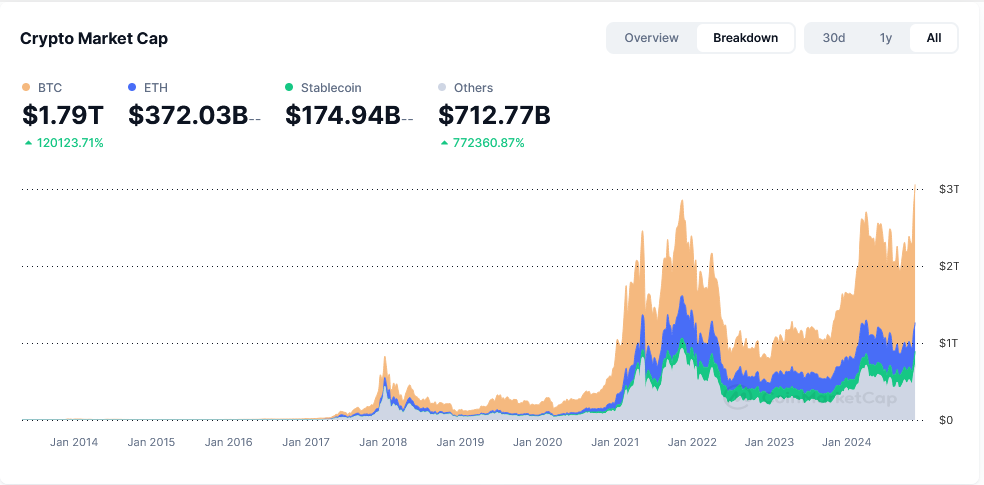

The cryptocurrency market has officially entered uncharted territory. It surpassed $3 trillion in total market capitalization for the first time, according to data from CoinGecko. This historic milestone has been driven largely by Bitcoin’s meteoric rise to an all-time high of $93,000. Also, Ethereum and other altcoins contributed significantly to the market’s explosive growth. The achievement marks a pivotal moment in the evolution of digital currencies. It signals their growing influence in the global financial ecosystem.

A Closer Look at the $3 Trillion Milestone

Crossing the $3 trillion threshold solidifies cryptocurrency’s place as a major financial asset class. Bitcoin remains the dominant player, accounting for nearly half of the total market capitalization. Ethereum, the second-largest cryptocurrency, has also seen significant gains, driven by its use in decentralized finance (DeFi) platforms and non-fungible tokens (NFTs).

Altcoins like Solana, Cardano, and Binance Coin have played a supporting role. They reflect a diversified market that has moved beyond Bitcoin’s initial promise of digital cash to encompass smart contracts, decentralized applications, and even digital art. These developments have accelerated adoption among institutional investors and mainstream audiences alike.

Notably, this valuation now exceeds the GDPs of countries like Canada, Brazil, and Italy, emphasizing the scale and rapid growth of the cryptocurrency market. The global financial system can no longer ignore digital assets, as their market cap rivals the economies of G7 nations.

Political Shifts and Economic Policies Fueling the Boom

The cryptocurrency market’s latest surge comes against the backdrop of significant political and economic developments. Key among these is the recent election of Donald Trump as President of the United States. Trump’s presidency has been closely associated with pro-business policies. His administration is widely expected to favor a more lenient regulatory approach to cryptocurrencies. Investors are betting on the possibility of relaxed oversight, which could encourage further institutional adoption.

Complementing the political tailwinds is a shift in monetary policy by the U.S. Federal Reserve. Faced with global economic uncertainty and sluggish growth, the Fed has adopted a dovish stance, hinting at potential interest rate cuts. Historically, such monetary easing has driven investors toward alternative assets like cryptocurrencies. They perceive such assets as a hedge against inflation and fiat currency devaluation.

This combination of political optimism and economic incentives has created a perfect storm for the cryptocurrency market, drawing in new capital and bolstering investor confidence.

The Role of High-Profile Endorsements

Elon Musk’s influence in the cryptocurrency market remains a recurring theme. Known for his outspoken support of digital currencies, Musk recently endorsed Bitcoin, reigniting enthusiasm among his millions of followers and the broader market. His past endorsements of Dogecoin and Bitcoin have had a measurable impact on their valuations. Clearly, this latest nod comes at a critical juncture for the market.

Musk’s involvement highlights the broader trend of influential figures and institutions backing digital assets. Companies like Tesla, Square, and MicroStrategy have already incorporated Bitcoin into their balance sheets. They signal their belief in its long-term value. Such endorsements have legitimized cryptocurrencies and encouraged other corporations and retail investors to participate in the market.

Broader Implications: Beyond Speculation

While the cryptocurrency market has often been criticized for its speculative nature, the $3 trillion milestone underscores its expanding utility and acceptance. DeFi applications are reshaping traditional financial systems by offering decentralized lending, borrowing, and trading platforms. Meanwhile, NFTs have introduced blockchain technology to the art, entertainment, and gaming industries, creating entirely new revenue streams.

Moreover, central banks worldwide are taking notice. Many are exploring the potential of central bank digital currencies (CBDCs) as a response to the growing popularity of cryptocurrencies. This further cements digital assets’ relevance in the global financial conversation.

Challenges on the Horizon

Despite the euphoria, not everyone is convinced that the market’s growth is sustainable. Critics warn of a potential bubble, citing the volatile nature of cryptocurrencies and the speculative behavior of many retail investors. Regulatory uncertainties also loom large, particularly as governments and central banks grapple with how to oversee this burgeoning sector without stifling innovation.

Additionally, environmental concerns persist. Bitcoin mining, in particular, has been criticized for its high energy consumption. That prompted some companies and investors to favor more environmentally sustainable blockchains like Ethereum 2.0 and Solana.

A Market at a Crossroads

As the cryptocurrency market continues to evolve, it stands at a crossroads. On one hand, the $3 trillion milestone represents a significant achievement, reflecting increased adoption, innovation, and legitimacy. On the other hand, the market must navigate challenges like regulatory scrutiny, environmental impact, and potential corrections.

What’s clear is that cryptocurrencies are no longer a niche interest. They have become a major force in the financial world, influencing everything from investment strategies to geopolitical discussions. Whether this growth will continue unchecked or face significant headwinds remains to be seen. But for now, the cryptocurrency market has firmly established itself as a key player in the global economy.

Readers’ frequently asked questions

What specific role did institutional investors play in driving the cryptocurrency market to this milestone?

Institutional investors have played a transformative role in legitimizing and driving the cryptocurrency market’s growth. Unlike retail investors, who often engage in speculative trading, institutional players such as hedge funds, pension funds, and publicly traded companies have brought significant capital and stability to the market. Their interest in cryptocurrencies stems from their utility as a hedge against inflation, diversification of portfolios, and increasing integration into global financial systems. Companies like MicroStrategy, Tesla, and Square have allocated portions of their balance sheets to Bitcoin. They signal confidence in its long-term value. Additionally, investment funds have launched crypto-focused products, such as exchange-traded funds (ETFs). That makes it easier for traditional investors to gain exposure to digital assets. This influx of institutional capital has provided the market with liquidity and credibility, which, in turn, has attracted even more participants.

How does the cryptocurrency market’s growth compare to other historical financial milestones?

The cryptocurrency market’s $3 trillion valuation is not just a numerical milestone; it represents a fundamental shift in financial paradigms. Comparisons to the GDPs of nations like Italy or Canada highlight the scale of this growth. The implications, however, go beyond economics. Historically, transformative financial innovations – such as the rise of stock markets or the proliferation of internet-based companies – took decades to reach similar levels of adoption and valuation. Cryptocurrencies, in contrast, have achieved this in just over a decade since Bitcoin’s inception. This rapid ascent is unprecedented and reflective of the technology-driven era we live in. Information spreads quickly and adoption cycles are compressed. However, the speed of this growth also raises questions about stability and resilience. These are issues that older, more established financial systems have had time to address over decades or centuries.

How sustainable is the current cryptocurrency market growth, and what risks could derail its momentum?

The sustainability of the cryptocurrency market’s growth hinges on several factors, including adoption rates, regulatory developments, technological advancements, and macroeconomic conditions. While the $3 trillion milestone suggests a strong upward trajectory, the market’s inherent volatility and dependence on external influences pose significant risks. One key challenge is regulatory uncertainty; governments worldwide are still grappling with how to regulate cryptocurrencies without stifling innovation. Sudden or restrictive regulatory changes in major markets, such as the United States or the European Union, could lead to significant downturns.

Another risk is the reliance on speculative investments. While institutional interest provides some stability, a substantial portion of the market is still driven by retail investors seeking short-term gains. This speculative behavior can exacerbate volatility and increase the likelihood of sharp corrections.

Additionally, environmental concerns, particularly regarding Bitcoin’s energy consumption, could affect its long-term viability as more investors prioritize sustainability. The shift to more eco-friendly blockchain technologies, such as Ethereum’s transition to proof-of-stake, is a step in the right direction, but broader adoption of sustainable practices will be crucial for maintaining growth.

Ultimately, while the cryptocurrency market has demonstrated resilience and adaptability, its sustainability depends on balancing innovation with regulation, investor education, and environmental responsibility.

What Is In It For You? Action Items You Might Want to Consider

Reassess Your Portfolio Allocation

With Bitcoin reaching $93,000 and the cryptocurrency market crossing the $3 trillion mark, it’s a good time to evaluate your portfolio. Consider whether your current exposure aligns with your risk tolerance and investment goals. If you’re over-leveraged in speculative assets, think about diversifying into more established cryptocurrencies like Bitcoin or Ethereum. These continue to attract institutional interest and show long-term growth potential.

Stay Alert to Regulatory Signals

The political and economic backdrop is shifting. Donald Trump’s presidency and the Federal Reserve’s policy adjustments will likely influence the market. Keep an eye on regulatory announcements or policy changes that could impact market sentiment. Being proactive in understanding how these developments affect specific cryptocurrencies or sectors like DeFi can help you make informed trades.

Capitalize on Market Trends but Plan for Volatility

The $3 trillion milestone highlights the growing adoption of digital assets, but remember that the market is still highly volatile. Use tools like stop-loss orders to protect gains during sudden market corrections. Additionally, explore emerging opportunities in decentralized applications, NFTs, or eco-friendly cryptocurrencies like Ethereum 2.0, which could benefit from the current focus on sustainability. Balancing bold moves with a risk management strategy is key in such dynamic market conditions.