TL;DR

- Crypto market sentiment starts the week driven by the January 30 U.S. funding deadline, Fed messaging, and bond yields, not crypto-specific headlines.

- A risk-on flip likely needs shutdown clarity, softer Fed tone, stabilizing yields, and inflation data that reinforces gradual disinflation, with leverage still active across derivatives.

Crypto markets are starting the week under pressure, but the drawdown itself is not the story. The real question for traders and investors on Monday morning is what could flip market sentiment back to risk-on, and what would keep crypto markets pinned in defensive mode.

The latest risk-off move comes as Congress works against a January 30 funding deadline, just weeks after the record-long U.S. government shutdown that only ended in mid-November 2025. That political overhang has coincided with renewed volatility across risk assets, including crypto, where leverage remains elevated despite recent pullbacks.

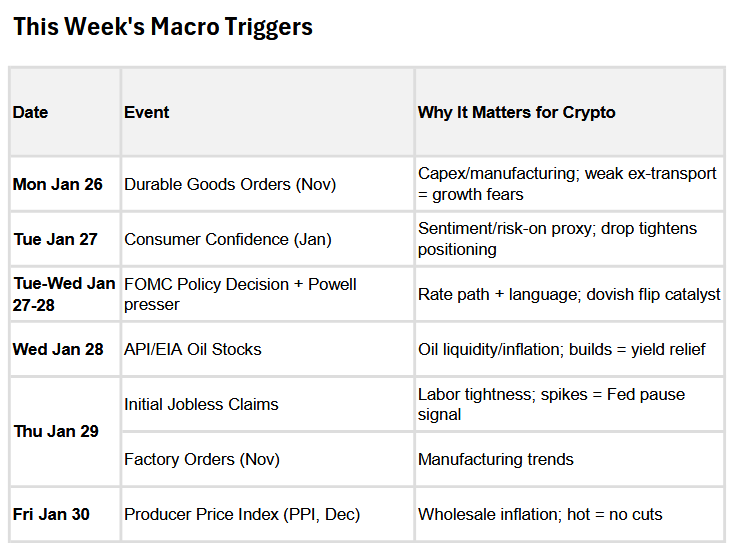

This sets up a familiar but fragile environment: positioning has lightened since early January, yet conviction remains thin. Direction this week will be dictated almost entirely by macro signals rather than crypto-specific news.

Political risk is the immediate overhang

The fastest sentiment catalyst remains clarity around U.S. government funding.

Most federal agencies are currently operating on stop-gap funding that expires January 30, forcing Congress to either pass the remaining spending bills or approve another continuing resolution. Markets do not require a long-term fiscal solution, but they do need the removal of a near-term deadline that introduces binary risk.

This matters even more because November’s reopening was just another temporary fix. Another short-term extension would reinforce the pattern of political uncertainty, but it would still reduce headline risk enough to calm markets.

Until funding clarity emerges, crypto and other risk assets are likely to trade defensively. When certainty arrives, regardless of quality, volatility typically compresses quickly.

Federal Reserve messaging still defines the medium-term trend

Beyond politics, the key variable is how markets interpret the Fed’s messaging at the start of 2026, after last year’s rate cuts.

Following multiple cuts in 2025, the Federal Reserve has entered a pause stance with inflation still above target. Markets are no longer pricing an aggressive easing cycle. Instead, they are debating whether the Fed merely holds rates steady or delivers a very shallow path of cuts later in the year, with consensus expectations now clustered around mid-2026 at the earliest.

In this environment, language matters more than action. Any acknowledgment that financial conditions have tightened, or any softening away from explicit “higher for longer” framing, would materially improve risk sentiment. Reaffirming the restriction, on the other hand, would cap rallies fast.

Bond yields remain the key liquidity barometer

Equities and crypto continue to take their cues from the bond market.

Heavy Treasury issuance has continued into early 2026, pressuring term premiums higher and keeping yields elevated even as markets mark down the odds of early-year rate cuts. That dynamic has absorbed liquidity and limited risk appetite.

Markets will be watching:

- Whether 10-year yields fail to make new highs

- Demand strength at auctions run by the U.S. Treasury

- Signs that term premiums are stabilizing rather than rising

Stable or lower yields would act as a relief valve for risk assets and help stabilize sentiment in the crypto market. Rising yields would continue to crowd them out.

Inflation data must reinforce gradual disinflation

Inflation remains the main constraint on monetary flexibility. Projections still show core inflation above the Fed’s 2% target for much of 2026, which limits how quickly policymakers can pivot toward meaningful easing.

This week’s data will matter less for headline numbers and more for trend confirmation. Markets are looking for:

- No upside surprises

- Continued cooling in services inflation

- Consistency across releases

A single benign print helps sentiment. Repeated confirmation reinforces positioning. Any upside shock, however, would revive concerns that policy remains tighter for longer than markets can tolerate.

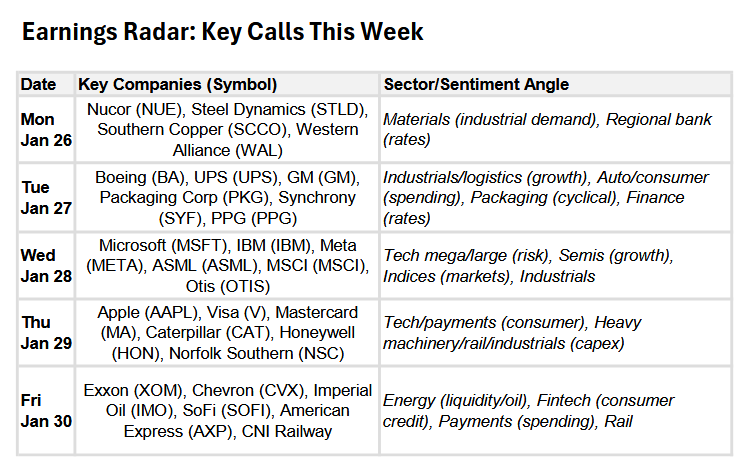

Earnings guidance feeds into crypto indirectly

Corporate earnings are not a direct crypto driver, but guidance continues to shape risk appetite and market sentiment.

Multiple cyclical and rate-sensitive sectors, like industrials, materials, regional banks, and consumer discretionary, have signaled caution entering 2026, citing higher funding costs and slower growth. That combination weighs on capital expenditure plans and reinforces defensive positioning across markets.

When equity confidence weakens, crypto typically follows with a short lag.

The dollar remains a quiet tightening channel

The U.S. dollar continues to act as a background constraint on global liquidity.

With the Fed only gradually shifting toward eventual cuts, and other major central banks also remaining cautious, the dollar still has room to function as a quiet tightening mechanism. Sustained dollar strength tends to compress risk appetite across commodities, emerging markets, and crypto simultaneously.

For risk-on momentum to build, the dollar likely needs to at least stop strengthening.

Leverage has been reduced, but not reset

Recent liquidation waves have knocked back some of the froth in futures positioning, but aggregate derivatives open interest remains elevated by historical standards. Bitcoin futures open interest is still meaningfully higher than at the start of the year, while options open interest has overtaken futures in notional terms. That suggests that risk-taking has not disappeared, but is increasingly expressed through more structured or hedged exposures. This shift reduces immediate liquidation pressure, yet indicates that leverage across crypto markets has not fully reset.

In simple terms, futures are leveraged bets on price direction, while options are often used to hedge or structure exposure—meaning leverage can persist even as outright risk-taking cools.

What would flip sentiment this week?

Markets would likely turn decisively risk-on if several of the following align:

- A funding deal or continuing resolution that pushes the shutdown deadline beyond January 30

- Fed communication that reinforces a pause rather than renewed tightening

- Stabilizing or lower Treasury yields

- Inflation data that reinforces gradual disinflation

- Earnings guidance that does not deteriorate further

Absent these signals, rallies are more likely to remain tactical than trend-defining. As long as macro uncertainty dominates, crypto will trade in line with market conditions rather than improving sentiment around the asset class itself.

>>> Read more: Why Crypto Is Down: Macro Risk, Liquidity, Leverage

Bottom line

What we are seeing is not a market searching for a bottom. This market is searching for certainty.

With political risk unresolved, monetary easing expected to be gradual at best, and liquidity still constrained, crypto remains firmly macro-driven. As seen during the 2025 shutdown episode, the macro calendar, rather than crypto headlines, will decide the week.