After suffering a devastating $230 million hack in July 2024, WazirX is now at a crossroads, urging its creditors to vote on a recovery plan that could define the fate of their lost funds. The proposal offers two stark choices: accept the recovery scheme and begin receiving reimbursements in 2025, or reject it and risk waiting until 2030 for an uncertain payout. The decision is crucial for creditors hoping to reclaim their funds and for WazirX’s ability to restore trust and sustain operations.

WazirX’s Proposed Recovery Strategy

Under the proposed plan, WazirX intends to relaunch its trading operations through a new decentralized exchange (DEX). The DEX would be integral to its reimbursement process as WazirX aims to issue tradable recovery tokens. Creditors could sell or hold the tokens, with WazirX promising periodic buybacks using platform profits. At least 75% of creditors by claim value must approve the plan for initial payouts to begin within ten business days. The full recovery process will then unfold gradually.

>>> Read more: WazirX Recovery Plan Approved for Hack Victim Repayment

If creditors reject the plan, the situation becomes far less predictable. WazirX would enter liquidation under Singapore’s Companies Act. This process could result in a “fire sale” of assets, leading to significantly lower recoveries. The exchange has warned that declining the recovery plan could delay repayments until 2030, leaving affected users in limbo for years.

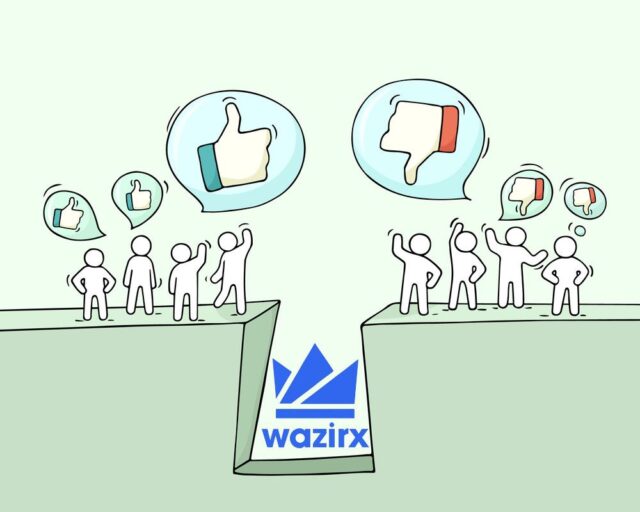

Skepticism and Criticism Surrounding the Plan

Despite WazirX’s assurances, the proposal has sparked intense debate within the crypto community. Many users remain unconvinced that the restructuring plan provides a fair and transparent path to recovery. Critics lament the lack of clear guarantees regarding the value and liquidity of the recovery tokens and the long-term viability of the proposed DEX model. They argue that WazirX asks creditors to take a leap of faith with no firm assurances and without detailing a roadmap for how the exchange will generate revenue and sustain buybacks.

The plan has also been met with backlash from users who see it as an ultimatum rather than a fair choice. Some argue that WazirX is pressuring creditors by presenting liquidation as an unappealing alternative. They feel forced into accepting a plan that may not be in their best interests. Others question whether WazirX can execute its recovery strategy effectively, given the magnitude of the losses and the regulatory scrutiny the exchange has faced in recent years.

The Uncertain Road Ahead

As the voting deadline approaches, WazirX creditors must weigh the risks of both options. If they approve the restructuring plan, the exchange must swiftly implement its recovery measures to regain credibility and demonstrate that its new strategy can deliver results. However, rejecting the plan could result in a long liquidation process stretching for years. Many would not have access to their funds until at least 2030.

The outcome of this vote will not only shape WazirX’s future. It is also a critical case study of how crypto exchanges handle large-scale security breaches. Regardless of the decision, the WazirX hack has once again highlighted the vulnerabilities of centralized exchanges and the pressing need for stronger security measures and clearer accountability in the crypto space.

Readers’ frequently asked questions

What exactly is a decentralized exchange (DEX), and how would it help WazirX recover lost funds?

A decentralized exchange (DEX) is a type of cryptocurrency trading platform that operates without a central authority. Unlike traditional exchanges, which hold user funds and execute trades on their behalf, a DEX allows users to trade directly from their own wallets using smart contracts. In WazirX’s case, the proposed DEX would generate revenue through trading fees. It plans to use a portion of those profits to buy back the recovery tokens issued to creditors. They assume that as the DEX grows in popularity, the demand for recovery tokens will increase. Increased demand potentially improves their value and helps users recover lost assets over time. However, this plan hinges on the success of the new platform, which is far from guaranteed.

Why would liquidation take until 2030, and why is it considered a bad option?

If creditors reject WazirX’s restructuring plan, the exchange enters a legal liquidation process in Singapore, where it is incorporated. Liquidation involves selling WazirX’s remaining assets and distributing the proceeds to creditors. However, this process can be lengthy due to legal proceedings, asset valuation disputes, and market conditions that may affect how much money is recovered. Additionally, because WazirX’s primary assets are crypto-related, a “fire sale” could result in significantly lower prices. Creditors might recover far less than they originally lost. WazirX has warned that declining the plan could delay payouts until 2030, making it a highly uncertain path for users hoping to reclaim their funds.

If WazirX issues recovery tokens, does that mean creditors will not get their original funds back?

No, WaxirX will not return the exact cryptocurrencies creditors lost in the hack. Instead, they would distribute special recovery tokens, which can be traded on the new decentralized exchange or sold on the open market. WazirX plans to periodically buy back these tokens using profits from its trading operations. The idea is that as WazirX’s DEX grows, the value of these tokens could increase, allowing creditors to recover their funds over time. However, this approach carries risks. If the DEX fails to gain traction, the recovery tokens may have little to no value, leaving creditors with an asset that is difficult to sell.

What Is In It For You? Action Items You Might Want to Consider

Evaluate the risks before deciding on WazirX’s recovery plan

If you’re a creditor affected by the WazirX hack, don’t rush into voting without understanding the implications. Assess whether you trust the exchange’s ability to launch its decentralized exchange (DEX) successfully and whether you believe the recovery tokens will hold value in the long run. If you prefer a faster payout, supporting the plan might make sense. However, if you’re skeptical about the DEX’s viability, consider whether waiting for a liquidation process, despite its uncertainties, is a better alternative.

Monitor the potential market for WazirX’s recovery tokens

Even if you’re not directly affected by the hack, keeping an eye on WazirX’s recovery tokens could open up trading opportunities. If the restructuring plan moves forward, these tokens will be issued and traded on WazirX’s new platform. Traders should analyze their liquidity, price action, and demand to determine if they could present a speculative opportunity. Watch how WazirX implements its buyback mechanism, as this will influence price stability and market interest.

Reassess your exchange security and portfolio diversification

The WazirX hack is another reminder of the risks associated with keeping funds on centralized exchanges. If you’re actively trading, ensure you use exchanges with strong security measures and consider moving long-term holdings to private wallets. Additionally, review your portfolio diversification strategy—being overly exposed to assets linked to a single platform or ecosystem can increase vulnerability. Learning from past incidents can help you mitigate risks in future trades.

[…] March 2025, the company secured overwhelming support: more than 90% of voting creditors backed the restructuring plan. A key milestone, but not the final […]