In the fast-evolving landscape of cryptocurrency, the United States Department of the Treasury sounded a clarion call to lawmakers, urging swift action on crypto regulation. This push comes amidst growing concerns about illicit activities, terrorism financing, and the need to adapt to the changing nature of financial transactions in the digital age.

US Crypto Regulation: A Crucial Imperative

As the crypto industry gains momentum, Deputy Secretary of the Treasury, Wally Adeyemo, presented a compelling case for extended powers. The US Treasury proposes a set of common-sense recommendations to expand authorities and tools, aiming to combat illicit actors in the digital asset space. Adeyemo emphasizes the necessity of updating authorities that have not seen revisions in decades, highlighting the adaptive strategies employed by terrorist groups, such as Hamas.

Tackling Terrorism and Illicit Finance

One key aspect of the Treasury’s proposal is the call for a new secondary sanctions tool against exchanges supporting terrorism. This tool, if granted, would not only sever a firm’s ties to the US financial system. It would also expose entities engaging with sanctioned organizations to a similar fate. Adeyemo asserts that these measures are crucial to curb the exploitation of cryptocurrencies by terrorists and other illicit actors, ensuring the robustness of the financial system.

Extraterritorial Jurisdiction and Stablecoins

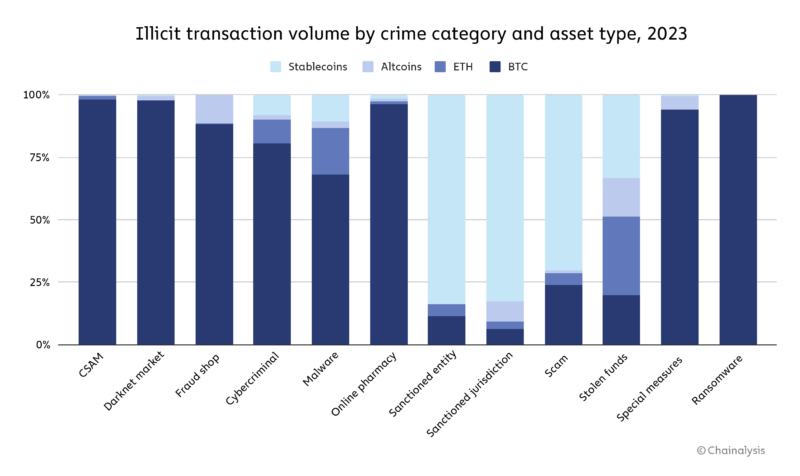

The proposal also delves into the extraterritorial jurisdiction over stablecoins, singling out major players like Tether. By explicitly authorizing the Office of Foreign Assets Control (OFAC) to exercise jurisdiction over transactions in stablecoins, the Treasury aims to extend its oversight beyond traditional USD transactions. Adeyemo emphasizes the need for non-US stablecoin issuers to implement procedures preventing terrorists from abusing their platforms.

FinCEN’s Proposed Rule on Crypto Mixers

The Financial Crimes Enforcement Network (FinCEN) has also entered the fray. It proposed a rule to increase transparency around cryptocurrency mixers and target the anonymity provided by these software tools. If approved, financial firms will be mandated to report transactions suspected to involve crypto mixers. This move underscores the heightened scrutiny on crypto’s role in financing activities of groups like Hamas, bringing the need for comprehensive regulation to the forefront.

Urgency Backed by President Biden

The urgency for crypto regulation has garnered support at the highest levels. President Biden endorsed efforts to address the risks and benefits of digital assets. A 2022 executive order outlined a comprehensive strategy, emphasizing consumer protection, financial stability, and national security concerns related to cryptocurrencies. Treasury Assistant Secretary Graham Steele reinforces the existing robust regulatory framework and the need for stringent enforcement to ensure protection for users and adherence to regulatory principles.

In conclusion, the call for swift action on US crypto regulation echoes the dynamic nature of the digital asset landscape. The Treasury’s proposals and FinCEN’s initiatives signal a commitment to adapt regulatory frameworks to address emerging challenges. As stakeholders navigate these changes, a delicate balance must be struck. Foster responsible innovation without compromising the integrity of financial systems. The evolving crypto landscape demands a proactive approach. The proposed regulations aim to lay the groundwork for a secure and thriving digital financial ecosystem.

Read more: Crypto Crime 2023 – Chainalysis Report

[…] Read more: US Treasury’s Plea for Swift Crypto Regulation […]