As the United States heads toward the 2024 presidential election, blockchain-powered prediction markets are capturing headlines and drawing unprecedented volumes of bets. Platforms like Polymarket, Kalshi, and now Robinhood are emerging as significant players in this space. Each is offering unique insights into election sentiment through distinct lenses. While Polymarket’s global user base fuels its predictions, Kalshi and Robinhood provide regulated platforms tailored to U.S. citizens. Together, they reveal divergent perspectives on the U.S. election outcome, shaped by the regulatory, demographic, and technological frameworks of each platform.

Polymarket: A Global Perspective on U.S. Politics

Polymarket, built on the Polygon blockchain, has become a leading prediction platform for high-stakes events, including the 2024 U.S. presidential race. The platform’s open, decentralized model allows international participants to bet on election outcomes using stablecoins like USDC. It attracts a global pool of users with varied perspectives. However, Polymarket has geo-fenced U.S.-based users to avoid regulatory conflict with the Commodity Futures Trading Commission (CFTC). That means its election predictions largely reflect the sentiment of non-U.S. participants.

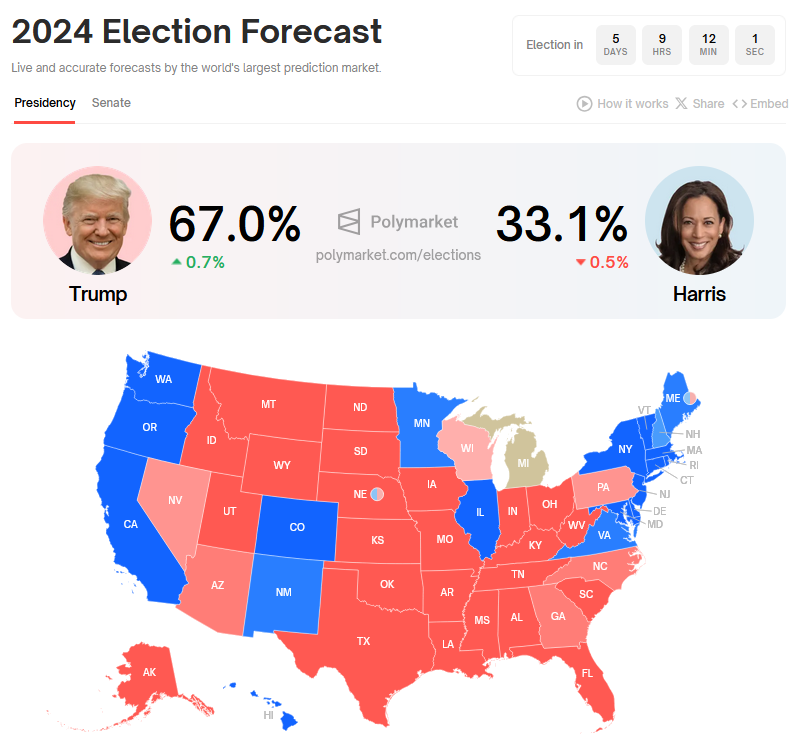

This global focus has raised intriguing questions about how accurately Polymarket’s predictions capture U.S. sentiment. As reported in late October, Donald Trump recently held a 64% probability of victory on Polymarket. Some analysts suggest that international users may have different assumptions or biases about American politics. The involvement of major international “whale” bettors, such as a prominent French trader placing substantial bets on Trump, adds to speculation that non-U.S. bettors could shape these odds.

Kalshi and Robinhood: Regulated U.S.-Based Options

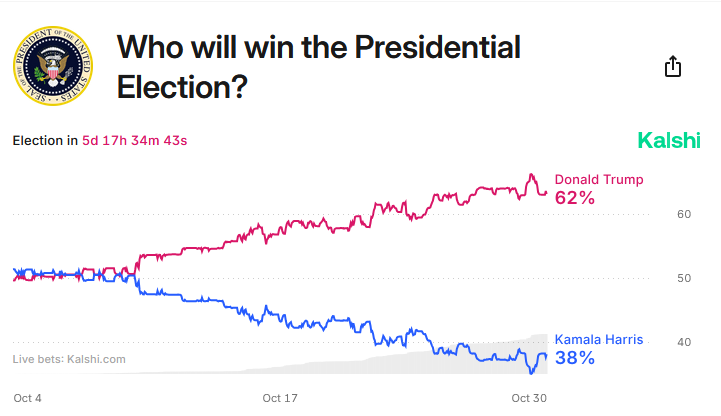

In contrast, Kalshi offers a legally sanctioned platform for U.S. election betting within the United States. It is one of the first prediction markets approved by the CFTC. Kalshi allows U.S.-based users to bet on the election outcome under strict regulatory compliance. Kalshi’s approval came after a prolonged legal process, culminating in an October 2024 decision by the U.S. Court of Appeals. By adhering to federal guidelines, Kalshi offers a more structured option for Americans interested in election betting without regulatory repercussions.

Robinhood recently joined Kalshi in offering election betting for U.S. citizens through Robinhood Derivatives, a CFTC-regulated entity allowing users to bet on specific event contracts. Users can bet on the Trump-Harris race by applying for an account and meeting specific criteria. This development introduces Robinhood as a mainstream alternative for American users. It enables legal betting on the 2024 election under federal oversight while competing with platforms like Kalshi to capture domestic sentiment.

The Role of Blockchain Prediction Markets in Election Forecasting

Despite their differences, all three platforms contribute to a growing trend where prediction markets are valued as tools for aggregating and analyzing public sentiment. Blockchain-based markets, in particular, bring transparency and decentralization, with each transaction recorded on a public ledger, offering a secure environment for forecasting political outcomes. These economic incentives create dynamic, market-driven probabilities that could provide a more accurate snapshot of sentiment than traditional polling alone.

However, Polymarket’s restriction on U.S. users limits its ability to reflect domestic perspectives. At the same time, Kalshi and Robinhood offer these insights tailored to U.S. audiences. This contrast underscores the influence of regulatory environments on prediction platforms’ user bases and how they shape election sentiment. As the 2024 election nears, odds on Polymarket, Kalshi, and Robinhood may continue to diverge, influenced by their respective regulatory, demographic, and technological landscapes.

>>> Read more: 10 Unconventional Blockchain Uses You’d Be Surprised About

Blockchain Prediction Markets: Shaping Political Expectations Beyond 2024

Looking beyond this election cycle, blockchain prediction markets are proving their potential to shift traditional approaches to political forecasting. Platforms like Polymarket, Kalshi, and Robinhood underscore the evolving relationship between finance, technology, and politics. They offer unique perspectives that challenge traditional methods. As they aggregate insights from diverse audiences, these platforms may continue to redefine how elections are interpreted, setting a new standard for political forecasting.

Readers’ frequently asked questions

How does Kalshi ensure compliance with U.S. regulations for election betting?

Kalshi operates under the regulatory oversight of the Commodity Futures Trading Commission (CFTC), which has authorized it to offer event-based contracts, including election predictions. The platform uses a fiat-based system, ensuring compliance with U.S. financial laws. These laws prohibit most election betting but allow certain structured event contracts. Kalshi’s approval was achieved through a lengthy legal process, distinguishing it from decentralized platforms that can’t meet U.S. regulatory standards.

What makes blockchain-based prediction markets more transparent than traditional betting platforms?

Blockchain prediction markets like Polymarket and Augur rely on decentralized ledgers to record every transaction transparently and immutably. This public ledger feature prevents tampering and adds a layer of security that centralized systems cannot easily match. Blockchain technology also allows anyone to observe real-time changes in market odds, fostering a sense of transparency and accountability in how predictions are formed. Additionally, using smart contracts ensures that payouts are automatically executed based on the outcome, further reducing human interference.

How does Robinhood’s prediction market differ from typical blockchain prediction markets?

Robinhood launched its prediction market under Robinhood Derivatives. It complies with CFTC regulations, offering event-based election contracts to U.S. users but it does not use blockchain technology. Instead, it operates within a centralized, regulated framework, providing a straightforward user experience, more familiar to traditional investors. Unlike Polymarket or Augur, which use cryptocurrency transactions and decentralized frameworks, Robinhood offers a more conventional model. It appeals to users seeking regulated, fiat-based access to prediction markets without the need for crypto or blockchain knowledge.

What Is In It For You? Action Items You Might Want to Consider

Explore Cross-Platform Insights

Consider following both Polymarket and Kalshi for comprehensive perspectives on the 2024 election sentiment. Polymarket’s global user base can reveal international trends, while Kalshi’s regulated, U.S.-focused environment offers insight into domestic sentiment.

Leverage Blockchain Transparency

With platforms like Polymarket, monitor real-time transaction data on the blockchain to gauge market confidence and potential trend shifts. Blockchain transparency could reveal sudden whale activity or significant odds changes.

Assess Regulatory Implications

Robinhood and Kalshi’s regulated offerings may present lower-risk alternatives for U.S. traders. For those concerned about regulatory stability, these compliant platforms could offer safer opportunities compared to decentralized prediction markets.

[…] >>> Read more: How Blockchain Prediction Markets Shape the 2024 U.S. Election […]