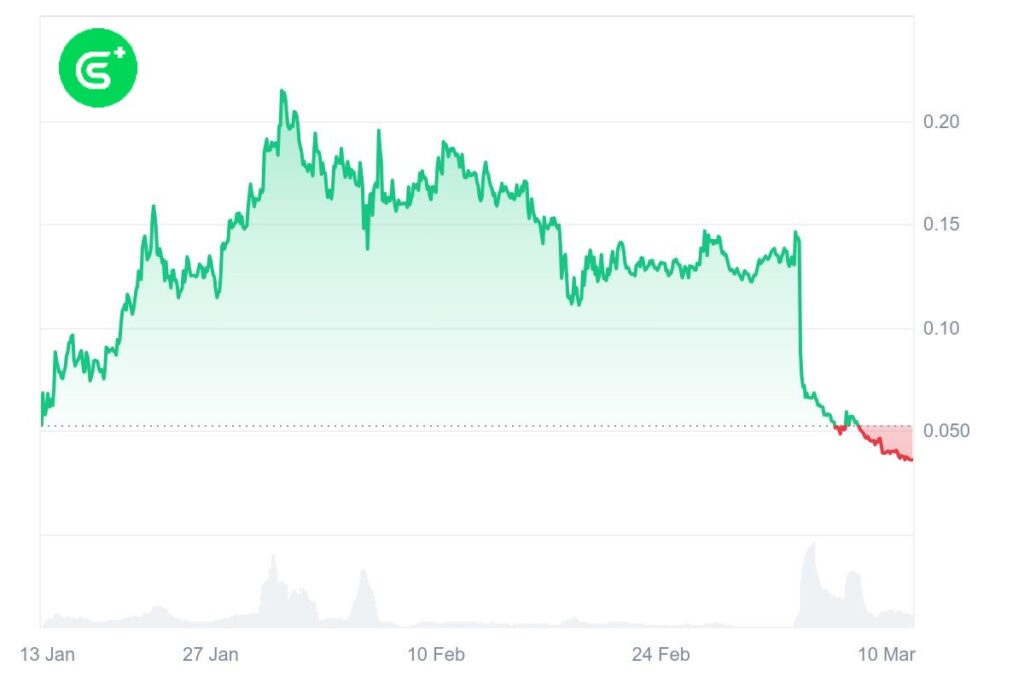

Binance shook the cryptocurrency market announcing the termination of a market maker responsible for severe trading irregularities involving the GoPlus Security (GPS) and MyShell (SHELL) tokens. The decision came after an internal investigation revealed that the market maker had aggressively offloaded 70 million GPS tokens between March 4 and March 5, 2025, without placing corresponding buy orders, leading to an abrupt 60% price drop.

Binance has since confiscated the market maker’s funds and pledged to compensate affected investors, yet uncertainty surrounding the process has fueled community backlash and concerns over investor protection. In response, GoPlus Security has launched its own internal probe into the incident, denying allegations of insider trading.

Investor Outrage and Demands for Compensation

The fallout from the market maker’s removal has sparked widespread criticism from GPS token holders. The sudden price collapse caught many caught off guard. Traders have voiced frustration over the lack of immediate compensation details. They questioned whether Binance’s decision would be sufficient to cover their losses.

Binance confirmed they would use funds confiscated from the market maker to reimburse affected users. However, the exchange failed to disclose the specific amount recovered and did not define the exact criteria for compensation eligibility. Many investors fear they could be left with significant losses. Those who entered leveraged positions or bought GPS tokens at higher prices before the crash are particularly concerned.

>>> Read more: Binance France Investigation: Money Laundering Probe

GoPlus Security Responds Amid Transparency Concerns

GoPlus Security, the issuer of the GPS token, has sought to distance itself from the controversy. The issuer stated the market maker did not inform them in advance about the activities or Binance’s decision to list GPS on March 4. The company has launched an internal investigation into the abnormal trading activity, but skepticism remains high among investors.

Adding to the controversy, some reports suggest that the banned market maker might have ties to prominent figures in the industry. While Binance has not disclosed its identity, speculation within the community has linked the entity to major crypto trading firms. However, companies such as Animoca Brands and GSR have publicly denied involvement, fueling further uncertainty.

Binance’s Market Integrity Efforts – But Are They Enough?

Binance’s decision to remove the market maker aligns with its broader efforts to ensure market integrity and prevent manipulative trading practices. The exchange reaffirmed its strict market-making principles, which require participants to:

- Maintain both bid and ask orders

- Ensure adequate order sizes at different price levels

- Prevent market disruption through excessive order cancellations or aggressive sell-offs

However, critics argue that Binance’s reactive approach does little to prevent future incidents of this nature. The controversy surrounding GPS and SHELL raises deeper concerns about investor protection and the lack of safeguards against price manipulation in token listings.

>>> Read more: SEC Binance Pause: A Surprising Turn in Legal Standoff

A Broader Crypto Market Challenge

The GPS token crash is not an isolated event. Cases of market makers engaging in questionable trading practices have surfaced before, raising questions about exchange oversight and accountability. With investor sentiment already fragile due to recent market downturns, the incident has exacerbated distrust in centralized exchanges and reignited calls for greater transparency in market-making agreements.

Binance’s handling of the situation will serve as a test case for investor protection policies in crypto markets. For now, affected GPS holders are left waiting for clearer compensation guidelines. Whether this marks a turning point in exchange accountability or just another temporary controversy remains to be seen.

Readers’ frequently asked questions

What is a market maker, and how can it manipulate a token’s price?

A market maker is a trading entity, usually an individual or a firm, responsible for providing liquidity to a market by placing both buy and sell orders for a token. This ensures that traders can easily buy and sell assets without significant price fluctuations due to low liquidity. However, suppose a market maker does not follow fair trading practices. In that case, it can manipulate the price by aggressively selling a large quantity of tokens while placing few or no buy orders. This can create an artificial sense of market pressure, causing a token’s price to drop sharply, as seen in the GPS token incident. Market makers are supposed to stabilize prices. But when they act irresponsibly, they can instead destabilize the market and cause significant losses for retail traders.

How does Binance’s compensation plan work, and will affected users get their money back?

Binance has stated that it confiscated the funds from the banned market maker and will use them to compensate affected users. However, Binance has not yet provided specifics. How much was recovered, who qualifies for compensation, or what percentage of losses will be reimbursed? This lack of clarity is one of the main reasons why the crypto community is concerned. Typically, in cases like this, Binance or the affected projects (such as GoPlus Security) might distribute compensation based on users’ trading records, prioritizing those who suffered losses directly linked to the market maker’s actions. Until Binance provides more details, users remain uncertain about whether they will receive full, partial, or no compensation at all.

What does this incident mean for investors holding GPS or other newly listed tokens?

Removing the market maker and Binance investigating highlight the risks of newly listed tokens, especially those with low liquidity and high volatility. GPS investors now face increased uncertainty because Binance has placed the token under a Monitoring Tag. Users must pass a risk quiz every 90 days to continue trading it. This suggests that Binance considers GPS to be a high-risk asset. For traders and investors, this incident serves as a reminder to exercise caution when trading newly listed tokens, as they can be vulnerable to manipulative practices and sudden price fluctuations. It also reinforces the need to research token projects and market conditions before making investment decisions.

What Is In It For You? Action Items You Might Want to Consider

Be Wary of Newly Listed Tokens with Low Liquidity

If you’re trading a recently listed token like GPS, always assess its liquidity, market depth, and trading volume before making a move. Low-liquidity tokens are more vulnerable to price manipulation by market makers, leading to sharp crashes like the one seen with GPS. Use tools like order book analysis and on-chain data to spot unusual trading patterns before entering a position.

Monitor Exchange Announcements for Red Flags

Binance’s Monitoring Tag on GPS should be a clear warning – such flagged tokens often carry higher risks due to volatility or security concerns. If a token you’re holding gets tagged or if an exchange issues a sudden rule change, reassess your position immediately. Staying ahead of these updates can help you adjust your risk exposure before it’s too late.

Secure Profits and Set Stop-Losses to Protect Against Market Manipulation

Given the increasing number of cases involving market makers acting against retail traders, it’s essential to implement strict stop-loss strategies to safeguard your capital. If you’re holding a highly speculative or newly listed token, consider taking profits at key levels rather than waiting for long-term gains. This way, you lock in returns while minimizing potential losses from unpredictable sell-offs like the one that hit GPS holders.