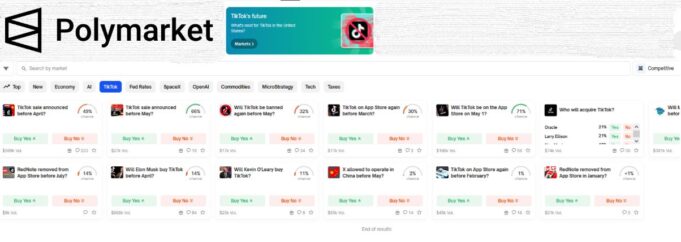

Polymarket, a decentralized prediction market, faces intense scrutiny following its controversial decision to resolve its TikTok ban market as a “Yes” win – even though the social media platform remains accessible in the United States. Critics argue that the resolution was premature. They question the reliability of blockchain-based betting platforms regarding high-stakes political and regulatory events. The dispute has reignited broader discussions about the role of decentralized prediction markets in financial forecasting and the ethical and regulatory implications of betting on real-world geopolitical developments.

The TikTok Ban Market Controversy

The Polymarket contract in question asked traders to bet on whether the U.S. would ban TikTok by May 2025. Following a recent U.S. Supreme Court ruling upholding a ban on the app due to national security concerns, Polymarket resolved the market as a win on January 20, 2025. However, this decision came after former President Donald Trump granted TikTok a 75-day extension to negotiate a potential deal. The platform remained operational beyond the supposed ban date.

Many users and market participants took to social media and crypto forums to express their frustration. They argued that Polymarket’s resolution ignored the practical reality of the situation. Critics claim that the decision was made in a way that benefited certain stakeholders at the expense of others, raising concerns about how decentralized platforms define event outcomes and ensure market integrity.

Market Integrity & Trust in Decentralized Prediction Markets

Decentralized prediction markets like Polymarket operate by allowing users to trade contracts based on the likelihood of real-world events occurring. Ideally, these markets leverage the “wisdom of the crowd” to forecast outcomes with a high degree of accuracy. However, the TikTok bet controversy exposes a key vulnerability in these systems—ambiguity in resolution criteria.

Unlike traditional regulated betting markets, decentralized platforms rely on oracles and predefined resolution rules to settle outcomes. The issue arises when the real-world interpretation of an event does not align with the technical resolution criteria. In this case, the question of whether TikTok was “banned” before the deadline became murky. The law was upheld but enforcement was delayed.

This has led to calls for clearer resolution frameworks, independent arbitration mechanisms, and improved governance models for blockchain-based betting platforms. Without these safeguards, critics warn that decentralized prediction markets risk losing credibility and alienating users feeling at the mercy of arbitrary decisions.

The Role of Prediction Markets in Political and Regulatory Events

Prediction markets have increasingly been used as financial instruments for gauging public sentiment and assessing probabilities of political and regulatory outcomes. They provide a mechanism for traders to hedge risks and for analysts to interpret market signals regarding upcoming policy decisions.

In theory, decentralized platforms like Polymarket offer a censorship-resistant alternative to traditional markets. They allow bets on controversial topics such as elections, regulatory crackdowns, and geopolitical conflicts. However, as the TikTok case illustrates, these platforms also face significant challenges when dealing with unpredictable government actions and legal gray areas.

A major concern is that such markets may inadvertently influence the events they are predicting. If major financial incentives are at play, stakeholders with vested interests could manipulate outcomes or use their influence to sway political decisions. This raises ethical questions. Is it responsible to allow users to bet on high-impact regulatory events? Or does it open the door to potential conflicts of interest?

The Ethical Implications of Blockchain-Based Betting Markets

While decentralized prediction markets are often praised for their transparency and lack of centralized control, their ethical implications remain a topic of debate.

One ethical concern is whether betting on real-world events, particularly those involving legal and political decisions, distorts incentives. If financial markets are built around the expectation of a ban or policy change, do they subtly pressure decision-makers to act in ways that align with market interests?

Additionally, the lack of regulatory oversight in decentralized prediction markets means there are few protections for participants in cases of disputed resolutions. Traditional betting markets, operating under legal frameworks, provide avenues for recourse when outcomes are disputed. In contrast, blockchain-based platforms often leave traders with no alternative but to accept the resolution provided. Even when the resolution appears to contradict real-world events.

The TikTok controversy has amplified discussions around whether decentralized prediction markets should be more accountable to their users, potentially through improved governance mechanisms or third-party resolution services that prevent perceived conflicts of interest.

Conclusion: A Turning Point for Prediction Markets?

The backlash against Polymarket over its handling of the TikTok ban market serves as a warning sign for decentralized betting platforms. As these markets gain prominence in financial speculation and political forecasting, maintaining integrity, clear resolution criteria, and fair governance will be crucial for their long-term credibility.

Blockchain-based prediction markets offer a novel and potentially valuable tool for risk assessment and financial forecasting. However, their effectiveness hinges on trust. If traders believe that market outcomes can be arbitrarily decided or that there are misaligned incentives, confidence in these platforms will erode. Their adoption might stall.

>>> Read more: Gambling Crackdown Hits Polymarket in U.S. and Singapore

As the dust settles on the TikTok bet dispute, the broader crypto and blockchain community will be watching closely to see whether decentralized prediction markets implement reforms to prevent similar future controversies. Whether Polymarket and its competitors can regain the trust of their users may determine the fate of blockchain-based forecasting markets in an increasingly regulated world.

Readers’ frequently asked questions

How does Polymarket decide when to settle a bet, and why is there controversy around this decision?

Polymarket, like most decentralized prediction markets, relies on predefined resolution criteria and external oracles to determine the outcome of bets. These oracles gather real-world data to verify whether an event has occurred. In the case of the TikTok ban bet, Polymarket justified its decision based on a U.S. Supreme Court ruling that upheld a law banning the platform. However, the controversy stems from the fact that despite the ruling, TikTok remains accessible due to a 75-day extension granted by the U.S. government. This discrepancy between the legal ruling and the practical outcome led to accusations that Polymarket resolved the bet prematurely. It raised concerns about whether its resolution process is transparent and fair enough to maintain user trust.

If decentralized prediction markets like Polymarket are not regulated, who ensures they operate fairly?

Unlike traditional betting platforms operating under government oversight, decentralized prediction markets function on smart contracts and blockchain technology. There is no central authority enforcing rules. Instead, fairness is supposed to come from transparent, algorithm-driven processes. However, as the TikTok case shows, market operators still have some discretion over how they interpret events, leading to potential disputes. Some decentralized platforms attempt to mitigate bias by using third-party resolution services or decentralized governance models where users vote on disputed outcomes. That said, because these platforms lack traditional consumer protections, traders often have no legal recourse if they disagree with a resolution, making trust in the platform’s integrity a key factor in participation.

Can prediction markets actually influence real-world events, or are they just a reflection of public sentiment?

Prediction markets are often seen as tools for gauging public sentiment, but they can also have real-world impact. When large amounts of money are wagered on political or regulatory decisions, the financial stakes may incentivize influential players to act in ways that align with market predictions. For example, if a market predicts with high certainty that a government will ban TikTok, it could contribute to media narratives pressuring policymakers. While this doesn’t mean that markets directly control events, they can shape perceptions and influence decision-making. They could even attract speculative financial activities that reinforce specific outcomes. The ethical dilemma arises when these platforms are used not just to predict events, but to profit from their outcomes in ways that could incentivize manipulation.

What Is In It For You? Action Items You Might Want to Consider

Scrutinize Resolution Criteria Before Entering Prediction Markets

Before placing bets on decentralized prediction platforms like Polymarket, always review how outcomes are determined. In cases involving regulatory or political events, the interpretation of a “win” may not be as clear-cut as it seems. If the resolution process lacks transparency or relies on subjective judgment, reconsider your position or hedge your bets accordingly.

Diversify Your Strategy Beyond Single-Event Bets

Markets influenced by legal and political decisions come with unpredictable variables. Court rulings, executive orders, and last-minute extensions can drastically shift outcomes. Instead of relying on a single prediction market bet consider diversifying your strategy. Engage in other markets with clearer resolution criteria or spread your risk across multiple events.

Monitor Market Sentiment and Exit Early If Needed

Price action within prediction markets often shifts based on breaking news and trader sentiment. If you’re holding a position in a market facing controversy, closely track community reactions and early payout disputes. If uncertainty arises – like in the TikTok ban market – consider exiting before a resolution to lock in gains or limit losses. Being proactive in volatile situations can help you avoid disputes and unexpected outcomes.