A growing number of Bitcoin mining firms are shifting from accumulation to liquidation. Miners are selling significant portions of their BTC holdings in response to mounting financial and operational pressures. This ongoing trend, driven by tighter post-halving rewards, rising energy costs, and changing market dynamics, signals a clear departure from the longstanding “hodl” strategy that once defined the sector. Rather than panic-driven capitulation, the sell-off increasingly reflects a pragmatic shift: miners are choosing operational sustainability over speculative conviction.

The Economics Behind the Exodus

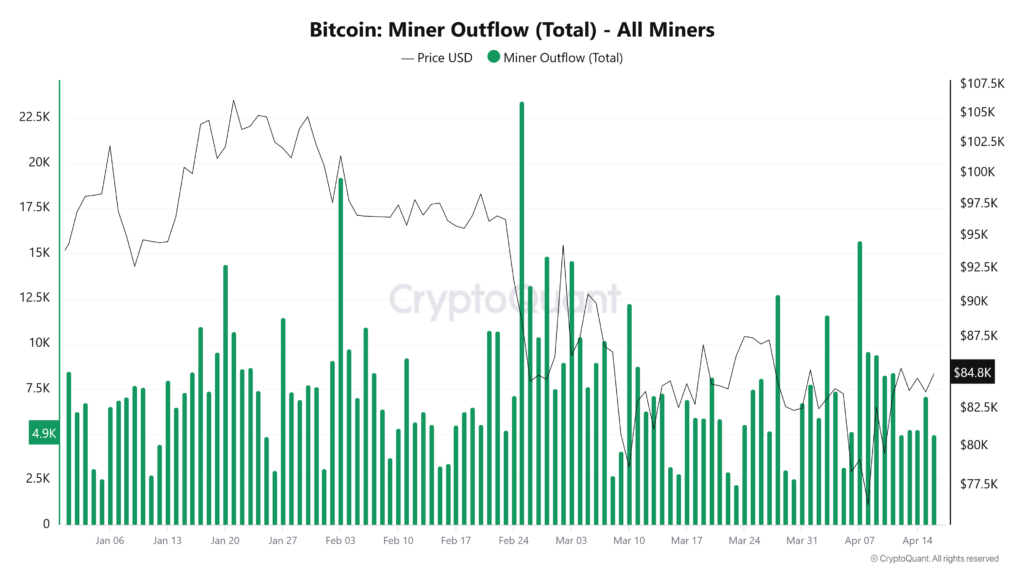

Throughout the first quarter of 2025, miner activity on-chain has shown a marked increase in BTC outflows. In early April alone, over 15,000 BTC, valued at approximately $1.1 billion at the time, were transferred from miner wallets to exchanges. This behavior aligns with the economic aftermath of the April 2024 halving, cutting block rewards from 6.25 to 3.125 BTC. Combined with higher mining difficulty and energy prices, particularly in key jurisdictions like North America and parts of Asia, many miners now face significantly compressed margins.

Bitcoin’s price performance over the past year added both complexity and urgency to this shift. After surpassing its previous all-time high in November 2024 and briefly topping $100,000 in December, BTC entered 2025 on a volatile note. It retreated to the $80,000–$85,000 range by March. As profit expectations narrowed, miners, especially those with debt obligations or public shareholders, began selling more aggressively.

From HODL to Self-Funding

A notable sign of this strategic shift is the move toward self-funding models among prominent mining firms. Instead of holding mined Bitcoin for long-term gains, these companies are increasingly using BTC sales to finance operations, reinvest in infrastructure, or service credit lines.

This approach reflects a maturing attitude in the sector. Mining firms are evolving from speculative entities into capital-efficient businesses, better aligned with the demands of institutional investors and public markets. Miners aim to remain agile in a more competitive and less forgiving landscape. Hence, they build liquidity buffers and reduce dependency on external financing.

A Divided Industry

Importantly, not all players are following the same script. While many mid-sized and public miners have opted to reduce their BTC reserves, others with lower operational costs or more diversified revenue streams continue to accumulate. This divergence underscores a structural shift within the industry. Miners are no longer a unified cohort of holders, but are instead adapting to localized economic and regulatory pressures.

Moreover, a contrasting trend has emerged among institutional investors and publicly listed crypto funds. Some of these entities have used the recent miner-led price dips as buying opportunities, reinforcing the dynamic of miners selling into institutional demand. The result is a gradual power shift: while miners once held the majority of newly issued Bitcoin, financial firms are now absorbing a larger share of the circulating supply.

Implications for Market Stability

The scale and consistency of miner selling have naturally raised concerns about market health. Sudden inflows of BTC to exchanges often foreshadow price corrections, and many traders are closely watching miner reserve data for signs of sustained pressure. However, historical patterns suggest that miner sell-offs, especially following halving events, are not inherently destabilizing. Rather, they often coincide with broader consolidation phases before the next bullish expansion.

That said, the broader implications are significant. As miners reduce their role as primary holders, price dynamics are increasingly shaped by institutional strategies, regulatory shifts, and macroeconomic trends. The decentralization ethos that once defined Bitcoin is now evolving into a more complex financial ecosystem, one where power, liquidity, and influence are more diffusely distributed.

The recent surge in miner-led BTC selling marks more than just a response to market stress. It is a strategic recalibration for survival. As 2025 unfolds, miners are repositioning themselves as financially disciplined operators, attuned to the realities of a post-halving, high-cost environment. For investors and analysts, this transformation offers both challenges and opportunities: while miner capitulation can weigh on short-term prices, it may also pave the way for a healthier, more resilient Bitcoin ecosystem in the long run.

Readers’ frequently asked questions

What exactly does a Bitcoin miner do, and why do they earn Bitcoin?

Bitcoin miners use powerful computers to solve complex mathematical problems that validate and secure transactions on the Bitcoin network. This process is called proof-of-work. When a miner successfully confirms a block of transactions, they are rewarded with newly created Bitcoin. This is known as the block reward. Miners also earn small fees paid by users making those transactions. This reward system incentivizes miners to keep the network running, but it becomes less profitable over time, especially after a halving event cuts the reward in half.

What is a “halving,” and why does it affect how much Bitcoin miners earn?

A halving is a scheduled event that happens roughly every four years on the Bitcoin network. It cuts the amount of new Bitcoin given to miners in half. For example, in April 2024, the block reward dropped from 6.25 BTC to 3.125 BTC. Halvings are built into Bitcoin’s code to control inflation by gradually reducing the rate at which new BTC enters circulation. While this makes Bitcoin scarcer over time, it also reduces the income miners earn from mining. It often forces them to sell more of their holdings to cover their costs.

Is it bad for Bitcoin if miners sell a lot of their BTC?

Not necessarily. Miners selling Bitcoin is a normal part of the ecosystem. They need to cover their expenses like electricity, hardware, and facility costs. While large sales can temporarily affect the market, Bitcoin is a global asset with many types of buyers, including retail investors and institutions. In fact, many institutional investors are now buying the Bitcoin that miners are selling. This shift in who holds Bitcoin doesn’t weaken the network but does change the market dynamics. It moves influence from miners to financial firms and long-term investors.

What Is In It For You? Action Items You Might Want to Consider

Monitor miner wallet flows for early market signals

Keep an eye on on-chain data tracking Bitcoin miner reserves and outflows. Significant BTC movements from miner wallets to exchanges can act as an early indicator of potential price pressure. Tools like CryptoQuant and Glassnode provide real-time metrics. Adding those to your watchlist could help you anticipate short-term volatility before it hits the broader market.

Use dips from miner sell-offs as strategic accumulation windows

If you’re long-term bullish on Bitcoin, periods of miner-driven selling may present ideal entry points. Historically, these sell-offs occur during post-halving adjustments and often lead to temporary price corrections, not full market breakdowns. Set buy orders near psychological support levels (e.g., $78K–$80K) and consider dollar-cost averaging to take advantage of market dips without overexposing.

Reassess your allocation strategy as market structure evolves

As power shifts from miners to institutions, the volatility profile and liquidity landscape of Bitcoin are evolving. Traders may want to rebalance their portfolios accordingly. This could mean shifting some exposure toward BTC derivatives, tracking ETF flows, or even adding miner equities if you’re bullish on their adaptation strategies. Understanding who’s driving the market now can give you an edge in aligning with the momentum.

[…] >>> Read more: Bitcoin Miners Selling Off BTC Holdings Now […]

[…] >>> Read more: Bitcoin Miners Selling Off BTC Holdings Now […]