TL;DR

- Bitcoin is showing signs of stress: more long-term holders are selling at a loss, and more coins are moving onto exchanges; but this still doesn’t look like a full market breakdown yet.

- Most of the pressure appears to be coming from people who bought in the last year, while longer-term holders are (on average) still above their cost basis.

- The key thing to watch next is whether BTC can stay above the long-term holders’ “cost basis” level. If it holds, this may be redistribution; if it breaks, the risk of deeper selling increases.

Selling at a loss is rising, and Bitcoin exchange inflows are increasing, yet the structural cost basis of long-term Bitcoin holders remains intact. Recent on-chain data shows visible stress inside the cohort. However, stress alone does not confirm capitulation.

(Note: On-chain metrics define “long-term holders” (LTHs) as coins unmoved for 155+ days (~5 months), though many investors intuitively think 1–3+ years of true HODLing.)

Long-term Bitcoin holders are selling at a loss, according to LTH SOPR readings that have slipped below 1. At the same time, exchange inflows from older coins have accelerated. These signals suggest distribution pressure. Still, price continues to trade above the LTH realized price, which historically separates strain from structural failure.

The current environment presents tension. Some long-term holders are reducing exposure. Others remain above cost basis and inactive. The distinction matters.

What the Bitcoin On-Chain Data Is Actually Showing

Recent on-chain data highlights two developments. First, some long-term Bitcoin holders are selling coins at a loss. Second, Bitcoin exchange inflows are rising from older supply bands. These metrics reflect behavior under pressure. However, they do not automatically confirm capitulation.

Long-Term Bitcoin Holders Are Selling at a Loss

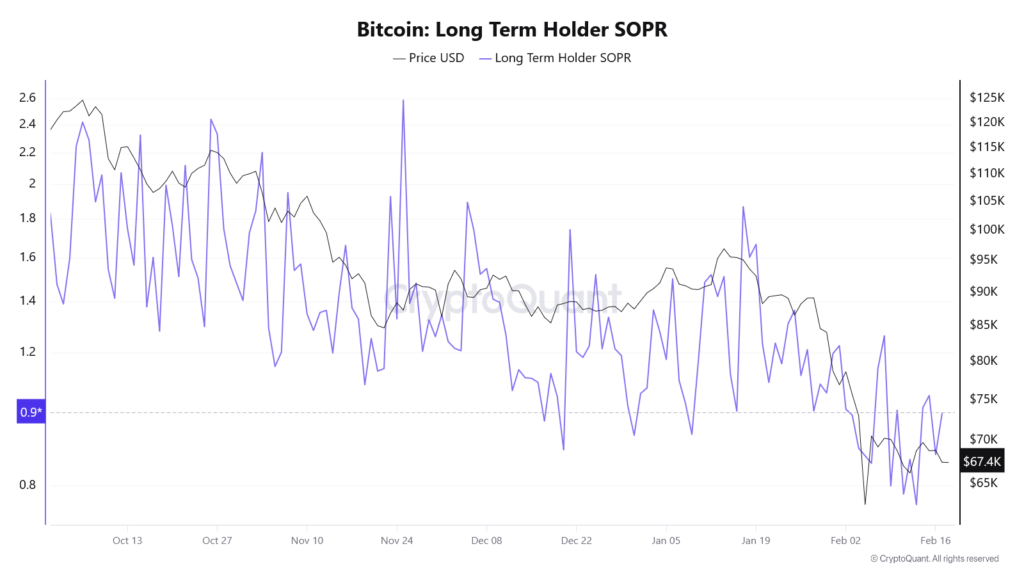

The LTH SOPR metric measures whether long-term holders are realizing profits or losses when spending coins. When LTH SOPR drops below 1, it indicates that coins older than 155 days are being sold at a loss.

Current readings show LTH SOPR below that threshold. This confirms that some long-term bitcoin holders are selling at a loss. Historically, this condition appears during drawdowns and late-stage corrections.

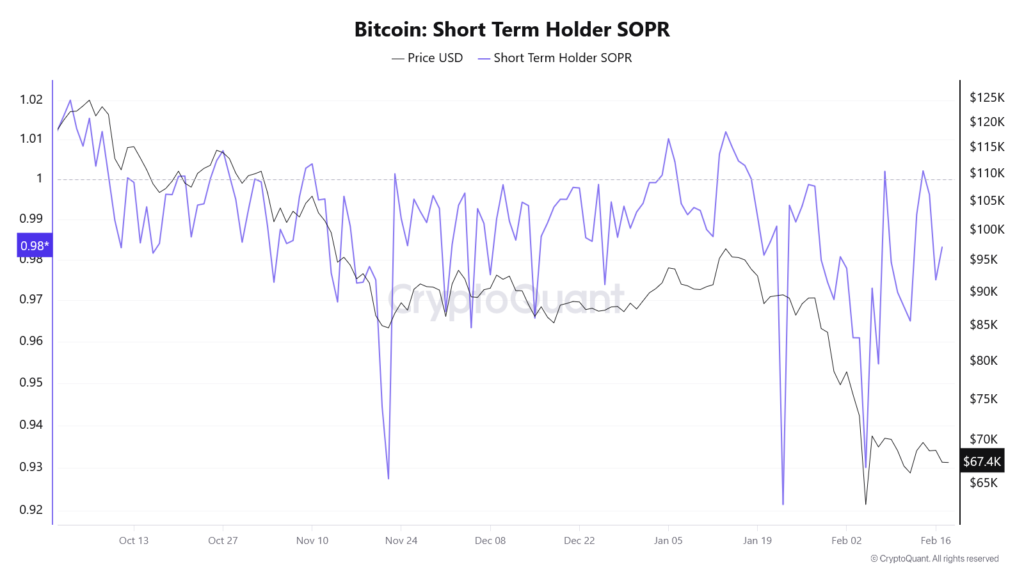

Meanwhile, STH-SOPR has remained below 1 since October 2025, indicating prolonged pressure on recent buyers, which suggests the stress is more persistent among short-term cohorts than among long-term holders.

However, LTH SOPR reflects behavior. It does not measure Bitcoin’s structural support. Short-term stress can coexist with long-term stability.

Periods of weak LTH SOPR have occurred without immediate capitulation. The context around structural levels is therefore essential.

CryptoQuant data shows LTH-SOPR dipping below 1 in early February, briefly recovering February 7–8, then stabilizing around 0.98 as of February 18, 2026

CryptoQuant LTH SOPR chart, Oct 2025–Feb 18

STH-SOPR has remained below 1 since October 2025.

CryptoQuant STH SOPR chart, Oct 2025–Feb 18

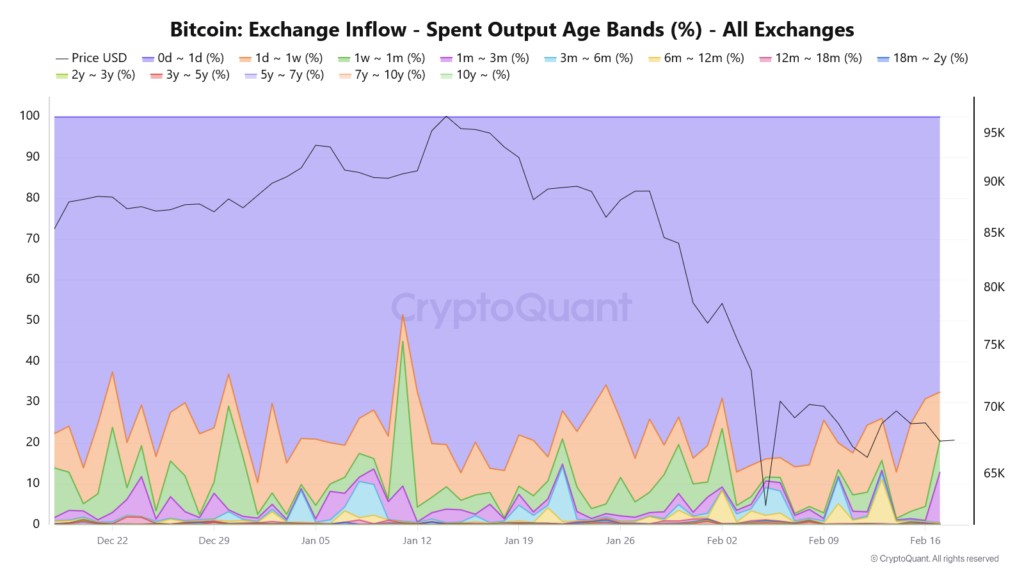

Bitcoin Exchange Inflows Are Rising

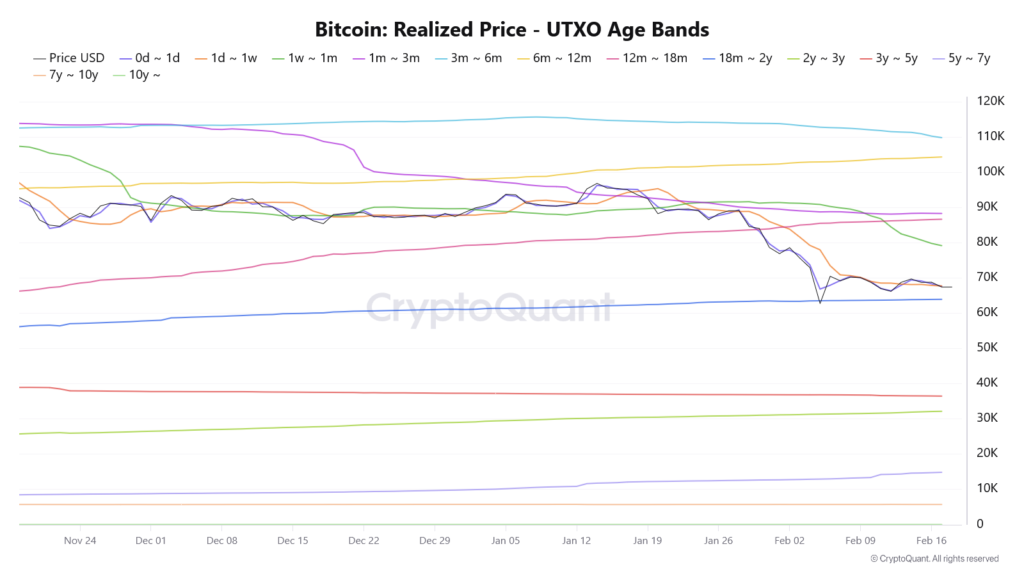

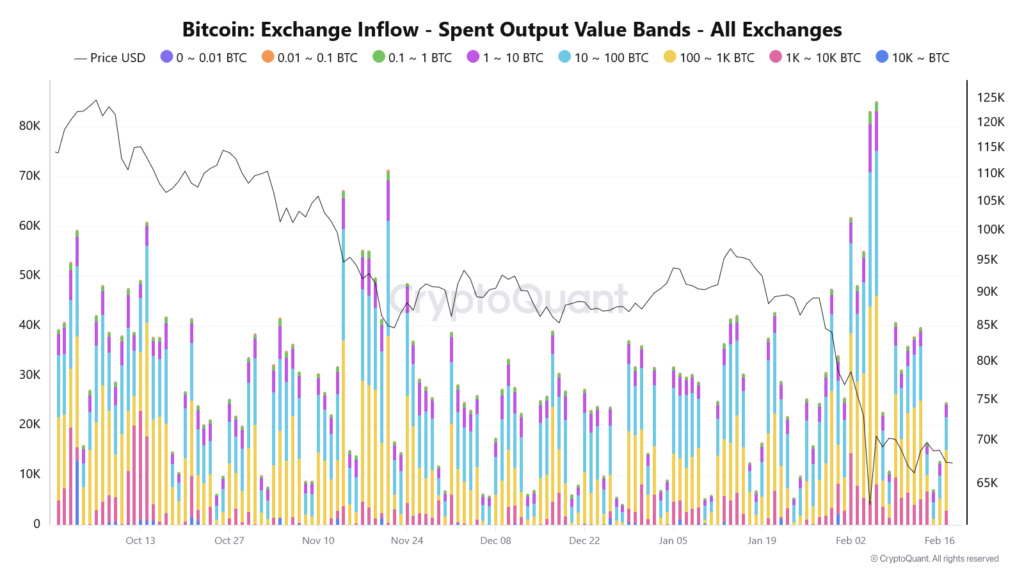

Bitcoin exchange inflows from mid-term holders have increased in recent sessions. Inflows have accelerated specifically from the 3–6-month (light blue) and 6–12-month (yellow) age bands in January through mid-February.

Rising exchange inflows often signal intent to sell or rebalance positions. However, this activity is currently concentrated in recent cycle buyers rather than older multi-cycle supply. Even so, exchange transfers represent positioning. They do not guarantee sustained distribution.

In prior cycles, spikes in Bitcoin exchange inflows preceded volatility, but they did not always coincide with structural breakdowns.

The Line That Separates Stress From Capitulation

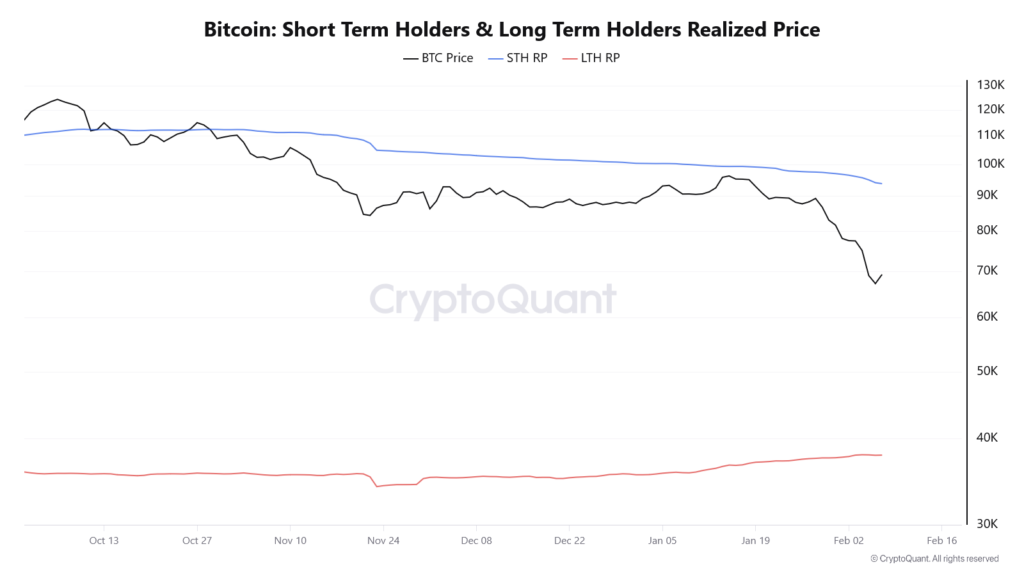

The LTH realized price represents the average acquisition cost of coins held by long-term Bitcoin holders. This level has historically acted as Bitcoin’s structural support during major drawdowns.

Bitcoin trades at approximately $68,000, well above the LTH realized price of roughly $42,000, according to CryptoQuant data. This keeps the cohort in aggregate profit despite recent volatility.

When the market price trades above the LTH realized price, the cohort remains in aggregate profit. When price breaks and holds below that level, broader Bitcoin capitulation risk increases.

In 2018 and 2022, decisive breaks below the LTH realized price marked structural breakdown. Sustained trading under that threshold coincided with prolonged bear markets.

Current on-chain data shows Bitcoin’s price above the LTH realized price. This suggests that long-term holders, as a group, are not underwater on average.

Stress is visible. Structural failure is not yet confirmed. The distinction between temporary weakness and Bitcoin capitulation often rests on this level.

Why One On-Chain Level Decides the Next Bitcoin Move

Markets tend to break when the aggregate cost basis fails. The LTH realized price functions as a reference point for structural support.

Realized Price by UTXO Age Bands shows that the 3–6-month cohort sits near ~$75,000 and the 6–12-month cohort near ~$85,000, both currently underwater relative to spot. The 18–24-month cohort around ~$55–60,000 would face pressure if BTC declines further. This clarifies which segments are experiencing strain.

If the price remains above the LTH realized price, selling pressure from long-term holders may represent a redistribution rather than a systemic exit. Volatility can persist without a regime shift.

If price decisively loses that level, the probability of Bitcoin capitulation increases. A sustained break would place a large share of long-term Bitcoin holders into unrealized losses.

On-chain data, therefore, centers on a single threshold. The reaction around the LTH realized price can determine whether the market stabilizes or weakens further.

Short-term indicators such as LTH SOPR provide context. Structural levels provide confirmation.

Redistribution or Capitulation?

Long-term holders selling at a loss does not automatically equate to Bitcoin capitulation. Within the cohort, behavior can diverge.

Some long-term holders are under pressure. Others remain inactive and above cost basis. At the same time, parts of the market appear to be increasing exposure during weakness.

Recent bitcoin on-chain data shows that while mid-term age bands are moving coins to exchanges, balance growth has appeared in other cohorts, implying that supply entering the market is being absorbed rather than cascading lower without bids.

Exchange Inflow by Spent Output Value Bands further shows increased activity from mid-tier holders (10–100 BTC and 100–1k BTC) and whales (1k–10k BTC) as prices fell, alongside retail (<10 BTC), suggesting calculated positioning across size cohorts rather than uniform liquidation.

Exchange inflows reflect positioning adjustments. They do not confirm forced liquidation across the entire cohort.

When evaluating on-chain data, the interaction between LTH SOPR and the LTH realized price is critical. Weak LTH SOPR with price above realized cost basis indicates stress. Weak LTH SOPR with price below realized cost basis signals deeper risk.

In the current phase, selling pressure from long-term holders is visible. However, the presence of growing balances in selected cohorts implies that some participants view the drawdown as an opportunity rather than an exit.

At present, the data shows pressure but not confirmed Bitcoin capitulation.

Why This Doesn’t Look Like 2022 — Yet

During 2022, capitulation followed a sustained break below structural cost basis levels. Price remained under the LTH realized price for an extended period. Loss realization intensified across cohorts.

Yes, today, some long-term Bitcoin holders are selling at a loss, and exchange inflows have increased. However, Bitcoin’s structural support at the LTH realized price remains intact.

The absence of a decisive structural breakdown differentiates the current phase from prior capitulation events. This does not eliminate downside risk, but it clarifies the threshold that defines regime change.

>>> Read more: Bitcoin Survival After the Crash: What Sustains Bitcoin Now

Conclusion: Stress Is Visible — Collapse Is Not Confirmed

Long-term Bitcoin holders are under pressure. LTH SOPR shows that some are selling at a loss. Bitcoin exchange inflows indicate heightened positioning activity.

At the same time, on-chain data points to selective balance expansion within other cohorts. This suggests that part of the market is absorbing supply during weakness.

Yet the LTH realized price continues to act as Bitcoin’s structural support. As long as the price remains above that level, the evidence points to stress rather than confirmed capitulation.

Bitcoin on-chain data provides mixed signals. Behavioral metrics show strain. Structural metrics remain intact.

The distinction between stress and collapse rests on one level. For long-term Bitcoin holders, that level is the LTH realized price.