TL;DR

- The ECB fears a stablecoin run could disrupt bond markets and its monetary-policy path.

- But past depegs show runs start in crypto leverage unwinds, not payment failures.

- Europe’s exposure comes from USD stablecoin dominance and gaps MiCA I didn’t close.

- MiCA II targets these structural risks, but the ECB is still modeling the wrong crisis trigger.

The ECB’s stablecoin warning is dominating crypto, macro, and regulatory headlines. Olaf Sleijpen, a Dutch central bank governor and member of the ECB’s Governing Council, argued that a major run on dollar stablecoins could force the ECB to rethink its ECB monetary policy path. His point was direct: if large stablecoin issuers suddenly face mass redemptions, they may need to liquidate short-term U.S. Treasuries fast. Such a move could severely disrupt global bond markets and spill directly into the eurozone.

This narrative has been repeated across most media coverage. Yet, it misses a critical point. The kind of systemic stablecoin event Europe fears has actually never come from payment failures or consumer distrust. Historically, what triggers stablecoin runs is the same pattern every time: a crypto leverage unwind during sharp market stress. The ECB is preparing for a payments crisis, but the fuse sits inside high-velocity crypto markets where liquidity shifts in seconds, not in retail checkout lines.

Focusing on the wrong catalyst risks designing safeguards around the wrong problem.

What the ECB Is Actually Warning About

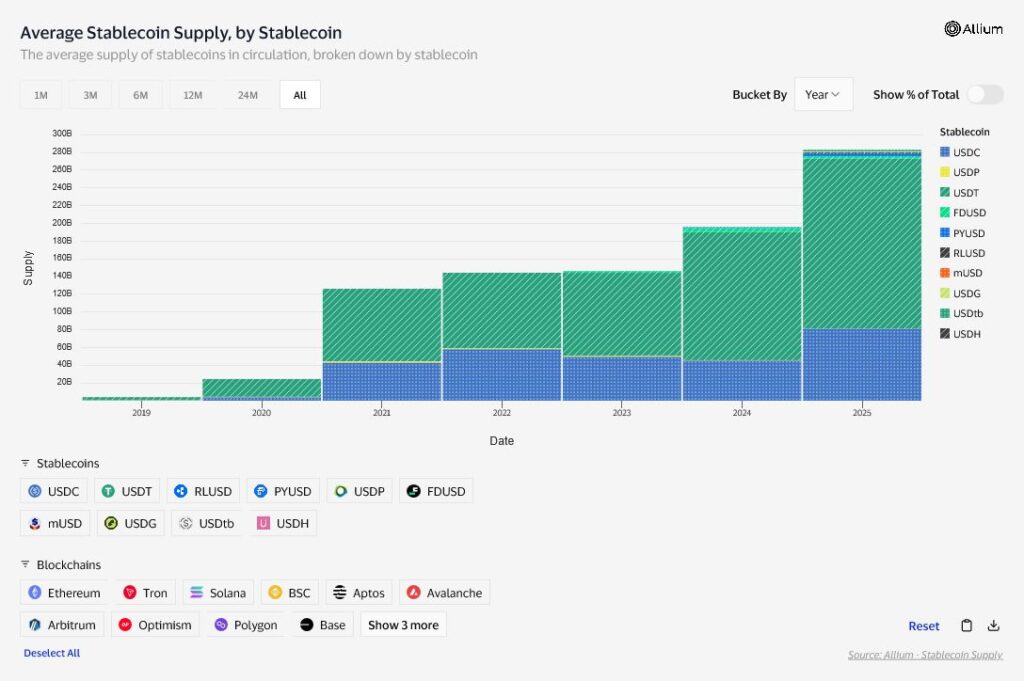

The global stablecoin market has surpassed $300 billion, driven mostly by USDT and USDC and overwhelmingly denominated in U.S. dollars. European regulators highlight three core risks:

- Large-scale redemptions could force issuers to liquidate U.S. Treasuries at scale.

That kind of a sudden sell-off can push yields higher, disrupt funding markets, and destabilize sovereign debt markets. - Spillovers into European financial conditions.

A surge in Treasury yields would increase government borrowing costs in Europe, affecting everything from bank funding costs to inflation projections. - Dollar stablecoin dominance.

Because Europe has no large euro-denominated alternatives, the region remains exposed to a foreign monetary system running on crypto rails.

Together, these issues form an EU financial stability risk. A major stablecoin run could shake the Eurozone even if the issuers sit outside its jurisdiction. It is the core reason policymakers highlight weaknesses in MiCA stablecoin rules, especially for tokens issued both inside and outside the EU simultaneously.

But all of this raises one question: why would a stablecoin run start at all?

>>> Read more: Stablecoin Transaction Volume Challenges Payment Giants

The Blind Spot: Stablecoin Runs Come From Crypto Crashes, Not Payments

Looking back, over the past five years, every major stablecoin stress event has come from crypto-market volatility. None were caused by payment failures or merchant distrust. This matters because the ECB’s entire scenario analysis could be built around the wrong assumption.

Case 1: Terra/UST (2022)

The collapse emerged from a leveraged DeFi unwind, not from payment use. Arbitrage loops failed, liquidity vanished, and the depeg accelerated instantly.

Case 2: USDC Depeg (2023)

USDC lost its peg after exposure to Silicon Valley Bank. This was a traditional banking shock that spilled into crypto markets. Payments confidence had nothing to do with it.

Case 3: USDT Volatility (multiple episodes)

USDT comes under pressure during sharp BTC or ETH downturns. Traders unwind leverage, sell collateral, or rotate liquidity between exchanges.

None of these events involved consumer payments at all. In practice, stablecoins serve as:

- collateral in DeFi

- settlement tools for exchanges

- liquidity for trading

- instruments for arbitrage

This reveals the real root of stablecoin run risk: crypto-native leverage, fast liquidity cycles, and cross-exchange flows.

When crypto markets fall 15–25% in a single day, a pattern seen during stress, traders exit stablecoins rapidly. Exchanges drain liquidity and DeFi protocols trigger automated liquidations. Panic spreads fast. This is where the danger of a stablecoin liquidity crisis emerges.

Critically, these are the situations where issuers must sell Treasuries to meet redemptions. That is the stablecoin redemption shock the ECB describes, but it begins in crypto markets, not payments.

Why Crypto-Liquidity Runs Matter More Than Payment Redemptions

If a consumer-facing stablecoin used for everyday purchases loses trust, redemptions happen slowly. Users act cautiously. It resembles a traditional payment run: measured, observable, and constrained. One could almost call it predictable.

Crypto markets act differently. During downturns, redemptions happen in seconds, not days, because stablecoins are the primary exit route for traders unwinding risks. This leads to:

- fast and large-scale sales of reserve assets

- liquidity drains across platforms

- collateral calls in DeFi

- sudden withdrawal surges when exchanges show stress

The ECB’s model assumes a payments-driven spike in redemptions. Real-world stablecoin behavior shows something else. The mechanics of crypto market contagion are far more violent than any payments-based fear scenario.

The ECB’s Model Doesn’t Match Real-World Stablecoin Usage

Europe is modeling the wrong risk channel for three reasons.

1. Stablecoins are not widely used for retail payments in Europe

Merchant adoption is low. Payment use is limited. A consumer-driven run is unlikely.

2. Stablecoin velocity comes from trading, not payments

Stablecoins move between exchanges, DeFi platforms, and trading desks. The speed and scale of these flows exceed anything seen in consumer systems.

3. Monetary sovereignty concerns are real, but misdiagnosed

The ECB focuses on payments. The real vulnerability is the lack of euro-based liquidity. EU dependence on USD stablecoins amplifies every shock.

This is where dollar stablecoin dominance becomes central. Europe has only a modest euro-stablecoin market, while dollar tokens exceed $300 billion. The imbalance is structural, not cyclical.

Where the ECB’s Concerns Are Valid

To be clear, the ECB’s concerns are not unfounded, and they are rightly worried about rapid Treasury sales. A massive Treasury liquidation could influence how stablecoins affect bond markets, tightening financial conditions in Europe through no fault of the ECB’s own actions.

Real vulnerabilities exist:

- reliance on dollar liquidity

- opaque cross-border issuance

- gaps in MiCA for multi-jurisdictional structures

- no large euro-stablecoin alternative

- limited real-time reserve transparency

These justify the ECB’s emphasis on EU financial stability risk and the need for better crisis planning. But the focus must shift toward real-world triggers, not hypothetical payment failures.

MiCA II: Europe’s Attempt to Close the Gap

Europe is already moving toward reforms through the MiCA II consultations now underway. MiCA II aims to correct cross-jurisdictional weaknesses left unresolved by MiCA I. It targets inconsistent redemption rights, mismatched reserve oversight, and liquidity rules that fail to cover tokens issued outside the EU. The framework seeks unified standards that reflect how stablecoins actually move across borders. For once, the regulatory lens is pointed at the right structural risks.

What the ECB Should Actually Stress-Test

Europe cannot prevent a Treasury fire-sale unless it models the right scenarios. Stress tests need to reflect crypto-market structure, not retail payments. This is the gap the latest ECB stablecoin warning attempts to highlight, but the underlying assumptions still miss where the real pressure builds.

The ECB should model:

- DeFi liquidation cascades

- liquidity drains across exchanges

- a major exchange bankruptcy

- BTC/ETH crashes triggering mass stablecoin exits

- Treasury-market stress during crypto volatility

Not:

- merchant adoption declines

- consumer payments distrust

- slow retail-driven redemptions

The systemic risk originates inside crypto liquidity cycles, not European checkout systems.

What’s at Stake for Europe

If Europe keeps treating stablecoins primarily as a payments issue, it will fail to prepare for a plausible crisis: a market-driven rush out of crypto leverage. That is the scenario that can trigger a fast, destabilizing run.

A future ECB stablecoin warning will carry more weight when it is tied to the real pressure points:

- crypto leverage structures

- reserve management practices

- contagion from exchange failures

- cross-border redemption flows

- structural reliance on dollar tokens

As long as the EU regulates payments more than liquidity, it will remain exposed to shocks formed elsewhere.

Conclusion

The ECB is right to fear a large stablecoin run. A disorderly redemption wave could shake global bond markets and reshape ECB monetary policy. But the next crisis will not stem from consumers losing trust at checkout counters. It will come, as past events show, from inside crypto markets, where leverage, automated liquidations, and fast liquidity cycles can drain reserves in minutes.

Until regulators acknowledge that the real trigger is crypto leverage unwind, not payments, Europe will keep preparing for the wrong crisis.