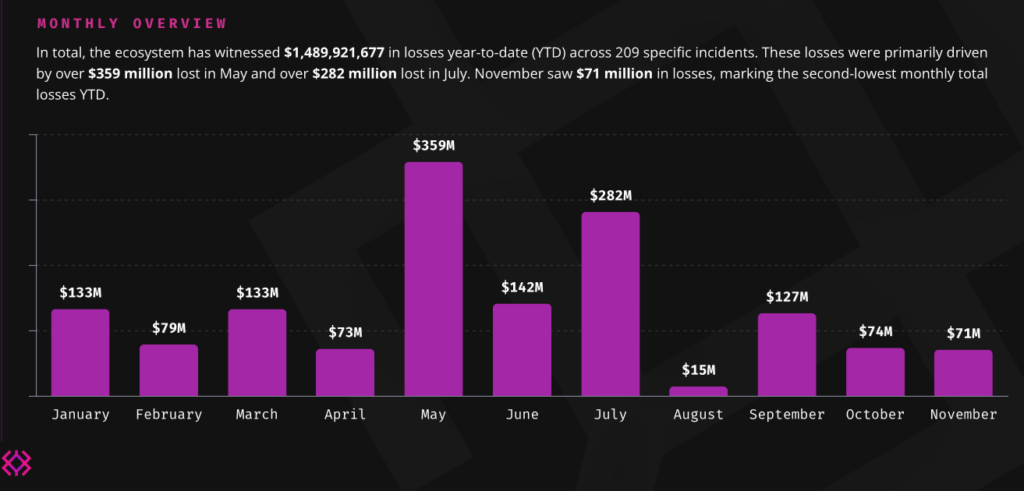

The cryptocurrency industry, celebrated for its innovation and potential to decentralize finance, continues to grapple with a significant Achilles’ heel — security. In 2024, despite advancements in cybersecurity measures, the sector reported losses totaling $1.5 billion across 209 incidents. The staggering figure underscores the relentless threat posed by sophisticated hackers, particularly to decentralized finance (DeFi) platforms, which accounted for most of these breaches.

A Year in Numbers: Trends and Targets

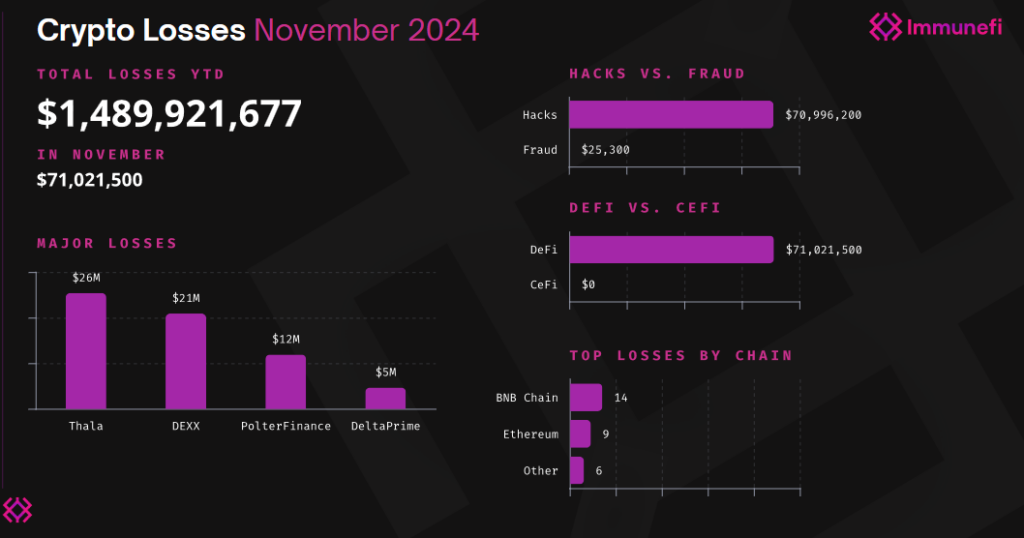

According to data from the Immunefi November 2024 Crypto Losses Report, hacks have overshadowed fraud as the predominant cause of the industry’s financial loss. Out of $1.5 billion in total losses year-to-date, $71 million occurred in November. Though it is one of the lowest monthly figures in 2024, the industry is far from secure. The BNB Chain and Ethereum emerged as the most targeted blockchains, with 46.7% and 30% of total November incidents respectively.

Notably, DeFi platforms faced 100% of November’s attacks, reinforcing their position as the primary focus for cybercriminals. Centralized Finance (CeFi) platforms, in contrast, reported no losses during the same period. This seems to indicate a possible shift in attack vectors favoring decentralized systems.

High-Profile Incidents

Among the notable breaches in 2024, Thala Labs suffered a $25.5 million loss in November, while the DEXX platform lost $21 million. These incidents reflect the persistent vulnerability of DeFi protocols. They remain lucrative targets for hackers due to their open-source nature and the vast sums of liquidity they handle.

Other significant losses throughout the year included attacks on platforms like PolterFinance and DeltaPrime, demonstrating that no segment of the DeFi ecosystem is immune to exploitation.

Security Improvements and Persistent Challenges

While the $1.5 billion loss represents a 15% reduction from the $1.75 billion reported in 2023, the marginal improvement highlights the enduring challenges in securing DeFi ecosystems. Enhanced security measures, including external audits and bug bounty programs like those offered by Immunefi, have played a critical role in identifying and mitigating vulnerabilities. However, the evolving tactics of hackers – ranging from phishing schemes to smart contract exploits – continue to outpace defensive measures.

Rug pulls, previously a significant source of losses, accounted for a mere 0.04% of November’s financial toll, suggesting progress in combating this particular form of fraud. Yet, the growing complexity of hack strategies, including cross-chain exploits and flash loan attacks, keeps the industry on high alert.

The Path Forward

The persistence of high-value losses underscores an urgent need for the crypto industry to adopt more proactive and collaborative security approaches. Experts advocate for standardized security audits, continuous monitoring of smart contract vulnerabilities, and broader adoption of white-hat hacker programs. Additionally, greater regulatory clarity around cybersecurity standards for DeFi platforms could incentivize stronger safeguards.

>>> Read more: Crypto Security Breaches Cost $1.19B so far in 2024

As blockchain technology continues to revolutionize finance, its success hinges not only on innovation but also on the ability to secure its foundation. For DeFi to fulfill its promise of a decentralized future, the industry must confront its vulnerabilities head-on, ensuring that recurring breaches do not erode trust in the ecosystem.

Readers’ frequently asked questions

What should I do if the DeFi platform I use gets hacked?

If a DeFi platform you are using gets hacked, the first step is to stop interacting with the platform immediately. Avoid any further transactions to prevent additional losses. Check official announcements from the platform’s developers to understand the scope of the hack and follow their instructions. If the platform has a recovery plan, like tracking the stolen funds or reimbursing users, ensure you register for updates or claims. Additionally, report the incident to blockchain security firms or local authorities specializing in cybercrime. Use this experience to evaluate other platforms for better security practices before investing again.

How can I identify if a DeFi platform is secure before using it?

To evaluate the security of a DeFi platform, check if it has undergone recent audits by reputable blockchain security firms such as CertiK or Immunefi. Look for detailed audit reports that list vulnerabilities and their resolution status. Research whether the platform offers bug bounty programs, as these incentivize ethical hackers to identify flaws proactively. Verify if the platform has been operational for some time without major incidents and consider its reputation within the community. Platforms with transparent development teams and robust documentation are generally more reliable. Always start with small transactions to test the platform’s safety before committing larger funds.

Can stolen funds in a crypto hack be recovered?

Recovering stolen funds in a crypto hack is challenging but not impossible. In some cases, law enforcement and blockchain analytics firms can trace stolen assets using blockchain transparency. Platforms like Thala Labs have successfully recovered funds with the help of legal authorities. However, the chances of recovery depend on the hacker’s methods, the speed of the response, and the cooperation of exchanges where the stolen assets may be moved. To improve the chances of recovery, victims should report the incident immediately to the platform, blockchain security firms, and law enforcement agencies specializing in cybercrime.

What Is In It For You? Action Items You Might Want to Consider

Prioritize Security When Choosing DeFi Platforms

Before engaging with any DeFi platform, ensure it has undergone recent audits by reputable blockchain security firms like CertiK or Immunefi. Look for transparent audit results and active bug bounty programs. Platforms that openly share their security practices and have a track record of resolving vulnerabilities are safer choices for your investments.

Diversify Your Assets Across Multiple Platforms

Avoid concentrating your funds in a single DeFi platform, no matter how reputable it seems. Spreading your assets across multiple platforms reduces the risk of significant loss if one is hacked. Diversification is a practical way to minimize exposure to the vulnerabilities of any single platform or blockchain.

Stay Updated on Emerging Threats and Security Measures

Make it a habit to follow blockchain security news and updates from platforms you use. Cyber threats evolve quickly, and being informed about new exploits or patches can help you react proactively. Subscribing to updates from blockchain security firms or using alert services can keep you one step ahead in safeguarding your investments.

[…] >>> Read more: DeFi Security: $1.5B Lost to Hacks in 2024 […]

[…] >>> Read more: DeFi Security: $1.5B Lost to Hacks in 2024 […]

[…] >>> Read more: DeFi Security: $1.5B Lost to Hacks in 2024 […]