The sharp decline that began with the October 2025 market shock unsettled Bitcoin investors. At the time, many analysts projected a rapid recovery and a return to new highs before year-end. Those expectations did not materialize.

Instead, the downturn extended. By early February, Bitcoin had failed to stabilize, and prices continued to weaken. What initially appeared to be a sharp but temporary correction has turned into a prolonged period of uncertainty. Confidence has eroded not because of a single event, but because recovery narratives repeatedly failed to hold.

This shift matters because Bitcoin adoption is not only about access or awareness. It is also shaped by expectations. When widely promoted timelines break down, and weakness persists across months, uncertainty grows around Bitcoin’s future and its role in portfolios. The result is not panic, but sustained hesitation.

That hesitation explains why broader questions are resurfacing. Investors are no longer focused solely on near-term price targets. They are reassessing what Bitcoin represents after the crash and whether its current role remains sustainable under prolonged pressure.

Why collapse narratives resonate now

Extended drawdowns change how markets process risk. When optimism fades, narratives that once felt extreme gain attention. Questions about Bitcoin survival tend to emerge in these moments, even without new technical failures.

This dynamic is not unique to digital assets. Markets often reassess fundamentals when price action contradicts expectations. In Bitcoin’s case, the reassessment is sharper because speculation has played an outsized role in prior cycles.

As leverage unwinds and activity slows, the question shifts from short-term recovery to continuity. Can Bitcoin survive prolonged disappointment without relying on renewed speculative momentum?

Jacob King’s theory as a stress test, not a forecast

One framework that has gained attention comes from Jacob King, CEO of SwanDesk and self-proclaimed crypto contrarion. He outlines a gradual failure scenario rooted in declining conviction rather than a single shock. His argument does not depend on protocol failure or external bans. It depends on participation.

In this view, Bitcoin’s future is shaped by behavior. If fewer participants are willing to hold, secure, and integrate the asset, pressure compounds over time. The value of this framework is not its predictive certainty. It functions as a stress test for Bitcoin survival under unfavorable conditions.

Importantly, the scenario highlights dependency rather than inevitability. It describes how erosion could occur, not that it must occur.

The original promise — and where it fell short

Bitcoin was introduced as a peer-to-peer system for electronic cash. In that vision, adoption implied everyday economic use without intermediaries. In practice, that outcome did not take hold.

The constraint was not only technical. Bitcoin peer-to-peer payments remained possible, but they never became the dominant way value was exchanged in daily life. One reason is that Bitcoin did not become a unit of account.

Prices continued to be expressed in fiat terms. Even when transactions settled in BTC, negotiation and comparison still happened in national currencies. A private sale, such as a car transaction between individuals, is typically priced in dollars or euros and converted at the moment of settlement. Hence, Bitcoin functions as a payment rail rather than a pricing standard.

Because we never measured value directly in BTC, Bitcoin struggled to displace existing monetary habits. This helps explain why Bitcoin is not used as money in everyday commerce despite global awareness and accessible infrastructure. Over time, Bitcoin became layered on top of existing pricing systems rather than replacing them.

Bitcoin didn’t need to be money to survive

Despite this limitation, Bitcoin continued to exist and grow. That outcome suggests that Bitcoin survival did not depend on fulfilling every traditional function of money.

Bitcoin did not become a primary unit of account, nor did it replace fiat in routine transactions. Instead, it increasingly functioned as a store of value. Participants treated it as an asset to hold rather than a currency to spend, and supporting infrastructure developed around custody, security, and settlement.

Bitcoin speculation reinforced this shift. Rising prices encouraged holding behavior and reduced transactional use. Over time, persistence became tied to asset credibility rather than payment utility.

This evolution does not imply failure. Some systems remain relevant without serving everyday retail functions. In Bitcoin’s case, survival depended less on becoming money and more on remaining meaningful as an asset within a broader financial system.

The real dependency: belief expressed through action

Today, Bitcoin belief is expressed through concrete actions. These include holding through volatility, maintaining mining operations, providing liquidity, and integrating Bitcoin into financial systems.

In this context, Bitcoin adoption reflects coordination rather than usage. The question of what is Bitcoin adoption becomes a question of participation thresholds. How many actors are willing to continue engaging with the system under less favorable conditions?

Belief does not require universal enthusiasm. It requires sufficient alignment to sustain security, liquidity, and relevance.

Can Bitcoin survive without reclaiming its 2025 ATH?

This leads to a difficult but necessary question: Can Bitcoin survive without 2025 ATHs returning? The answer depends on expectations.

Expectations of renewed ATHs shaped prior Bitcoin cycles, but they are not a structural requirement for persistence. An asset can lose speculative dominance and still remain relevant if participation stabilizes at lower levels.

In such a scenario, Bitcoin speculation would play a smaller role. Volatility could decline, and narratives would adjust. This would represent a reset rather than a collapse.

Where King’s theory may overreach

The assumption underlying many failure scenarios is that reduced upside eliminates belief. That outcome is possible, but it is not automatic.

Bitcoin’s future may involve lower growth expectations alongside continued relevance. Bitcoin survival depends less on price milestones than on whether the asset remains meaningful to enough participants.

The distinction between erosion and reset matters. One implies disappearance. The other implies adjustment.

Bitcoin’s test is no longer technical

Bitcoin’s current challenge is not a protocol issue or an adoption bottleneck. It is a coordination problem shaped by expectations, behavior, and belief.

Bitcoin adoption no longer hinges on becoming everyday money. It hinges on whether enough participants accept a future without constant upside and continue to act accordingly. The future of Bitcoin without ATH scenarios is difficult to accept, but it is not incompatible with persistence.

The outcome remains uncertain. What is clear is that Bitcoin’s survival now depends on conviction expressed through action, not on recovering past highs.

Readers’ frequently asked questions

How can I transfer BTC peer-to-peer?

Bitcoin can be transferred directly between two parties by sending BTC from one self-custody wallet to another using a Bitcoin address. The sender signs the transaction with their private key, and the transaction must be broadcast to the Bitcoin network to be validated and recorded on-chain. This requires network connectivity at some point so the transaction can reach Bitcoin nodes. No exchange, bank, or custodian is involved as long as both parties control their private keys.

Does Bitcoin require intermediaries to function at the network level?

No. Bitcoin transactions are validated by a decentralized network of nodes and miners rather than by financial intermediaries. While many users choose to rely on exchanges or custodial services, the Bitcoin protocol itself allows transactions to occur without third-party approval or account-based control.

Why are most Bitcoin transactions still referenced to fiat prices?

Most goods and services are priced in fiat currencies because fiat remains the dominant unit of account in modern economies. Even when Bitcoin is used for settlement, its value is typically calculated by converting from a fiat price at the time of the transaction. This reflects economic convention rather than a technical limitation of Bitcoin.

What’s in it for you? Action items you might want to consider

Clarify why you hold Bitcoin

Review whether your Bitcoin exposure is based on expectations of speculative upside, long-term diversification, or non-sovereign value storage. Each rationale implies a different risk tolerance and time horizon.

Understand your custody and control model

Confirm whether your Bitcoin is held through custodial platforms or self-custody wallets, and what that means for counterparty risk, direct peer-to-peer transfers, and control over assets.

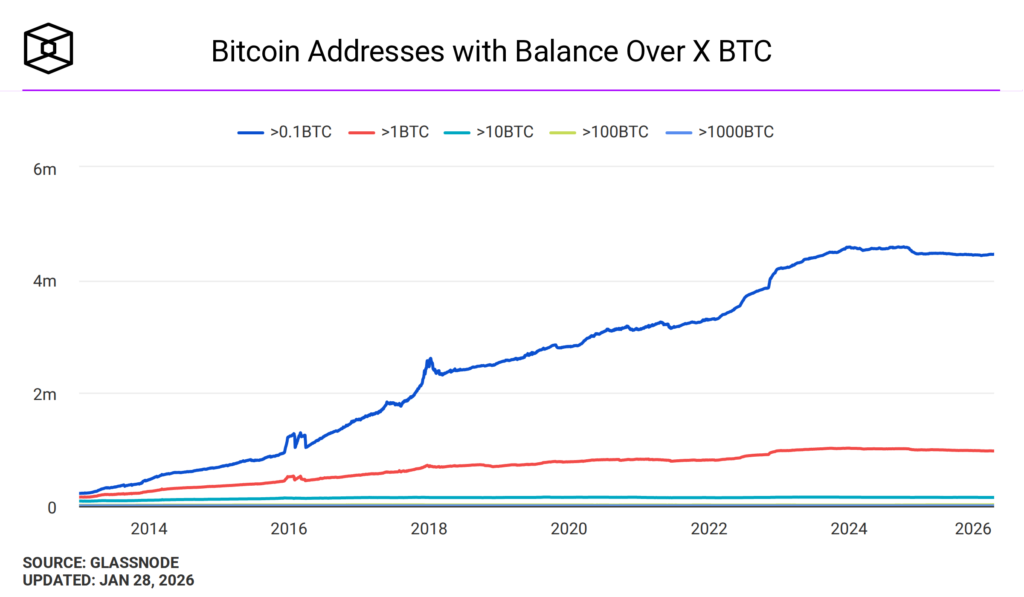

Monitor participation signals beyond price

Pay attention to indicators such as network security participation, liquidity depth, and infrastructure activity. Don’t rely solely on price movements when assessing Bitcoin’s continued relevance.