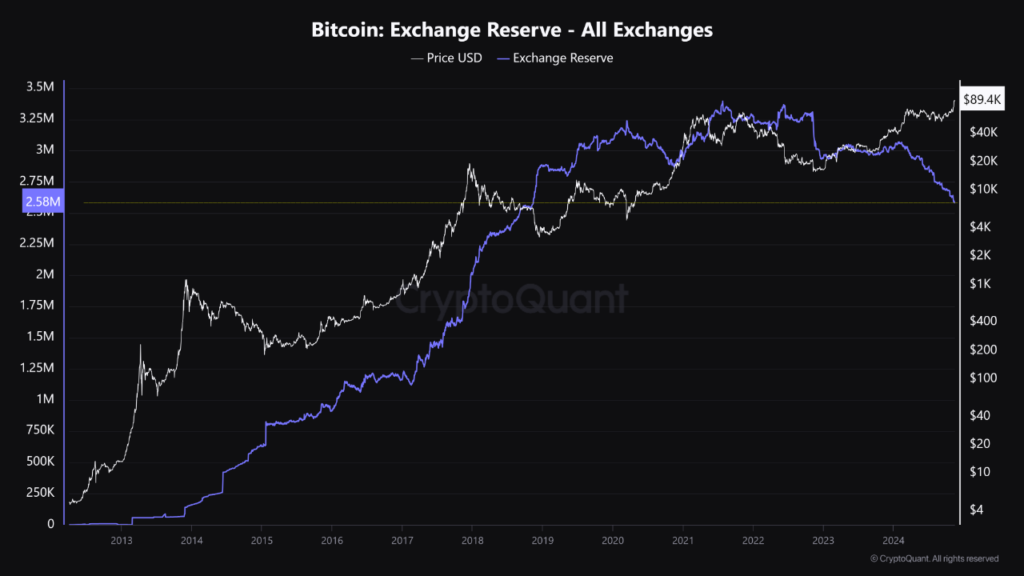

The trend of dwindling Bitcoin reserves on cryptocurrency exchanges, first noted months ago, shows no signs of slowing. As of November 2024, exchange-held reserves have plunged to their lowest levels in five years, reinforcing a transformative shift in the digital asset market. This persistent decline, driven by investors moving their Bitcoin holdings into private custody, signals a growing conviction in its long-term value. However, the ongoing scarcity also presents fresh challenges for institutional stakeholders and government initiatives, including President-elect Donald Trump’s ambitious proposal to establish a U.S. Bitcoin reserve.

The continuation of this trend highlights a broader narrative: Bitcoin is steadily transitioning from a speculative trading asset to a cornerstone of long-term investment strategies. Yet, as reserves shrink, market dynamics become increasingly complex, posing obstacles to large-scale acquisitions and amplifying price volatility risks.

A Shift Toward Self-Custody

The dramatic decline in Bitcoin held on exchanges reflects a shift in investor behavior. Data shows that many are opting for cold storage solutions and private wallets, motivated by security concerns and a belief in Bitcoin’s long-term appreciation. By holding their assets outside of exchanges, investors mitigate risks associated with centralized platforms, such as hacking or mismanagement. This shift also signals a broader market trend: a transition from speculative trading toward long-term investment strategies.

This movement aligns with the broader adoption of decentralized financial practices. By taking their Bitcoin off exchanges, investors are signaling trust in the network’s resilience and the underlying value of the asset. These dynamics, while positive for market stability, reduce the immediate supply of Bitcoin available for trading, potentially amplifying price volatility.

Implications for Global Markets

The declining reserves pose a double-edged sword for the global cryptocurrency ecosystem. On one hand, reduced liquidity on exchanges can drive scarcity, which historically correlates with upward price trends. On the other, it introduces challenges for entities seeking to acquire large quantities of Bitcoin without triggering significant market disruptions.

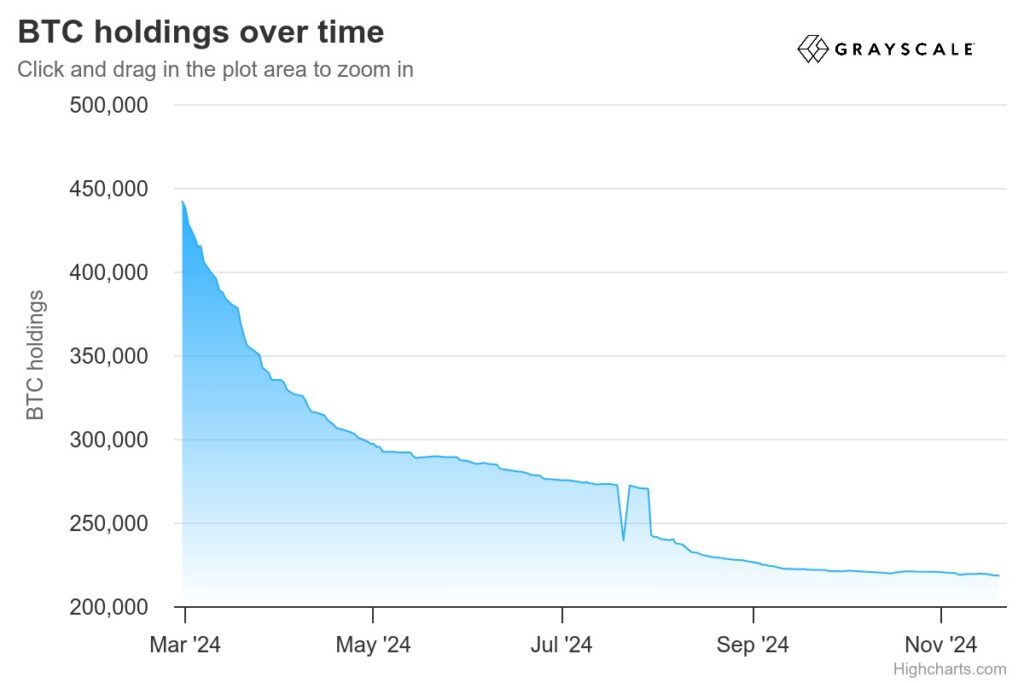

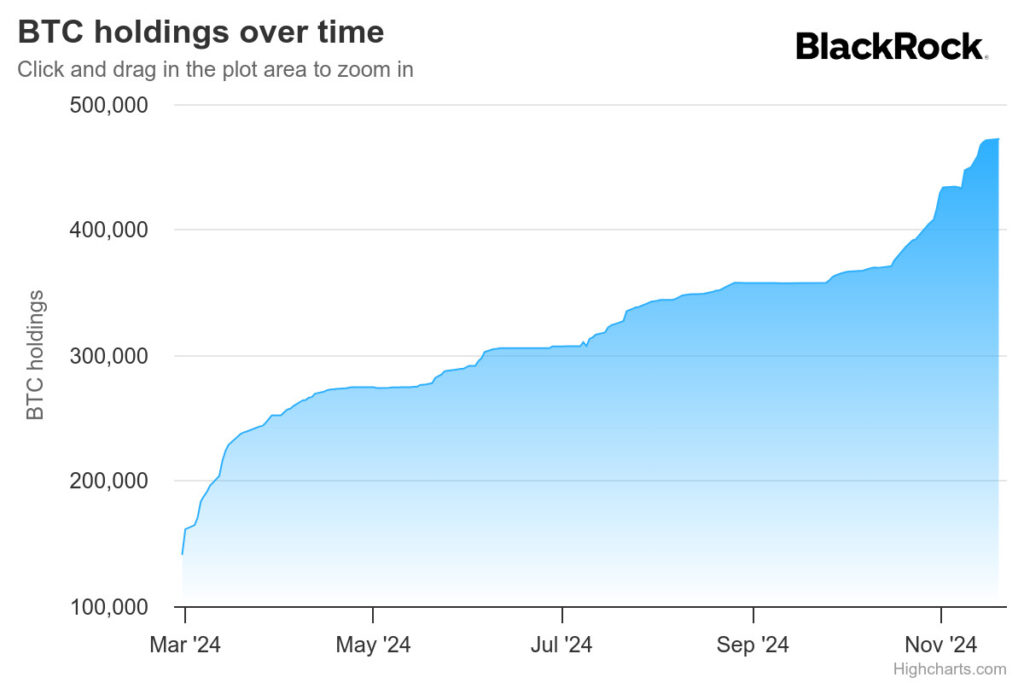

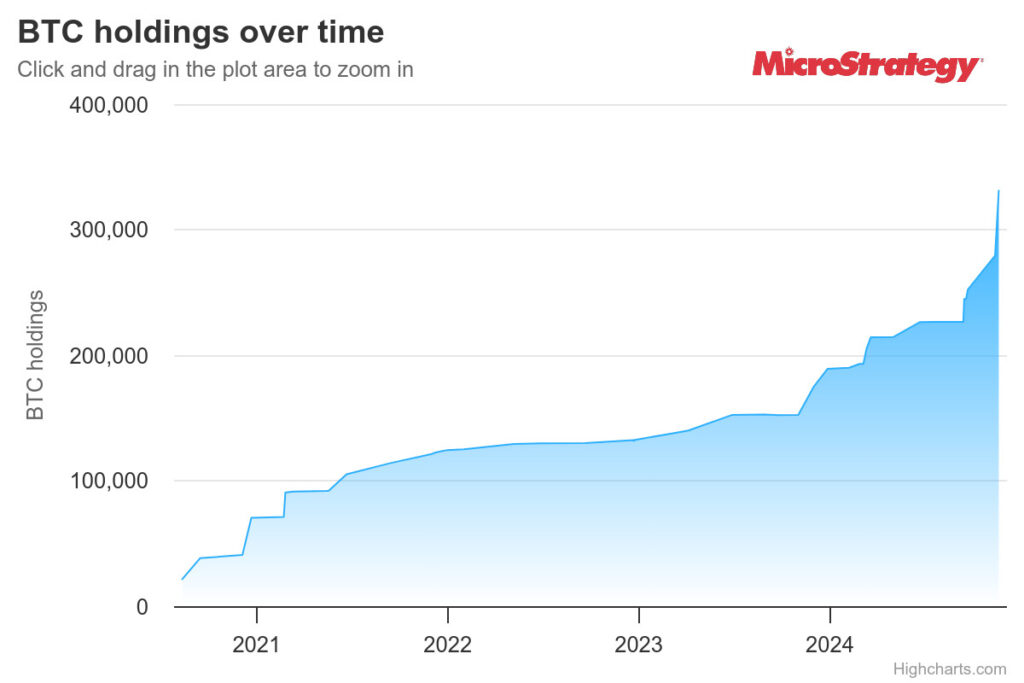

Institutional investors, who often rely on exchanges for transactions, may need to adjust their strategies. Over-the-counter (OTC) desks or direct partnerships with existing holders could become the preferred methods of acquisition. This approach, while mitigating market impacts, requires careful planning and negotiation.

Challenges for a U.S. Bitcoin Reserve

The proposal by President-elect Donald Trump to establish a U.S. Bitcoin reserve adds another layer of complexity to this narrative. A government initiative to acquire substantial Bitcoin holdings would face significant hurdles in the current low-liquidity environment. Without careful execution, such efforts could inadvertently lead to price spikes, making the acquisition more expensive and market conditions more volatile.

Analysts suggest that any large-scale government purchase would need to be conducted discreetly, possibly through OTC transactions or strategic alliances with major Bitcoin holders. Even then, the reduced exchange reserves could limit the pace and scale of such an initiative.

Conclusion

Bitcoin’s declining exchange reserves highlight a critical juncture for the cryptocurrency market. The shift toward long-term holding reflects the growing maturity and stability of the asset class, demonstrating confidence in its value. However, it also presents challenges for large-scale acquisitions, particularly for institutions and governments like the U.S., which may struggle to navigate the complexities of a tightening supply.

As Bitcoin continues to evolve, this trend underscores the need for strategic foresight and innovation in acquisition and management practices. For now, Bitcoin’s growing scarcity reinforces its position as a unique asset, capable of reshaping global financial markets while challenging traditional paradigms of liquidity and governance.

Readers’ frequently asked questions

Why are investors moving Bitcoin to private wallets instead of keeping it on exchanges?

Investors are shifting their Bitcoin to private wallets for enhanced security and greater control over their assets. When Bitcoin is stored on exchanges, it remains vulnerable to potential hacks, operational failures, or even regulatory interventions that could freeze or confiscate funds. By using private wallets, investors remove these third-party risks and gain direct ownership of their cryptocurrency. This move reflects a growing sophistication among market participants, who are now treating Bitcoin more like digital gold—a store of value to be safeguarded rather than actively traded.

How does reduced Bitcoin liquidity affect ordinary investors?

For individual investors, the reduced Bitcoin liquidity on exchanges can have both positive and negative consequences. On the positive side, decreased supply often leads to higher prices over time as demand outpaces availability. This can benefit long-term holders who are looking for value appreciation. However, for active traders or new buyers, reduced liquidity may result in higher transaction costs and greater price volatility, making it harder to execute trades at predictable prices. For those entering the market, timing and strategy become crucial in a low-liquidity environment.

Could a U.S. Bitcoin reserve actually impact the global Bitcoin market?

If the U.S. were to move forward with establishing a Bitcoin reserve, it could significantly influence the global market. Such a move would signal institutional and governmental validation of Bitcoin as a strategic asset, potentially spurring adoption worldwide. However, the mechanics of acquiring Bitcoin on a large scale could strain the already limited supply, driving prices higher and creating ripple effects across the market. Additionally, other governments might respond by accumulating Bitcoin themselves, further intensifying competition and shaping Bitcoin’s role as a geopolitical asset. For individual investors, this could mark the beginning of a new phase in Bitcoin’s evolution, where its value is influenced not just by market forces but also by state-level strategies.

What Is In It For You? Action Items You Might Want to Consider

Explore Private Wallet Solutions for Long-Term Security

If you’re holding Bitcoin on exchanges, consider moving a portion of your assets into private wallets or cold storage solutions. This protects your holdings from exchange vulnerabilities like hacks or operational failures, while aligning with the growing trend of long-term holding. Evaluate hardware wallets or trusted software wallets that prioritize security and ease of use.

Adapt Your Trading Strategy for Low Liquidity Conditions

With exchange reserves at historic lows, Bitcoin markets could experience heightened price volatility. Use this as an opportunity to refine your trading strategy. If you’re an active trader, set tighter stop-loss limits and consider scaling into positions gradually to avoid abrupt price movements. For long-term investors, dollar-cost averaging remains a smart way to accumulate Bitcoin without overexposing yourself to market spikes.

Monitor Institutional Moves and Government Initiatives

Stay alert to developments surrounding institutional Bitcoin acquisitions or government-led initiatives, such as the U.S. Bitcoin reserve proposal. Large-scale purchases can significantly impact market dynamics and create opportunities for traders. Keep an eye on over-the-counter trading activity or major wallet movements that might indicate institutional buying pressure. Being ahead of such trends could give you a competitive edge in market positioning.