The U.S. Securities and Exchange Commission (SEC) reached a historic settlement with Terraform Labs. A federal judge approved the $4.5 billion agreement, concluding a lengthy investigation into allegations of securities fraud involving Terraform Labs and its co-founder, Do Kwon. It underscores the growing scrutiny and regulatory enforcement actions within the burgeoning digital asset sector.

Understanding the Settlement

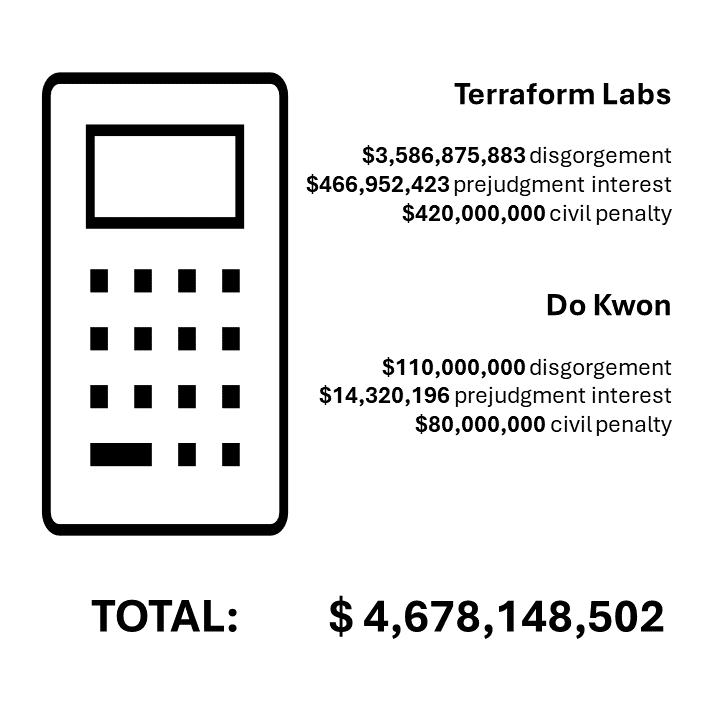

Terraform Labs, known for its prominent role in the decentralized finance (DeFi) space, agreed to pay the SEC $4.6 billion to resolve accusations of misconduct related to its cryptocurrency offerings. The SEC alleged that Terraform Labs misled investors by failing to disclose pertinent information and violating securities laws. This settlement is one of the largest in SEC history, signaling a robust response to perceived infractions in the crypto industry.

Key Allegations and Implications

Central to the SEC’s case were allegations that Terraform Labs and Do Kwon engaged in practices that constituted securities fraud. The commission argued that the company misled investors about the nature of its digital assets and the risks associated with investing in them. Such allegations have broader implications for investor protection and regulatory oversight in the evolving landscape of blockchain technology and cryptocurrencies.

>>> Read more: SEC scores a victory against Do Kwon, found of Terraform Lab

Financial Impact and Future Outlook

The $4.5 billion settlement amount, while substantial, may pose significant financial challenges for Terraform Labs. Reports speculate on the potential dissolution of the company following the settlement. It highlights the severe consequences of regulatory non-compliance in the crypto sector. Moreover, the resolution of this case sets a precedent for future regulatory actions. This underscores the importance of transparency and compliance within digital asset markets.

Community and Market Reaction

The settlement elicits varied responses from stakeholders within the cryptocurrency community and financial markets. Some view it as a necessary step toward ensuring market integrity and investor confidence. Others raise concerns about the regulatory burden on innovative fintech enterprises. Analysts and industry experts continue to debate the long-term ramifications of such regulatory measures on the growth and development of decentralized financial platforms.

The SEC’s $4.5 billion settlement with Terraform Labs represents a landmark event for regulatory oversight of digital assets. It highlights the imperative for companies operating in the crypto space to adhere rigorously to securities laws and maintain transparency with investors. As the blockchain market continues to evolve, stakeholders will closely monitor how regulatory frameworks adapt to accommodate technological innovation while safeguarding investor interests.

This settlement serves as a pivotal case study in the ongoing dialogue surrounding the regulation of cryptocurrencies. It influences future practices and policies within the global financial ecosystem.

Readers’ frequently asked questions

Why did Terraform Labs agree to such a large settlement amount?

Terraform Labs agreed to the $4.5 billion settlement with the SEC to resolve allegations of securities fraud, which included misleading investors about their digital assets. The settlement reflects the seriousness of the accusations and aims to address regulatory concerns while avoiding prolonged legal battles.

What does this settlement mean for the future of Terraform Labs?

The settlement’s financial impact could potentially lead to significant changes for Terraform Labs, including the possibility of company dissolution. It serves as a stark reminder of the consequences of regulatory non-compliance in the cryptocurrency industry, influencing how other firms navigate compliance and investor protection issues.

How will this settlement affect the broader cryptocurrency market and regulatory landscape?

The settlement sets a precedent for regulatory actions against digital asset platforms, emphasizing the SEC’s commitment to enforcing securities laws in the crypto space. It may prompt increased scrutiny and regulatory clarity, impacting market participants’ strategies and regulatory compliance efforts moving forward.

What Is In It For You? Action Items You Might Want to Consider

Review Your Investment Portfolios for Regulatory Risks

In light of the Terraform Labs settlement, it’s prudent to assess your current cryptocurrency investments. Ensure that the projects you’re involved in comply with regulatory standards to mitigate potential risks.

Stay Informed on Regulatory Developments

The evolving regulatory landscape can significantly impact your trading strategies. Regularly follow updates from the SEC and other regulatory bodies to stay ahead of any changes that could affect your holdings.

Prioritize Transparency in Future Investments

When considering new cryptocurrency investments, prioritize projects that demonstrate clear and transparent communication about their operations and compliance with securities laws. This can help safeguard your investments and align with regulatory expectations.

[…] The recent settlement between Terraform Labs and the U.S. Securities and Exchange Commission (SEC) has ignited speculation about its potential ramifications for Ripple and its ongoing legal struggle. As Ripple contests a formidable $2 billion fine from the SEC, the Terraform Labs case introduces a new precedent that could sway the final outcome. […]

[…] >>> Read more: SEC vs Terraform Labs $4.6B Landmark Settlement […]