Estimated reading time: 7 minutes

TL;DR

- Ethereum security initiatives have moved from planning to execution, as the Ethereum Foundation announced funding for post-quantum research, while TheDAO Security Fund commits significant capital to ecosystem security work.

- Quantum risk acts as a catalyst, but the response targets broader Ethereum protocol security, infrastructure hardening, and long-term resilience rather than an imminent threat.

- By separating research leadership from capital deployment, Ethereum distributes security responsibility across institutions instead of centralizing it.

Ethereum’s recent security initiatives show an ecosystem that is no longer just discussing future risks, but actively funding and institutionalizing long-term security across multiple layers. Within days, two separate but aligned actions underscored that shift. The Ethereum Foundation launched a dedicated post-quantum security effort, while TheDAO Security Fund (rebooting 2016 edge-case ETH) announced a renewed mandate to deploy significant capital toward Ethereum security. Together, the moves signal a practical commitment to security that goes beyond statements or roadmaps.

Rather than framing security as an abstract concern, Ethereum is backing it with organizational focus and measurable resources. This approach reflects a broader effort to treat security as core infrastructure, not as a reactive response to isolated threats.

Ethereum institutionalizes security beyond short-term threats

For years, Ethereum security discussions often followed incidents, audits, or isolated research breakthroughs. The current phase looks different. Ethereum security initiatives are now being structured as long-term programs with dedicated teams, budgets, and governance boundaries.

The significance lies in the shift from ad hoc responses to institutionalized planning. By formalizing security work, Ethereum reduces its dependence on informal coordination and volunteer research. This signals an expectation that the network will need to manage evolving risks over decades, not months.

How the Ethereum Foundation is approaching post-quantum security

The Ethereum Foundation’s new initiative focuses on post-quantum security as a defined research and coordination domain. The effort includes a dedicated team and $2M in prizes ($1M new Poseidon Prize for hash/ZK hardening + $1M ongoing Proximity Prize). The stated goal is preparation, not emergency intervention.

The Ethereum Foundation’s security-related efforts emphasize research, ecosystem alignment, and long-term planning. There is no immediate proposal to change Ethereum’s core cryptography. Instead, the work centers on understanding migration paths, testing assumptions, and coordinating across clients, wallets, and tooling.

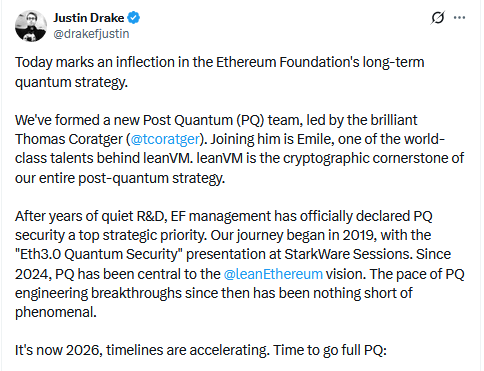

This framing is deliberate. Quantum security is treated as a future-facing risk that requires early groundwork rather than last-minute fixes. By investing now, the Foundation aims to avoid rushed decisions later. As Justin Drake noted, “Today marks an inflection… Time to go full PQ.”

Why post-quantum security forces broader protocol hardening

Post-quantum security research does not exist in isolation. Preparing Ethereum for post-quantum cryptography requires reviewing key management, validator assumptions, recovery mechanisms, and upgrade coordination.

As a result, the work naturally extends into long-term security planning. Even if quantum timelines remain uncertain, the research improves today’s security posture. Protocol hardening driven by post-quantum considerations also strengthens defenses against non-quantum failures.

This makes quantum risk a catalyst rather than a narrow objective. The outcome is a more resilient protocol, regardless of when quantum capabilities mature.

The DAO Fund’s new role in Ethereum security funding

Alongside the Foundation’s initiative, TheDAO Security Fund announced a renewed mission focused on Ethereum security funding. The fund plans to activate up to 75,000 ETH to support security-related work across the ecosystem.

This marks a clear shift in purpose. Historically associated with early DAO experimentation, the fund is now positioned as a capital allocator for security and infrastructure. Its mandate does not limit support to quantum research alone. Instead, it targets Ethereum protocol security and ecosystem resilience more broadly. As the fund explained, “69,420 ETH staked for yield, creating an endowment” for audits and wallets.

Importantly, the fund operates independently from the Ethereum Foundation. That separation allows it to deploy capital flexibly, without centralizing control or decision-making.

Security capital outside the Ethereum Foundation

Ethereum’s infrastructure security often depends on teams and researchers that sit outside formal institutions. TheDAO Security Fund’s structure enables it to support those efforts directly.

By keeping security capital outside the Ethereum Foundation, security governance becomes more distributed. Research coordination can remain institutional, while funding execution can adapt to evolving priorities. This reduces concentration risk and aligns with Ethereum’s broader governance culture.

The presence of both initiatives highlights complementary roles rather than overlap. The Foundation focuses on research and standards, while the fund emphasizes deployment and execution.

>>> Read more: Griff Green, The Man Behind Crypto’s Charitable Revolution

How the two initiatives reinforce Ethereum security

Viewed together, these actions reinforce Ethereum security initiatives across multiple layers. One provides organizational clarity and research direction. The other supplies capital and flexibility.

In practice, the split is functional. The Ethereum Foundation leads foundational research such as Poseidon and coordinates with client teams like Lighthouse and Prysm. TheDAO Security Fund focuses on execution, funding audits through firms such as Trail of Bits and supporting wallet security tooling via RFPs and platforms like Giveth. The combination creates broader coverage than either approach could achieve alone.

This division mirrors how mature infrastructure systems manage risk. Responsibilities are shared, not centralized. Funding is diversified, not dependent on a single budget. Oversight emerges through transparency and outcomes rather than hierarchy.

The ecosystem support, including Vitalik (as per reports), adds continuity without implying control. Public communication has emphasized alignment of purpose, not consolidation of authority.

Why this is about more than quantum risk

It would be inaccurate to describe these developments as solely about quantum threats. Quantum considerations provided a clear entry point, but the scope is wider.

Ethereum protocol security faces ongoing challenges unrelated to cryptography alone. These include client diversity, validator safety, tooling reliability, and upgrade coordination. Funding and organizing security work in these areas improves Ethereum ecosystem resilience regardless of quantum timelines.

Ethereum security initiatives framed around long-term planning also avoid alarmist messaging. There is no claim of imminent failure. Instead, the approach treats security as an evolving discipline that requires sustained investment.

>>> Read more: The Rise of Quantum Computing and Its Effects on Bitcoin

Addressing skepticism without speculation

Some observers question whether these moves represent coordination or coincidence. The available information supports neither speculation nor grand narratives. What can be observed is behavior.

Resources are being allocated. Teams are being formed. Mandates are being clarified. These are concrete steps, not symbolic gestures. The absence of urgent language or dramatic claims further supports a measured interpretation.

Ethereum Foundation security planning and independent Ethereum security funding can coexist without formal linkage. In practice, that separation strengthens credibility by reducing centralization concerns.

What to watch as execution unfolds

The credibility of these initiatives will ultimately depend on follow-through. Observable signals will include public calls for proposals, named security projects, and transparent reporting on deployed funds. Developers can apply directly through thedao.fund for audits and tooling support, while investors will watch expected yields of roughly 4–6% and a potential 5–10% premium tied to post-quantum security positioning.

If those signals appear, Ethereum security initiatives will have moved firmly from intent to execution. If not, skepticism will be warranted. For now, the structure suggests preparation rather than performance.

Security treated as long-term infrastructure

Ethereum’s recent actions show a network that expects to endure. By funding research, organizing teams, and allocating independent capital, Ethereum is embedding security into its institutional fabric.

Ethereum security initiatives now extend beyond discussion. They reflect a deliberate effort to plan for future risks while improving present resilience. In infrastructure systems, that distinction matters.

Readers’ frequently asked questions

What does the Ethereum Foundation’s new post-quantum security team actually do day to day?

The team focuses on research, testing, and coordination around post-quantum cryptography, including evaluating cryptographic assumptions and aligning work across Ethereum clients and tooling. The Ethereum Foundation has not published a roadmap, deliverables, or an upgrade schedule.

How does the TheDAO Security Fund distribute its funds in practice?

The TheDAO Security Fund allocates ETH to security-related work such as audits, tooling, and infrastructure through application-based or proposal-driven processes. Funds are deployed independently of the Ethereum Foundation and are not tied to protocol governance decisions.

Who is eligible to receive funding from the TheDAO Security Fund?

Security auditors, wallet developers, infrastructure teams, and tooling projects that contribute to Ethereum security can apply. Funding is intended for practical security work rather than speculative development or token-based incentives.

What is in it for you? Action items you might want to consider

Developers and security teams: apply for security funding

If you are working on Ethereum-related audits, wallet security, client tooling, or infrastructure hardening, monitor application and RFP processes published by the TheDAO Security Fund. Funding is designed to support concrete security work rather than speculative development.

Track post-quantum research progress

Developers and infrastructure providers may want to follow research outputs from the Ethereum Foundation’s post-quantum initiative, particularly findings related to cryptographic assumptions, key management, and client coordination.

Investors: evaluate security-driven yield and positioning

Long-term investors can assess how security-focused capital allocation, including ETH staking yields in the 4–6% range and a potential post-quantum security premium, may influence Ethereum’s risk profile and infrastructure resilience over time.