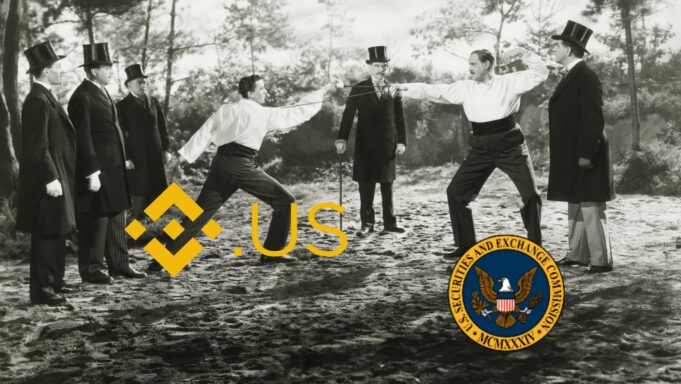

In a legal showdown in a courtroom in Washington D.C., Federal Judge Amy Berman Jackson intensely scrutinized Binance, the world’s largest cryptocurrency exchange. Binance sought to dismiss the high-profile lawsuit filed against it by the U.S. Securities and Exchange Commission (SEC). This courtroom drama comes hot on the heels of a similar clash between Coinbase and the SEC. Both exchanges pursue parallel legal arguments challenging the authority of the SEC.

The Complexities of the Legal Matter

The legal dispute between Binance and the SEC has become a focal point for the crypto industry, reflecting a broader trend of increased regulatory scrutiny on cryptocurrency exchanges. Last week, Coinbase also found itself in a similar legal battle with the SEC. It highlights the growing tension between regulators and major crypto platforms.

SEC Allegations Against Binance

In June last year, the SEC accuses Binance, its then-CEO Changpeng Zhao, and its U.S. Division of multiple violations. The allegations include artificially inflating trading volumes, diverting customer funds, failing to restrict U.S. customers, and providing misleading information about market surveillance controls.

Coinbase – A Battle in Parallel

Coinbase, another major cryptocurrency exchange, is currently embroiled in its own legal dispute with the SEC. The regulatory body has levied accusations against Coinbase alleging the offering of unregistered securities and involvement in fraudulent activities. There are similarities between these two cases beyond the allegations themselves. Both exchanges question the jurisdiction and authority of the SEC over crypto assets.

Legal Arguments – Contesting the SEC’s Jurisdiction

Echoing the Coinbase team, Binance’s legal representatives argue that the SEC lacks the authority to regulate certain crypto assets because they do not meet the criteria for being classified as investment contracts. At the core of this argument lies an examination of whether individuals are engaging in investment contracts with common enterprises with the expectation of a profit – a pivotal aspect evaluated through a U.S. Supreme Court case related to the Securities Act of 1933.

The SEC vehemently defended its regulatory authority. It argued that most crypto assets fall within its jurisdiction and are subject to the established rules and regulations. The agency emphasized the flexibility of the legal test for determining securities. It stated that there is “no bright line” and highlighting the need for a nuanced approach.

Major Questions Doctrine – A Common Link

Both Binance and Coinbase invoked what is known as the major questions doctrine, suggesting that the SEC is exceeding its regulatory boundaries without explicit authorization from Congress. However, the judges in both cases have shown doubt about this argument, raising questions about its relevance.

Implications for the Crypto Industry

The outcomes of these battles are extremely important for the entire cryptocurrency industry. They could set precedents for how crypto assets will be treated and regulated in the United States. As Binance and Coinbase navigate the complexities of these cases, the crypto community eagerly awaits the decisions that will shape the regulatory landscape.

In the changing world of cryptocurrency regulation, Binance’s clash with the SEC along with Coinbase’s parallel legal battle highlights the challenges faced by major exchanges. The resistance against regulation and the pursuit of clarity within regulatory frameworks are themes that resonate throughout the industry. Members of the community closely observe these legal dramas as they unfold, realizing their widespread implications for market dynamics and regulations.

Read more: Regulatory Showdown – Coinbase Challenges SEC’s Jurisdiction

What is the Major Questions Doctrine?

The Major Questions Doctrine is a legal principle derived from a Supreme Court ruling that asserts federal agencies cannot regulate without specific authorization from Congress on issues of major economic or political significance. It establishes that certain important policy decisions should be made by elected representatives rather than administrative agencies.

[…] >>> Read more: Binance Takes On The SEC […]