Once a leader in enterprise analytics, Strategy (formerly MicroStrategy) is now better known as the largest publicly traded corporate holder of Bitcoin, with nearly 500,000 BTC in its treasury. With over 20% of its workforce cut, research and development budgets slashed, and a relentless stock dilution strategy to finance Bitcoin purchases, the company has seemingly transformed into a high-stakes Bitcoin ETF in disguise. Is this a visionary long-term bet, or has Strategy sacrificed its core business at the altar of digital gold?

From Enterprise Analytics to Bitcoin Titan

Founded in 1989, Strategy built its reputation as a business intelligence (BI) software provider, helping Fortune 500 companies, government agencies, and financial institutions analyze large datasets. Its flagship product, MicroStrategy ONE, competed with industry leaders like Tableau (Salesforce), Power BI (Microsoft), and Looker (Google).

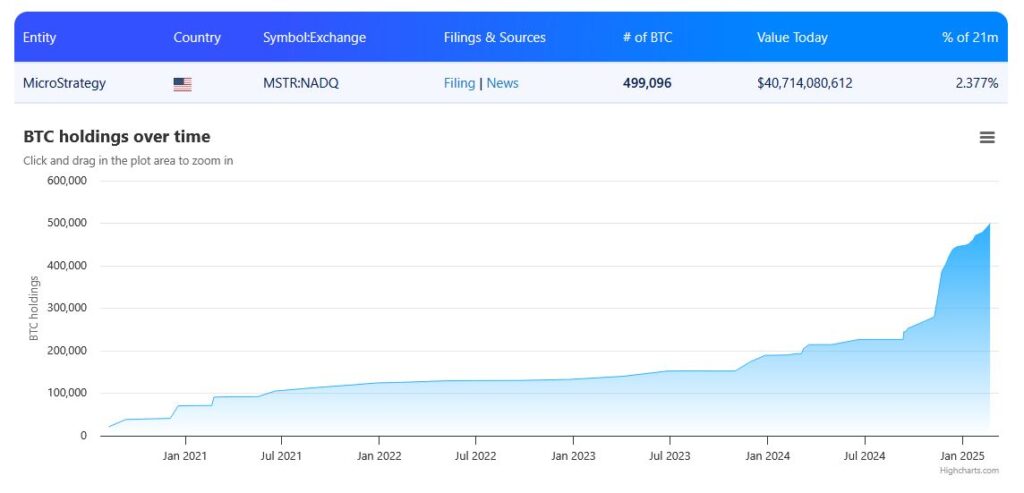

However, in August 2020, under the leadership of co-founder and chairman Michael Saylor, Strategy took an unprecedented turn. Citing concerns over inflation and currency devaluation, the company adopted Bitcoin as its primary treasury reserve asset and began aggressively purchasing BTC. This decision would reshape the company’s future, turning it into a Bitcoin-centric financial entity rather than a pure-play software firm.

How Strategy Funds Its Bitcoin Empire

Unlike traditional corporate Bitcoin buyers like Tesla or Block (formerly Square), using excess cash for crypto investments, Strategy has relied on debt issuance, stock sales, and convertible securities to fund its Bitcoin purchases.

- Stock Dilution: The company has repeatedly raised capital through at-the-market (ATM) stock offerings, selling shares to finance further Bitcoin buys. In its most recent move, Strategy announced a $21 billion preferred stock issuance with a 9% yield, further fueling its Bitcoin acquisition strategy.

- Convertible Debt: Over the past four years, the company has issued multiple rounds of convertible notes, raising billions of dollars.

- Corporate Bonds: Strategy has leveraged corporate bonds and private placements to increase its Bitcoin holdings without needing to liquidate existing assets.

As of March 2025, Strategy holds approximately 499,226 BTC, purchased at an average price of $66,360 per Bitcoin.

Operational Changes: Is Strategy Abandoning Business Intelligence?

Significant structural changes accompanied Strategy’s pivot to Bitcoin. In 2024, the company cut 20.7% of its workforce, reducing its headcount from 1,934 to 1,534 employees. These layoffs primarily affected research and development, consulting, and sales and marketing. That indicates a reduced focus on its enterprise analytics business.

Although MicroStrategy ONE remains available, the reduced investment in R&D and sales raises concerns about its long-term competitiveness. In a BI market dominated by well-funded rivals like Microsoft, Google, and Salesforce, Strategy’s software business may struggle to keep pace. It could potentially make the company more reliant on Bitcoin-driven financial strategies.

Financial Risks: A Bitcoin Bet with High Stakes

Strategy’s aggressive Bitcoin accumulation strategy has led to extreme stock volatility. Its shares have seen both massive rallies and sharp declines, tracking Bitcoin’s price movements.

Key Risks:

Stock Volatility: Strategy’s stock (MSTR) now became a Bitcoin proxy, often moving in tandem with BTC prices. This exposes investors to crypto market fluctuations, rather than the traditional stability expected from an enterprise software firm.

Leverage and Debt Exposure: The company’s debt-fueled Bitcoin strategy could become a liability if Bitcoin prices drop significantly. Convertible debt and high-yield stock issuances create long-term obligations that could strain financial flexibility.

New Tax Liabilities: Recent U.S. accounting rule changes now allow companies to report real-time Bitcoin market values. While this benefits firms with unrealized gains, it may also subject Strategy to a corporate alternative minimum tax on its $18 billion in unrealized Bitcoin profits, unless IRS exemptions apply.

Regulatory Uncertainty: The evolving U.S. regulatory landscape could impact corporate Bitcoin holdings, and taxation, or even impose new restrictions on how public companies can manage crypto assets.

Conclusion: A Corporate Visionary or a Bitcoin Gambler?

Strategy’s transformation from an enterprise analytics company into a Bitcoin-centric financial entity is one of the most radical shifts in corporate history. While Michael Saylor champions Bitcoin as superior to cash, the company’s reliance on debt, stock dilution, and extreme market volatility presents significant financial risks.

Is Strategy on the cutting edge of financial innovation, or has it sacrificed its core business for a speculative bet on Bitcoin? Only time will tell if this bold strategy secures long-term dominance or exposes the company to catastrophic financial risk.

Readers’ frequently asked questions

What does it mean that Strategy uses Bitcoin as a “treasury reserve asset”? How is this different from how other companies hold cash?

When companies hold a treasury reserve asset, they keep a portion of their financial reserves in a specific store of value rather than traditional cash or bonds. Most corporations hold cash in bank accounts or short-term government securities for stability and liquidity.

Strategy, however, chooses to hold Bitcoin instead of cash. The company believes that BTC will appreciate over time while fiat currencies lose value due to inflation. So, instead of keeping billions of dollars in cash reserves like Apple or Microsoft, Strategy continuously converts its spare cash – and even borrowed money – into Bitcoin. This is an unconventional approach because Bitcoin is far more volatile than cash. Strategy’s financial strength fluctuates based on BTC’s market price.

If Strategy’s stock is tied to Bitcoin, why not just buy Bitcoin directly instead of investing in Strategy’s shares?

Buying Strategy’s stock (MSTR) instead of Bitcoin appeals to investors who want exposure to Bitcoin without directly holding crypto. There are a few reasons for this:

Regulatory and Security Concerns – Some institutional and traditional investors are restricted from buying Bitcoin directly due to regulations or corporate policies. Buying MSTR allows them to gain indirect exposure to BTC without dealing with crypto exchanges, wallets, or custody issues.

Leverage on Bitcoin Price Movements – Strategy’s stock can sometimes amplify Bitcoin’s price movements. If BTC rises, MSTR often outperforms BTC due to investor speculation. However, this works both ways – if Bitcoin drops, MSTR can fall even more sharply.

Tax and Retirement Account Benefits – Some investors prefer stocks over Bitcoin because MSTR can be held in tax-advantaged accounts, such as IRAs and 401(k)s. Direct Bitcoin holdings may not have the same benefits.

That said, Strategy is not an ETF, meaning its stock price can sometimes trade at a premium or discount compared to Bitcoin’s actual value. Investors looking for pure Bitcoin exposure often choose Bitcoin ETFs instead of MSTR.

Why does Strategy keep buying Bitcoin instead of diversifying into other cryptocurrencies or assets?

Strategy’s Bitcoin-focused strategy is driven by Michael Saylor’s firm belief that Bitcoin is the best store of value in the world. Unlike other cryptocurrencies, Bitcoin is widely recognized as digital gold. It has the largest market capitalization, the strongest security, and a well-established regulatory framework compared to alternative crypto assets. Saylor has repeatedly stated that altcoins are too risky due to regulatory concerns and technological uncertainties. To him, Bitcoin is the only asset worthy of the company’s treasury strategy.

Additionally, Bitcoin’s scarcity (capped at 21 million coins) and its growing institutional adoption align with Strategy’s long-term vision. Diversifying into other assets like Ethereum or equities would dilute this vision and expose the company to additional risks, such as regulatory crackdowns on unregistered securities. Unlike hedge funds or trading firms, Strategy is not actively trading Bitcoin. It buys and holds, expecting BTC to appreciate over time.

What Is In It For You? Action Items You Might Want to Consider

Monitor Strategy’s Stock (MSTR) as a Bitcoin Proxy

If you’re trading Bitcoin but looking for alternative ways to gain exposure, keep an eye on Strategy’s stock (MSTR). It often amplifies Bitcoin’s price movements, meaning it can present trading opportunities when BTC is trending. If Bitcoin surges, MSTR may outperform BTC due to investor speculation. However, during corrections, MSTR tends to drop even harder. Use this correlation to your advantage – when Bitcoin enters an accumulation phase, MSTR might be an attractive leveraged play.

Track Strategy’s Capital Raises – They Can Signal Buying Pressure for BTC

Strategy funds its Bitcoin purchases through stock offerings, convertible debt, and corporate bonds. When the company announces a new capital raise, it’s a strong signal that they’re preparing to buy more Bitcoin. That may drive BTC prices up. If you’re trading Bitcoin, watch for these announcements – they often coincide with short-term market momentum shifts. Entering trades before or shortly after a Strategy purchase could allow you to ride a BTC price bump.

Prepare for Volatility – MSTR and BTC Moves Can Be Exaggerated

Whether you trade Bitcoin or stocks, remember that Strategy’s leveraged Bitcoin strategy magnifies volatility. When Bitcoin drops, MSTR can fall even more aggressively, and when BTC rallies, MSTR tends to overshoot gains. If you’re trading MSTR, tight stop-losses and risk management are crucial. If you’re trading Bitcoin, be aware that Strategy’s financial maneuvers – like debt-funded Bitcoin buys – can create market reactions that aren’t purely organic. Stay ahead by watching both the crypto and equity markets for cross-impact opportunities.

[…] Michael Saylor – Executive Chairman of Strategy […]

[…] sentiment has been notably positive. Analysts are calling this “Ethereum’s MicroStrategy moment.” Across social platforms and investor forums, sentiment spiked. The idea that a public company […]

[…] in the football world and aligns PSG with a growing number of corporations, such as Tesla and MicroStrategy, that have added BTC to their financial reserves as a hedge against fiat […]

[…] 2020, MicroStrategy has shifted from a business intelligence firm to a Bitcoin proxy. As of June 2025, MicroStrategy holds approximately 592,345 BTC, acquired at a total cost of around […]

[…] listing also contributes to broader narratives around Solana institutional adoption. Just as MicroStrategy’s Bitcoin accumulation influenced perceptions of BTC as an investable corporate asset, Sol Strategies’ presence on […]