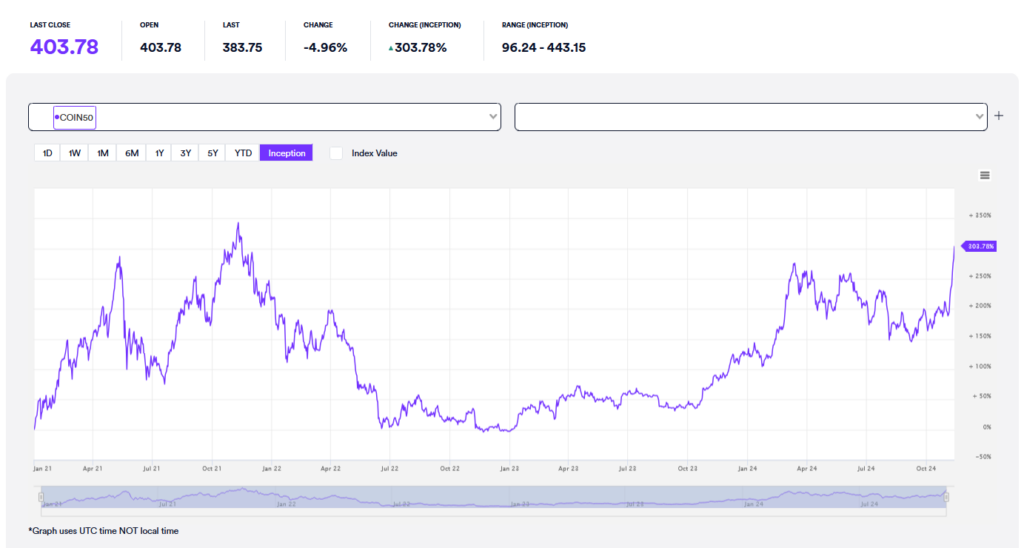

Coinbase has introduced a new tool in the world of digital assets: the COIN50 Index. This new indicator will track the top 50 digital assets listed on its platform and provide a market performance snapshot. It will consolidate major cryptocurrencies – including Bitcoin, Ethereum, Solana, and Dogecoin – into a single, straightforward benchmark. By creating a clearer view of the market’s most impactful assets, Coinbase aims to bring a sense of stability and transparency to an industry that has often been marked by volatility, inconsistent standards, and information silos.

Filling the Transparency Gap in Crypto

Modeled after the S&P 500, the COIN50 serves as a reference point to gauge the health of the broader cryptocurrency market. While previous indices have covered subsets of digital assets, few offer the comprehensiveness of the COIN50. This index includes top-performing assets across various sectors of the digital economy. For investors, the COIN50 presents a simplified yet diversified entry point into the crypto space. It tracks approximately 80% of the market’s capitalization through a curated selection of assets. By focusing on this selection, Coinbase aims to make it easier for retail and institutional investors to understand and navigate the crypto landscape.

The COIN50 includes a stringent selection process developed in collaboration with MarketVector Indexes. It evaluates each asset’s fundamentals, security, and architecture and excludes assets that do not meet these standards. Only the most robust projects make it into the index. Additionally, the COIN50 will be rebalanced quarterly. That will allow the index to adapt as market trends and asset performance evolve, offering an up-to-date reflection of the industry.

A Step Towards Investor Confidence and Institutional Adoption

For retail investors, the COIN50 represents a way to track market trends without getting lost in the complexity of the vast crypto ecosystem. For institutional players, this index functions as both a benchmark and a potential vehicle for portfolio diversification. The COIN50’s design makes it especially appealing for institutional investors familiar with using indices as a tool to gain diversified exposure. By setting a standard similar to established benchmarks in traditional finance, Coinbase positions itself as a bridge for institutions hesitant about entering crypto due to the sector’s perceived volatility and lack of regulation.

Beyond simplifying market access, the COIN50’s data-backed structure aims to build credibility in the sector. It offers a familiar investment framework with clear guidelines and strict entry criteria. This transparency could help Coinbase foster stronger relationships with institutional clients. At the same time, it promotes confidence in the crypto space among more cautious investors.

Strategic Moves in an Evolving Crypto Landscape

The COIN50 Index is also a significant step for Coinbase itself. “Regulatory scrutiny and market volatility continue to impact even the largest crypto exchanges. Developing a trusted, widely accepted benchmark may strengthen Coinbase’s reputation as a sector leader. This index positions Coinbase not just as a platform for trading but as a cornerstone of the industry’s infrastructure. As it gains traction, the COIN50 could become the go-to measure of market performance, akin to the S&P 500 for stocks. That would establish Coinbase as a key source of market insights and trends.

Though still new, the COIN50 is already recognized for its potential to add stability and structure to crypto – a sector long challenged by market sentiment swings. As more investors begin to use the COIN50 as a gauge of the industry’s direction, it may play a role in reducing volatility by promoting data-driven investment decisions. Ultimately, Coinbase’s COIN50 has the potential to enhance transparency and foster a more mature, confidence-inspiring environment within the digital asset space.

Readers’ frequently asked questions

How does the COIN50 Index impact my investment strategy if I already own individual cryptocurrencies like Bitcoin and Ethereum?

The COIN50 Index serves as a valuable addition to individual crypto holdings, especially if your portfolio focuses on a few major assets like Bitcoin and Ethereum. By investing in the COIN50, you gain exposure to a broader range of digital assets representing the top performers on Coinbase. That will include emerging projects and established cryptocurrencies. This diversification can reduce the risk associated with holding a limited number of assets. The index is designed to balance its components based on market capitalization, security, and token architecture. For long-term investors, the COIN50 can serve as a measure of overall market performance. It gives them a more stable benchmark that adjusts quarterly to reflect evolving trends. Thus, even if you already hold Bitcoin and Ethereum, the COIN50 adds another layer of diversification. It can act as a core holding to stabilize a crypto portfolio.

What advantages does the COIN50 Index offer over other cryptocurrency indices already in the market?

While several crypto indices exist, the COIN50 Index stands out due to its methodology and Coinbase’s reputation in the crypto industry. Partnering with MarketVector Indexes, the COIN50 applies strict criteria to asset selection. It considers factors like blockchain architecture, token economics, and security. This rigor sets it apart from other indices that may include a broader range of assets without such stringent standards. Additionally, Coinbase’s quarterly rebalancing of the index ensures it remains up-to-date with the market’s most influential assets, a feature not all indices provide. The COIN50 is also unique in its aim to mirror the function of traditional indices like the S&P 500. That makes it accessible to both new investors and seasoned market participants looking for a familiar benchmark. This structure helps reduce potential volatility. It excludes high-risk or less-established assets, positioning the COIN50 as a reliable, trusted measure of the digital asset market.

Could the COIN50 Index be affected by regulatory changes, and what would that mean for investors?

The COIN50 Index, like any investment tied to the cryptocurrency market, is subject to potential regulatory shifts. Given the current focus by regulators worldwide on digital assets, any changes in compliance standards, asset listings, or regulatory requirements for exchanges could impact the composition or accessibility of the COIN50. For example, if certain assets within the index face new regulations that affect their trading availability, the index could be rebalanced to reflect these changes. Coinbase’s partnership with MarketVector ensures that the COIN50 is adaptable. Nevertheless, investors should be aware that regulatory changes could influence the index’s makeup and performance. However, Coinbase’s emphasis on transparency and adherence to regulatory standards means that the COIN50 is designed to meet compliance and retain its integrity. That makes it a resilient option compared to less-regulated crypto investment vehicles.

What Is In It For You? Action Items You Might Want to Consider

Consider Using the COIN50 as a Benchmark for Portfolio Performance

If you’re tracking multiple cryptocurrencies individually, think about using the COIN50 Index as a benchmark to evaluate your portfolio’s performance against the broader market. This can give you insights into whether your holdings are in line with market trends or if there are underperforming assets you might reconsider.

Explore the COIN50 for Diversification

If your portfolio leans heavily toward a few big players like Bitcoin and Ethereum, look into the COIN50 for balanced exposure to a wider set of assets. Since the index covers the top 50 digital assets on Coinbase, it might provide a smoother way to diversify while still focusing on well-vetted projects with strong fundamentals.

Monitor Quarterly Rebalancing to Spot Market Shifts

Since the COIN50 is rebalanced every quarter, keep an eye on the changes to gain insights into market trends. Newly added assets or those removed might signal shifting market dynamics or emerging sectors within the crypto space. These shifts could help guide your next moves, whether you’re considering a new investment or adjusting your allocations.