As central banks across the globe approach the implementation of Central Bank Digital Currencies (CBDCs), a critical challenge looms—public trust. Despite the increasing technological capability to introduce and manage digital currencies, the lack of trust among consumers, merchants, and intermediaries could stifle their widespread adoption. Recognizing this barrier, the International Monetary Fund (IMF) has introduced the REDI Framework, designed to not only address regulatory and technical concerns but also place a strong emphasis on education and communication—key factors in building trust around CBDCs.

The REDI Framework: A Strategic Approach

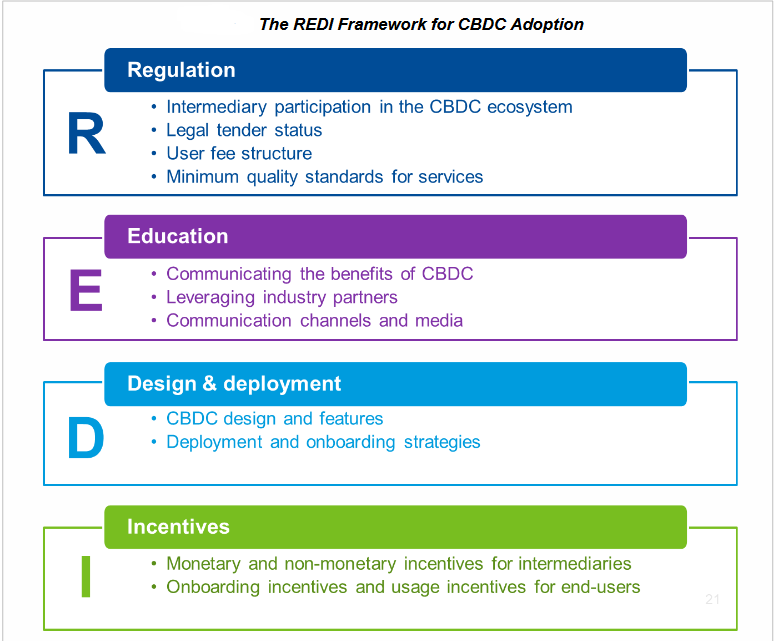

The REDI Framework, introduced in September 2024, is a comprehensive guide for central banks, aiming to boost CBDC adoption through four core pillars: Regulation, Education, Design, and Incentives. While regulation and design are crucial in ensuring CBDC functionality, the IMF stresses that education and public engagement are indispensable components for success.

As outlined in the REDI Framework, public awareness plays a pivotal role in fostering trust. Without a widespread understanding of what CBDCs are, how they work, and their potential benefits, public skepticism may hinder adoption. The framework encourages central banks to lead educational campaigns that simplify technical concepts and address concerns such as security, privacy, and financial inclusion.

Trust and Education: The Core of CBDC Adoption

One of the core challenges central banks face is that many people do not yet understand the concept of CBDCs or differentiate them from other digital currencies like cryptocurrencies. The lack of a clear distinction has led to confusion, and in some cases, outright mistrust. The IMF’s framework suggests that educational initiatives must target both the general public and financial intermediaries to create a unified understanding of the purpose and potential of CBDCs.

The REDI framework proposes that central banks act as the primary source of information for CBDCs, fostering a centralized and credible communication stream. This could include public workshops, accessible online content, and partnerships with financial intermediaries to explain the safety, privacy features, and benefits of using CBDCs. Without such targeted efforts, the IMF warns that misinformation could spread, potentially sabotaging even the most sophisticated CBDC implementations.

Overcoming Misinformation and Building Confidence

Misinformation poses a substantial risk to CBDC adoption, particularly in regions where digital financial literacy is low or skepticism toward government-managed digital systems is high. Public trust in central banks and digital systems varies significantly between regions. For example, in regions like the European Union, where digital payments and trust in institutions are high, CBDC adoption might face fewer hurdles. Conversely, countries with more skepticism toward governmental control or with less robust digital infrastructure could see significant resistance.

The REDI Framework acknowledges these regional differences and suggests that tailored communication strategies are necessary to address unique concerns. In some cases, central banks may need to emphasize the security and privacy features of CBDCs to combat fears that they could be used for surveillance or control over personal financial behavior.

Incentives: A Boost to Public Engagement

Beyond education, the IMF’s REDI Framework highlights the role of incentives in encouraging CBDC usage. Both monetary and non-monetary incentives could help entice early adopters. For instance, the IMF suggests that subsidizing merchant transaction fees or offering rewards for using CBDCs in daily transactions could make the transition to digital currencies more appealing. These incentives work hand-in-hand with education, helping to demonstrate the tangible benefits of using CBDCs, thus strengthening public trust.

Conclusion: Education as the Foundation of Trust

As central banks continue to develop CBDCs, it’s clear that technology alone is not enough to guarantee success. Public trust, built through targeted education and transparent communication, is the missing piece that will ultimately determine the success or failure of CBDC adoption. The IMF’s REDI Framework provides a roadmap not only for the technical implementation of digital currencies but also for cultivating the public confidence necessary for widespread usage.

By emphasizing the human factors – trust, understanding, and engagement – central banks can ensure that CBDCs are not only accepted but embraced as a transformative tool in the future of global finance. Without these efforts, even the most advanced CBDC systems may struggle to gain traction.