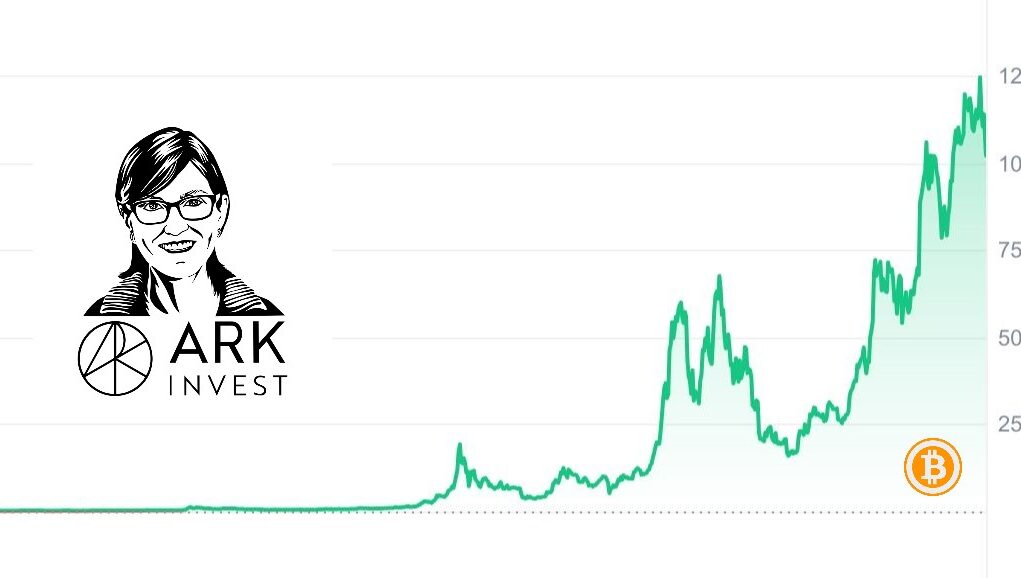

When Cathie Wood dropped her Bitcoin price target from $1.5 million to $1.2 million for 2030, headlines rushed to interpret it as a warning sign. The revision, announced in ARK Invest’s latest update, cited stablecoin adoption in emerging markets as the key reason for a more conservative outlook.

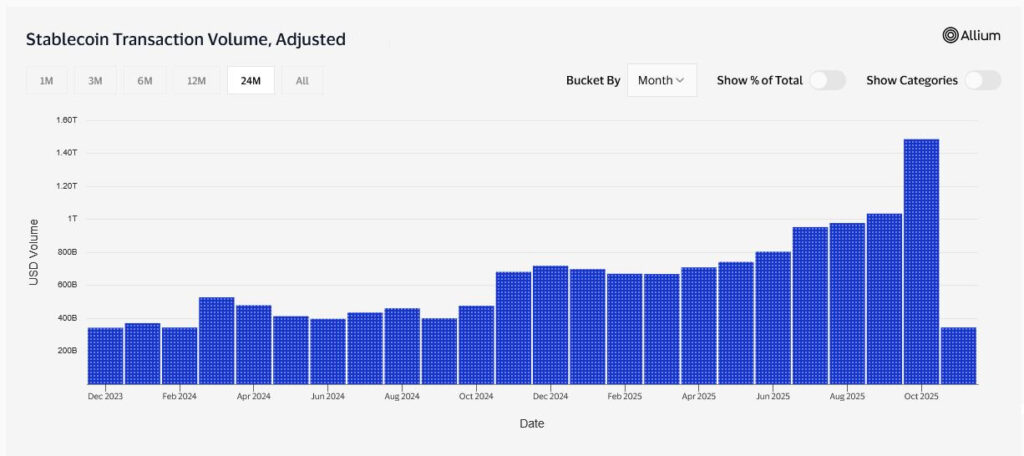

Mainstream outlets framed the move as a sign that stablecoins are eating Bitcoin’s lunch. But the data tells a more nuanced story. In 2025 alone, stablecoins processed over $8.9 trillion in on-chain volume, an 83% increase year-over-year. What’s happening isn’t a displacement; it’s a redistribution of monetary velocity across crypto’s layered economy.

For ARK and other institutional investors tracking the ARK Invest Bitcoin forecast, this shift reflects a maturing market where stablecoins dominate crypto payments in emerging markets. At the same time, Bitcoin consolidates its position as the foundational settlement asset. Crucially, Wood remains bullish, expecting approximately 1,600% appreciation from current levels even with the lowered target. The move highlights a recalibration, not a rejection, and faith in Bitcoin’s long-term potential remains.

The Media’s Surface Narrative

After Wood remarked that stablecoins are “usurping” Bitcoin’s role in day-to-day transactions, most coverage adopted a predictable framing: “Stablecoins Displace Bitcoin in Payments,” “Stablecoins Eating Bitcoin’s Lunch,” and similar takes. For instance, headlines on major finance platforms echoed fears of Bitcoin losing relevance to faster stablecoins.

This framing oversimplifies a complex relationship. The stablecoins vs Bitcoin narrative assumes a zero-sum contest between two assets competing for the same use cases. But in reality, they serve different functions within the same digital monetary system. Stablecoins thrive on transactional velocity, while Bitcoin underpins the system’s liquidity, network security, and reserve status. For readers asking why Cathie Wood cut the Bitcoin price target, the answer isn’t rivalry. It’s model recalibration. Stablecoins now absorb the high-frequency payment layer that ARK’s earlier Bitcoin 2030 prediction attributed to BTC itself.

The Overlooked Mechanism: Bitcoin as the Settlement Layer

Here’s what most analyses missed: stablecoins still depend on Bitcoin as the settlement layer. Whether issued on Ethereum, Solana, or Tron, stablecoins remain tied to Bitcoin’s deep liquidity and exchange infrastructure. BTC remains the dominant trading pair across exchanges and an essential component of custodial reserves. Tether’s rising Bitcoin reserves clearly underscore how stablecoin issuers themselves lean on BTC as a store of value.

Cross-chain bridges, Taproot Assets, and experimental Lightning-compatible stablecoins increasingly route transactions through Bitcoin’s network. Even as value moves in USDT or USDC, those settlements often loop through BTC liquidity pools. Many analysts would agree, “Every stablecoin transfer touching crypto liquidity eventually touches Bitcoin.” This feedback loop is accelerating innovation. Developers are already testing Bitcoin-backed stablecoins on the Lightning Network, closing the gap between BTC’s store-of-value base and the stable transaction layer above it.

ARK’s Revision: Reflection of Ecosystem Maturity

Seen through this lens, ARK’s downgrade to a $1.2 million ceiling looks less like a retreat and more like a recognition of ecosystem maturity. Cathie Wood reducing her Bitcoin price target explicitly reflects the portion of transactional velocity now handled by stablecoins rather than direct BTC transfers.

That doesn’t make Bitcoin weaker; it makes it more specialized. The ARK Invest Bitcoin forecast still positions BTC as the apex store of value in a digital economy increasingly powered by tokenized fiat. Meanwhile, Bitcoin institutional adoption through ETFs and corporate treasuries continues to expand. This reinforces its monetary premium even as stablecoins absorb microtransactional roles. In ARK’s model, the lost “velocity” translates into a $300K delta, not an existential downgrade. It marks a more mature valuation model that reflects crypto’s layered financial architecture.

Regulation and Ecosystem Integration

A second driver behind this structural shift is regulation. Frameworks like MiCA in Europe, the upcoming U.S. stablecoin bill, and new Asian licensing regimes are giving legitimacy to stablecoins while hardwiring them into traditional financial systems. Under these new regimes, reserve transparency and collateral composition matter more than ever.

Bitcoin’s liquidity depth and pristine collateral quality make it a benchmark asset for regulated stablecoin reserves. Regulatory clarity is widely seen as linking stablecoin ecosystems even more tightly to Bitcoin’s reserve role. In short, stablecoin regulation like MiCA isn’t separating stablecoins from Bitcoin. It’s institutionalizing their connection instead. Both now move together through the same compliance channels that govern cross-border payments and crypto payments in emerging markets.

What Comes Next: Growth, Layer 2, and Stablecoin Infrastructure

Looking ahead, Bitcoin’s technological expansion is set to accelerate. Bitcoin Layer 2 adoption via Lightning, Ark, and rollup-like protocols is creating faster settlement rails capable of hosting synthetic or pegged assets. Projects developing Bitcoin-backed stablecoins are already exploring hybrid models where USD-denominated balances are secured by BTC collateral.

These instruments could merge the transactional speed of stablecoins with the security and neutrality of Bitcoin. Emerging protocols are experimenting with Bitcoin-native stablecoins and synthetic assets that blend stablecoin transactional advantages with Bitcoin’s settlement finality and security. If successful, this evolution would bring ARK’s Bitcoin 2030 prediction full circle: the monetary layer Wood envisioned may reappear within Bitcoin’s own scaling stack, rather than on competing blockchains.

>>> Read more: Stablecoin Transaction Volume Challenges Payment Giants

Closing Thought

For investors tracking the Cathie Wood Bitcoin price target, the real takeaway isn’t that Bitcoin lost its dominance. It’s that Bitcoin’s role is shifting upward, from being money itself to being the monetary infrastructure of a tokenized world. Stablecoins aren’t Bitcoin’s competition. They’re its acceleration layer!

Readers’ frequently asked questions

What is the difference between a stablecoin and Bitcoin?

Stablecoins are digital tokens pegged to a stable asset like the U.S. dollar or euro, designed to maintain a fixed value. Bitcoin, by contrast, has a variable market price and is used as a decentralized store of value and investment asset rather than a price-stable medium of exchange.

Why are stablecoins important in emerging markets?

In countries with volatile currencies or limited banking access, stablecoins provide an easier way to hold digital dollars and transfer value across borders. They help users avoid local inflation and make cross-border transactions faster and cheaper than traditional remittance channels.

How can everyday users safely hold or transfer stablecoins?

Stablecoins can be stored in digital wallets compatible with their underlying blockchain (like Ethereum or Tron). To reduce risk, users should choose issuers that publish audited reserve reports and only use reputable exchanges or regulated platforms for transfers.

What Is In It For You? Action items you might want to consider

Review your exposure to stablecoins and Bitcoin

If you use stablecoins for payments or savings, assess how they fit alongside Bitcoin in your portfolio. Both assets play different roles. Stablecoins for short-term stability, Bitcoin for long-term value growth.

Use regulated and transparent stablecoin issuers

When holding or transferring stablecoins, choose providers that publish regular reserve attestations and comply with recognized frameworks such as MiCA or U.S. licensing standards.

Follow Bitcoin’s Layer-2 ecosystem development

Watch upcoming protocols like Lightning, Ark, and Taproot Assets. They could enable faster, cheaper stablecoin transfers directly on Bitcoin’s infrastructure, potentially changing how users move value across networks.