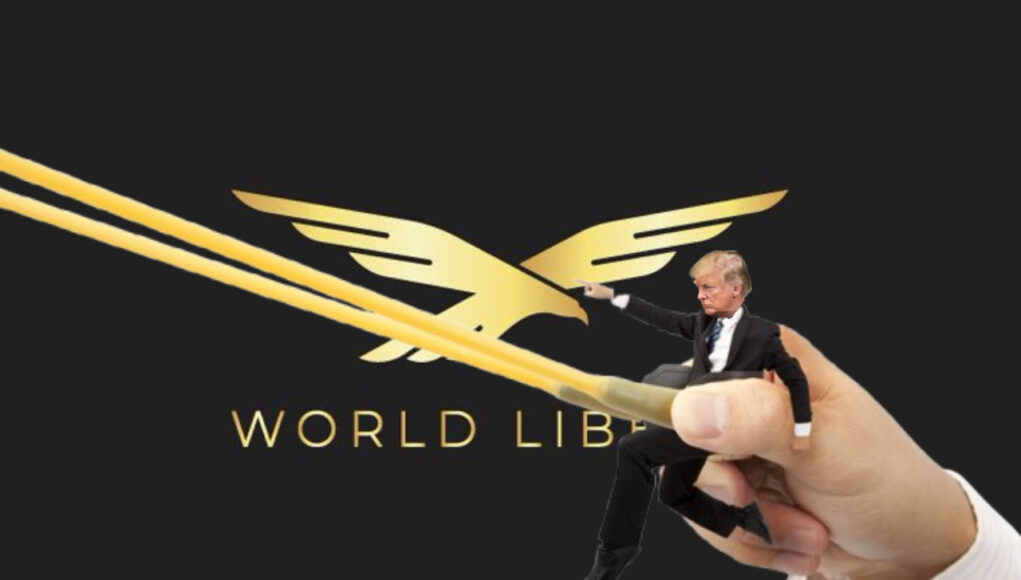

World Liberty Financial (WLF), the cryptocurrency platform promoted by Donald Trump and run by his sons Donald Trump Jr. and Eric Trump, is positioning itself as a revolutionary decentralized finance (DeFi) project. Marketed as a means of providing financial services like lending, borrowing, and stablecoin use to underserved populations, WLF has gained significant attention. However, the platform’s launch event on September 16 left many industry insiders skeptical. Concerns center on leadership inexperience and vague operational details. It raises questions about whether the project is genuinely ready to disrupt the traditional banking system.

A Flawed Launch Event

The Trump family had teased WLF for months as a transformative DeFi platform. The official launch event, hosted on X (formerly Twitter), however, failed to deliver substantial information. During the two-hour stream, Donald Trump spoke for around 40 minutes. His comments were mostly on unrelated political topics and addressed cryptocurrency only briefly. It wasn’t until later in the event that Zak Folkman and Chase Herro, key figures in the project, finally revealed more details about WLF.

Folkman shared that WLF would introduce a governance token, $WLFI. 63% of the tokens would be available for public sale, 17% set aside for user rewards, and 20% allocated for team compensation. These numbers came in response to earlier rumors that 70% of the token supply would be retained by the founders. That sparked concerns about potential profiteering. The token sale will be limited to accredited investors under Regulation D. Only select individuals will be able to participate.

Leadership Lacks Crypto Expertise

One of the most pressing issues facing WLF is the lack of experienced leadership. While the project is being led by Trump’s sons and includes figures like Steve Witkoff, a real estate developer, none of these individuals has a proven track record in the cryptocurrency space. This has raised doubts about their ability to navigate the complexities of DeFi, especially in a highly competitive market.

Corey Caplan, an adviser to WLF and cofounder of the decentralized lending platform Dolomite, offered more technical insight into the platform. But many in the crypto community remain unconvinced. Dolomite itself was hacked earlier this year, raising questions about the team’s ability to manage security risks in the DeFi space.

Shift in Trump’s Stance on Cryptocurrency

Trump’s involvement in WLF marks a notable shift from his earlier views on cryptocurrency. In 2019, he famously dismissed Bitcoin as a “scam”. However, his perspective has changed since the successful sale of his non-fungible token (NFT) collections. During the event, he credited his children with “opening his eyes” to crypto’s potential. His remarks on the subject, though, were mostly vague and non-technical.

Trump’s political rhetoric also played a role in the event. He used the platform to criticize the SEC’s regulatory stance and called the environment “hostile”. He also suggested embracing crypto could be key to winning voter support in the 2024 presidential election.

Mixed Reactions and Skepticism

The broader crypto community has responded to WLF with mixed feelings. Some view the project as a bold attempt to democratize finance, particularly for those who have been “unbanked” or excluded from traditional financial systems. Donald Trump Jr. and Steve Witkoff framed the platform as a way to help underserved communities gain access to credit and financial services.

However, others remain skeptical. The lack of clarity, combined with the team’s inexperience, is concerning. Earlier reports suggesting the project could be a means for quick financial gain have led many to question whether WLF is truly designed to empower individuals or merely capitalize on the current crypto trend.

>>> Read more: Trump World Liberty Financial: Crypto Innovation or Political Move?

While World Liberty Financial has generated significant buzz due to its association with the Trump family, the project’s vague details, lack of experienced leadership, and timing just ahead of the 2024 election have raised doubts about its long-term viability. There is no clear operational roadmap, and many essential questions remain unanswered. As a result, it is uncertain whether WLF is a serious DeFi player or a political maneuver aimed at courting the crypto community. For now, the platform’s future remains in question. The industry will be watching closely to see if WLF can deliver on its ambitious promises.

Readers’ frequently asked questions

Who can invest in the $WLFI tokens, and are there restrictions on participation?

The governance token for World Liberty Financial, known as $WLFI, is not available to the general public in the way some other tokens are. The token sales will be restricted under Regulation D. Only accredited investors who meet specific financial criteria can buy in within the U.S. There are also plans for a Regulation S offering, which allows non-U.S. investors to participate under certain conditions. This restricted approach has raised concerns within the crypto community. Some had hoped the platform would be more broadly accessible to the public. The equity structure is designed so that 63% of the tokens will be available for public sale (within the confines of these regulations), while 20% is set aside for team compensation and 17% for user rewards.

Who are Zak Folkman and Chase Herro, and are they experienced in the crypto space?

Zak Folkman and Chase Herro, mentioned as project leaders during the event, are not widely recognized within the established cryptocurrency community. There is limited public information available on their backgrounds or previous experience in leading decentralized finance (DeFi) or blockchain projects. This lack of visibility in the crypto industry has fueled skepticism about whether WLF has the necessary expertise to succeed in such a competitive and complex space. The Trump family has a strong presence in real estate and traditional business through the Trump Organization. However, their venture into crypto appears to be led by individuals with unclear qualifications in the field. This raises concerns about whether the platform can effectively implement its promises of stablecoin adoption and decentralized financial services.

What are the primary concerns or criticisms surrounding World Liberty Financial?

Several concerns have been raised about WLF, primarily revolving around its leadership, transparency, and timing. First, the lack of experienced leadership in the cryptocurrency space has made many skeptical. Donald Trump Jr., Eric Trump, and Steve Witkoff, the key figures behind WLF, have limited backgrounds in blockchain or DeFi projects. Their involvement sparked questions about their ability to successfully run a crypto platform. Second, the launch event lacked specifics. Trump discussed crypto only briefly and most of the project’s details were left vague. Lastly, there are concerns that the platform may be more of a political maneuver, given its launch just months before the 2024 election. Ethical questions have arisen about potential conflicts of interest. If Trump wins the presidency and implements crypto-friendly policies that could directly benefit WLF.

What Is In It For You? Action Items You Might Want to Consider

Wait for More Clarity Before Investing in WLFI Tokens

Before diving into World Liberty Financial’s $WLFI tokens, it’s crucial to wait for more operational and technical clarity. The project is still shrouded in uncertainty, with little information on its long-term plans, security protocols, or potential partnerships. If you’re considering adding $WLFI to your portfolio, it’s wise to wait until detailed white papers, platform roadmaps, and clear governance structures are released. Assessing the platform’s viability is key before making any investment decisions, especially considering the leadership’s limited crypto experience.

Monitor the Platform’s Regulatory and Legal Developments

WLF’s token sale is restricted under Regulation D, meaning only accredited investors can participate. If you’re not eligible for the initial token offerings, it’s important to track future regulatory updates closely, particularly around Regulation S, which may open up international opportunities. Regulatory clarity is essential for the project’s success, especially with Donald Trump’s vocal criticism of current SEC policies. If regulatory hurdles are cleared, the platform could gain traction, but if not, you may want to reconsider your options.

Keep an Eye on the Market Reaction and Industry Sentiment

Given the skepticism from the crypto community and concerns about leadership, it’s wise to monitor how the market reacts to World Liberty Financial over the coming weeks. Watch for community feedback, potential partnerships, and any incidents, such as security breaches, that could impact its credibility. Additionally, follow sentiment from key industry players who could influence the platform’s adoption. If market sentiment shifts favorably, it could indicate a safer time to enter, but be prepared to pivot if doubts continue to grow.

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job

[…] Liberty Financial (WLFI), a decentralized finance (DeFi) platform launched in September 2024, entered the crypto market with significant fanfare. Backed by the endorsement of Donald Trump and his family, the project promised to disrupt […]

[…] Of course, the project launched with strong political branding and instant name recognition. But it lacked something the crypto market often demands before assigning serious value: crypto-native […]