Estimated reading time: 8 minutes

TL;DR

- Tether is shifting from earning interest on U.S. Treasuries to financing real-world commodity trades as rates fall and banks retreat from trade finance.

- The strategy centers on Tether commodity lending, a fast-growing portfolio of short-term, collateralized loans to metals, oil, and agricultural traders.

- Tether has already deployed about $1.5 billion into commodity credit and aims for a $5 billion liquidity pool by 2026.

- The company is also investing across supply chains (including gold, oil, and a major agriculture acquisition), turning USDT into a settlement and liquidity tool for real-world trades.

- Regulators are increasingly concerned about transparency, systemic risk, and the fact that Tether is effectively acting as a global, cross-border shadow bank without traditional supervision.

Tether has dominated the crypto markets for years with USDT, the world’s most widely used stablecoin. But its ambitions are now moving far beyond being the default source of dollar liquidity for traders and exchanges. As interest rates fall and the traditional banking system pulls back from financing global trade, the company is stepping into an unexpected role: a major provider of real-world commodity credit.

What began as opportunistic deployment of excess profits has evolved into a strategic shift toward Tether commodity lending, a model that combines over-collateralized loans, global supply-chain exposure, and crypto-native settlement rails. It’s a move that positions Tether as a key source of finance for metals, oil, and agricultural firms; and one that brings a new set of systemic questions.

The End of the Easy-Money Era

For much of 2023–2025, Tether’s business model looked almost effortless. With USDT reserves invested heavily in short-dated U.S. Treasuries, the company earned billions from high interest rates. But as the Federal Reserve begins to cut rates, that era is fading. Lower yields translate to shrinking income on the assets that once generated the bulk of Tether’s profits.

At the same time, banks are facing tighter compliance requirements, higher capital charges, and stricter anti-money-laundering controls. Many have reduced their exposure to trade finance, especially in emerging markets. As a result, funding gaps emerged in sectors like metals, minerals, agriculture, and energy. In these areas working capital is essential and credit cycles move fast.

To preserve profitability and diversify away from rate-dependent income, Tether has turned to new forms of lending backed by commodities. This shift redefines how the company uses its reserves and signals a broader transformation in how stablecoins interface with the real economy.

How Tether Became a Shadow Commodities Bank

Tether has now quietly lent about $1.5 billion to commodity traders, as reported by Bloomberg, often in short-term structures secured by inventory or receivables. The company aims to scale this to a $5 billion commodities liquidity pool by 2026. The loans are typically extended to mid-tier trading firms that struggle to secure financing from banks, either due to compliance friction or elevated risk profiles.

A central part of this strategy is Tether commodity lending. The short-duration credits are denominated in USDT or USD, and are backed by liquid assets and structured to rotate quickly. Borrowers receive funds faster than with traditional lenders and can settle trades on-chain, reducing delays and lowering costs.

This is also where the company’s stablecoin footprint becomes strategically important. As Tether extends more credit, USDT becomes increasingly embedded in commodity transactions. Firms use the stablecoin for working capital, settlement, and even cross-border transfers where traditional banking rails slow them down. The rise of Tether’s commodity lending operations therefore reinforces USDT’s role as a global liquidity instrument.

For commodity traders that operate in regions underserved by banks, Tether has become an alternative source of credit. It acts as a non-bank institution willing to finance trades others avoid.

Building a Commodity Empire: Gold, Oil, and Agriculture

Gold: From Reserve Asset to Supply-Chain Strategy

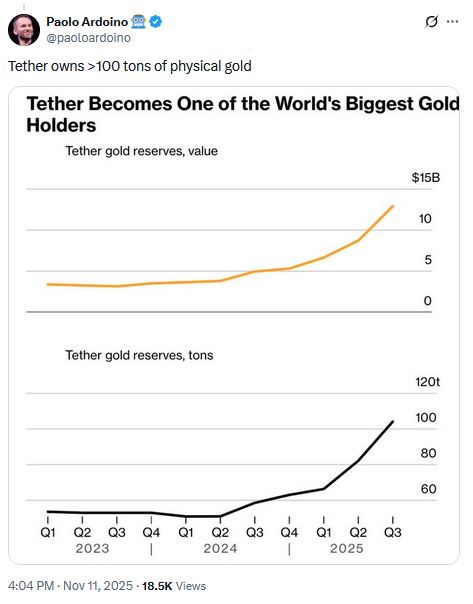

Tether’s gold strategy goes far beyond holding bullion as part of its reserves. The company reportedly manages about $8.7 billion in gold stored in Swiss vaults and has taken positions in mining and royalty companies, including a meaningful stake in Elemental Altus Royalties. This deeper involvement broadens Tether’s exposure to the full value chain, complementing its gold-backed token XAUT and providing a hedge against volatility in other markets.

These moves show how Tether’s lending in the commodity sector is increasingly tied to assets it also owns or influences. The more Tether integrates with gold infrastructure, the more strategic flexibility it gains across lending, reserves, and tokenization.

Oil: A Pilot That Signals a Larger Play

One of Tether’s first and most significant steps was financing a $45 million crude oil trade for a major Middle Eastern producer back in October of 2024. While modest compared to global oil flows, the deal served as a real-world proof of concept for Tether oil trade financing. It demonstrated that a stablecoin issuer can facilitate deals typically reserved for banks, and it showed how USDT can operate as a settlement and liquidity tool in an industry dominated by traditional finance.

This approach positions Tether as a flexible, fast-moving lender at a time when banks have become more cautious about energy-sector exposures.

Agriculture: A Strategic Move Into Food and Fuel

Tether’s reported 70% acquisition of Adecoagro, a major Latin American producer of rice, sugar, and ethanol, signals another expansion. Through this Adecoagro acquisition, Tether gains exposure to food production, biofuels, and farmland assets. It also opens new channels where commodity lending can integrate directly with a producer’s operations, tightening the relationship between USDT and physical supply chains.

Seen together, gold, oil, and agriculture signal a clear shift: Tether is assembling a broad commodity-financing ecosystem that ties lending, reserves, and real-world assets into one strategy.

Why Regulators Are Paying Attention

A Non-Bank Acting Like a Bank

Traditional trade finance is dominated by banks subject to capital rules, stress tests, and extensive oversight. Tether, by contrast, faces none of these requirements. Yet through its expanding commodity lending operations, it is effectively providing the same type of credit, at scale and across borders.

This raises questions for regulators about systemic importance, supervision, and the role stablecoins should play in global credit markets.

Opacity and Concentration Risk

Tether discloses very limited details about its commodity loan book. Hence, the exact collateral, borrower profiles, and default protections remain largely undisclosed. As Tether commodity lending grows, the lack of transparency becomes more material. Unlike banks, Tether is not obligated to report risk concentrations, stress scenarios, or exposures to sanctioned regions.

Spillover Risks Across Markets

Commodity markets are subject to abrupt shocks: geopolitical events, sanctions, shipping disruptions, or price collapses. If Tether faces losses on commodity-backed loans, the impact could ripple into USDT, a stablecoin that underpins much of the crypto market’s liquidity. This intertwining of digital asset markets with real-world credit cycles creates interconnected risks regulators have only begun to confront.

What This Means for USDT and Global Markets

If Tether successfully scales its commodity-finance portfolio, USDT could become more entrenched in global trade. The company would gain new revenue streams less dependent on monetary policy, and commodity-producing countries might adopt USDT more widely for settlement.

But the strategy carries equal downside. The more deeply Tether embeds itself in commodity markets, the more sensitive it becomes to global economic shocks. Its role as a commodity-focused lender may challenge regulators already concerned about stablecoin risks. Consequently, it could prompt closer scrutiny from financial authorities in the U.S., EU, and emerging markets.

For the crypto industry, the expansion could boost liquidity. However, for the broader financial system, it raises difficult questions about oversight and stability.

>>> Read more: Tether Stablecoin Faces Pressure and Reinvents Itself

Conclusion — A Turning Point for Tether and Global Trade Finance

Tether is evolving from a stablecoin issuer into a global commodities credit provider, reshaping how metals, oil, and agricultural trades secure funding. Its approach blends fast settlements, alternative liquidity channels, and a growing footprint across supply chains. But as Tether’s commodity lending becomes more influential, the regulatory spotlight sharpens.

The world’s most widely used stablecoin now plays a role once limited to banks. And until regulators decide how to classify and supervise this new model, Tether’s expansion will continue to challenge the boundaries between crypto markets and the real-world economy.

Readers’ frequently asked questions

How does Tether structure the collateral for its commodity-related loans?

Tether typically uses short-term, over-collateralized structures where the underlying commodity — such as metals, oil, or agricultural goods — serves as collateral. In many cases, receivables from the trade or inventory held by the borrower are used as security. The specific terms vary by transaction and counterparties.

Which types of companies are eligible to borrow from Tether’s commodity lending program?

Borrowers are generally mid-tier commodity trading firms or producers that face restricted access to bank credit due to compliance constraints or slower approval cycles. These firms must provide collateral and meet Tether’s due-diligence and risk-assessment standards, which include documentation of assets, trade flows, and repayment sources.

Does Tether disclose where the financed commodity trades are settled — in USDT or in fiat currency?

Tether allows settlement in both USDT and U.S. dollars, depending on the counterparties involved and jurisdictional requirements. Some trades settle entirely in USDT to speed up cross-border transfers, while others use fiat for final clearance if required by local banking rules.

What Is In It For You? Action items you might want to consider

Monitor Tether’s disclosures around commodity loan collateral and repayment structures

Tether’s reporting on the size, duration, and collateralization of its commodity loans remains limited. Tracking new attestations, quarterly reports, or auditor notes can help users assess changes in risk exposure.

Track whether USDT adoption increases among commodity producers and mid-tier trading firms

If more commodity-sector companies begin using USDT for settlement or working capital, it may signal deeper real-world integration for the stablecoin beyond crypto markets.

Follow regulatory statements or consultations focused on stablecoins and non-bank credit providers

Global regulators are already examining how large stablecoins interact with traditional financial systems. Any guidance or rulemaking could affect Tether’s commodity-finance expansion and the broader market.