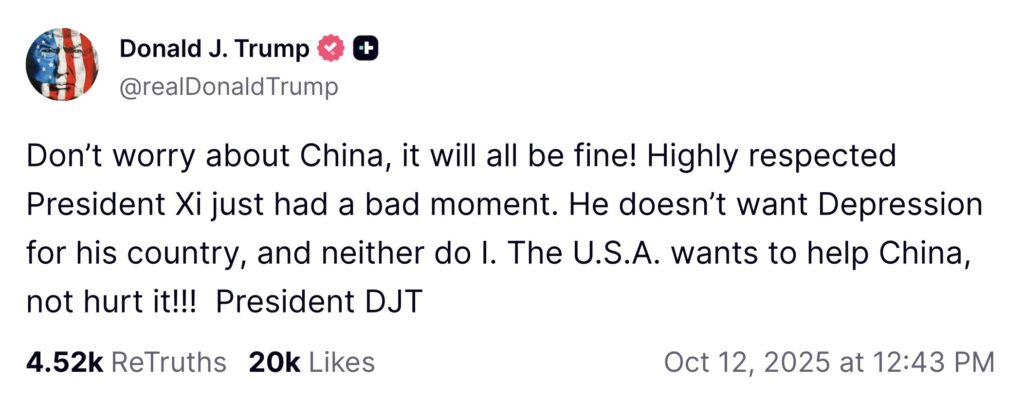

The sell-off began after a sharp Trump tariff announcement on Friday morning, a “100% tariff on Chinese imports” that immediately spooked global traders. As a result, risk assets wobbled, and crypto, already overloaded with leverage, became the first casualty.

Within minutes, large traders started trimming positions. Liquidity evaporated, market-making bots stepped back, and futures spreads widened. Consequently, what started as a macro reaction quickly turned into a structural breakdown as forced liquidations kicked in across major exchanges.

When leverage turns lethal

In highly leveraged markets, even small drops can snowball. Once the first wave of stop-losses hit, automated liquidation engines began selling crypto collateral to cover margin calls. The bitcoin price crash also triggered additional automated liquidations across derivative platforms, which amplified the sell-off. This cascade triggered more forced sales, which intensified the crash.

Data aggregators later counted more than $19 billion in liquidations, with long positions making up the majority. A well-known crypto whale, who reportedly earned $192 million shorting Bitcoin before the crash, even opened a new $163 million short position afterward. This fed speculation that the event was orchestrated.

However, forensic data tells a simpler story. Overcrowded leverage met thin liquidity, and the crypto flash crash was more mechanical than malicious.

When prices stopped making sense: the Binance moment

As the cascade spread, Binance became the epicenter of chaos. Certain tokens, including USDe, bnSOL, and wBETH, appeared to depeg dramatically, losing parity with their underlying assets.

The USDe stablecoin, issued by Ethena, traded far below $1 on Binance but remained stable elsewhere. Ethena’s founder quickly clarified that it was “not a true depeg, only a Binance-specific price slip.”

Binance attributed the issue to thin internal liquidity and auto-liquidation pressure from its cross-margin system. Because these synthetic assets mainly trade on Binance, their order books emptied faster than the broader market.

To contain the fallout, Binance announced $283 million in reimbursements for users affected by the depegs and published compensation terms for USDe, bnSOL, and wBETH pairs. It also denied responsibility for triggering the wider crash, insisting its systems “operated as intended under extreme conditions.”

As a result, many traders now view the episode as a warning about overreliance on a single exchange for liquidity.

From fear to rebound

After the carnage, market sentiment hit rock bottom. The Fear and Greed Index plunged to its lowest level of the year, signaling peak panic among investors.

Nevertheless, by Sunday evening, the market began healing. Spot buyers stepped in, open interest rebuilt, and confidence gradually returned. Bitcoin climbed back near $115,000, and total crypto market capitalization recovered roughly $190 billion.

In hindsight, Crypto’s Black Friday resembled a forced leverage reset. Although it was painful for traders, it ultimately cleared excess risk from the system.

What the data says: crash theories collide

Analysts remain split on what really caused the event.

- Macro camp: points to tariff shocks and policy uncertainty as the spark.

- Manipulation camp: argues a few large players timed shorts to profit from the cascade.

- Microstructure camp: highlights order-book fragility and derivative unwind patterns as the real culprit.

However, blockchain data supports the latter view. There was no exploit, no exchange breach, and no hidden manipulation trail. It was, therefore, a chain reaction of leverage, speed, and shallow liquidity amplified by panic.

In short, the crypto flash crash exposed the fragility of the ecosystem when leverage peaks and liquidity simultaneously thins out.

Why Binance alone saw depegs during the crash

Unlike other exchanges, Binance hosts synthetic versions of assets such as wBETH, bnSOL, and the USDe stablecoin that rely on its internal liquidity pools. When cross-margin liquidations hit, these assets were automatically sold into their own thin markets, draining depth almost instantly.

At the same time, Binance’s internal price feeds lagged external markets by seconds, which caused its interface to display large gaps between reference and live prices.

Other exchanges did not suffer similar distortions because they either do not list those wrapped tokens or use separate collateral pools for margin trading.

Consequently, Binance looked broken while others appeared normal, a venue-specific anomaly rather than a global failure.

Lessons from the crash

- Leverage is a double-edged sword. Excessive borrowing amplifies every price move.

- Exchange risk is real. Synthetic and wrapped assets can exhibit unpredictable behavior during stress events.

- Diversification matters. Holding funds across venues helps reduce single-exchange exposure.

- Macro headlines can ignite technical avalanches. What starts as tariff news can end as a 10-figure wipeout.

Therefore, while the weekend rebound does not erase the warning, it highlights the need for better risk management across the industry.

After the flood

By Monday, markets were calmer, yet the lessons were clear. Crypto’s Black Friday revealed a truth many forgot during the bull run: price discovery is only as strong as the liquidity beneath it.

The crypto market rebound shows resilience, but the event left lasting scars on trader psychology. As Binance repairs its image and regulators examine the sequence of events, one takeaway remains: in crypto, speed and leverage can break even the strongest hands.

Readers’ frequently asked questions

Was Binance responsible for the crypto flash crash?

No. Binance was not directly responsible for the market-wide crash. The sell-off started with macro triggers and cascading liquidations across exchanges. However, Binance did experience isolated pricing issues that affected some tokens, which led to user reimbursements totaling $283 million.

Did the USDe stablecoin actually depeg from the dollar?

Not in the true sense. The USDe token from Ethena slipped below $1 only on Binance because of thin liquidity and internal pricing lags. On other venues and on-chain, USDe remained stable, so the event is described as a “Binance-only depeg.”

What allowed the crypto market to stabilize after the flash crash?

Once the wave of forced liquidations ended, spot traders and long-term investors reentered the market, restoring liquidity. At the same time, leverage levels normalized, reducing volatility. This combination of fresh capital inflows and lower systemic risk helped stabilize prices and rebuild confidence within days.

What’s in it for you? Action items you might want to consider

Reevaluate your leverage exposure

If you trade with leverage, review your margin settings and liquidation thresholds. Even modest leverage can magnify small price moves into large losses during volatility spikes.

Diversify across exchanges and assets

Don’t keep all trading capital or collateral on one platform. Using multiple exchanges and limiting exposure to synthetic or wrapped tokens can reduce single-venue risk.

Track liquidity and sentiment indicators

Monitor on-chain liquidity levels and tools like the Fear and Greed Index to gauge when markets may be overheated or oversold. These signals often reveal when risk or opportunity is rising before major moves occur.

[…] October 10–11 market crash wiped out billions in leveraged positions. It also triggered the largest wave of forced […]

[…] already heavily leveraged, suffered the worst. Within 24 hours, over $19 billion in positions were wiped out, the largest single-day liquidation in crypto history. The event impacted 1.6 million traders and […]