In 2024, a quiet revolution took place in global finance. Stablecoins, once considered a niche utility for crypto traders, processed more transaction volume than Visa and Mastercard combined. Estimates place stablecoin activity between $15.6 trillion and $27.6 trillion, marking a historic shift in how value moves globally. What started as a fringe innovation on public blockchains has now evolved into a parallel financial system with significant weight.

This development raises urgent questions for the European Union. Can it chart its own path as the world tilts toward blockchain-based financial rails? Or, is it simply swapping reliance on Visa and Mastercard for dependence on dollar-pegged stablecoins? In the battle of digital euro vs stablecoins, the answer could define Europe’s economic sovereignty for decades to come.

Stablecoins Surpass Visa: The Rise of Crypto Payment Infrastructure

The stablecoin surge of 2024 wasn’t driven by retail crypto trading alone. It reflected the growing use of blockchain rails for remittances, cross-border commerce, and decentralized finance. At the heart of this trend sits Tether (USDT), which accounts for the majority of transaction volume. Most of it passes through the TRON network, which offers low fees and high throughput.

What this means is clear: global users are increasingly opting for stablecoin-based alternatives over traditional payment systems. These digital tokens offer instant settlement, lower friction, and global reach. Traditional financial institutions are still struggling to replicate these qualities. The fact that stablecoin transaction volume has eclipsed Visa and Mastercard underscores that we’re no longer speculating about the future of payments. It’s already happening.

Europe’s Strategic Push for Payment Sovereignty

For years, the European Union has talked about reducing its reliance on U.S.-dominated financial infrastructure. This includes not only Visa, Mastercard, and SWIFT, but increasingly, U.S.-based stablecoin issuers like Tether and Circle. Recent geopolitical events, from the weaponization of payment networks to legal disputes over data sovereignty, have made this goal more urgent.

The EU’s response has included efforts such as the European Payments Initiative (EPI) and the TARGET Instant Payment Settlement (TIPS) system. They designed regulatory frameworks like MiCA (Markets in Crypto-Assets Regulation) to create legal clarity for stablecoins and crypto assets. Yet despite these measures, Europe still lacks a native, scalable alternative that matches the liquidity and adoption of U.S. dollar-backed stablecoins.

The Digital Euro: Ambition Meets Resistance

The most visible symbol of the EU’s ambition is the digital euro, a central bank digital currency (CBDC) being developed by the European Central Bank (ECB). Intended as a digital extension of fiat money, the digital euro could offer citizens a stable, public form of programmable money, fully backed by the ECB.

But resistance is strong. Privacy advocates worry about government surveillance. Commercial banks fear that a CBDC could siphon deposits, disrupting their balance sheets and lending models. And ordinary citizens, accustomed to SEPA transfers and contactless cards, seem largely indifferent to yet another payment option. Without clear advantages over existing solutions, the digital euro risks becoming a politically costly tool with limited adoption.

At best, the ECB may launch a restricted, opt-in CBDC with usage caps. It will be useful for specific segments, but unlikely to counter the dominance of dollar-pegged stablecoins.

Stablecoins and the Illusion of Independence

Even as Europe looks to stablecoins for inspiration, it risks falling into a different trap. Most stablecoins used today are USD-denominated and backed by U.S. Treasuries. Tether, USDC, and even algorithmic solutions like DAI remain deeply tied to American monetary infrastructure. And, they are subject to U.S. regulatory reach.

This means a future built on stablecoins doesn’t free Europe from external control. It simply shifts the axis of dependency from card networks to token issuers. These stablecoins can be frozen, de-platformed, or regulated at the discretion of U.S. authorities. In this light, the debate around digital euro vs stablecoins is not just about technology. It’s about who controls the infrastructure and the monetary levers behind it.

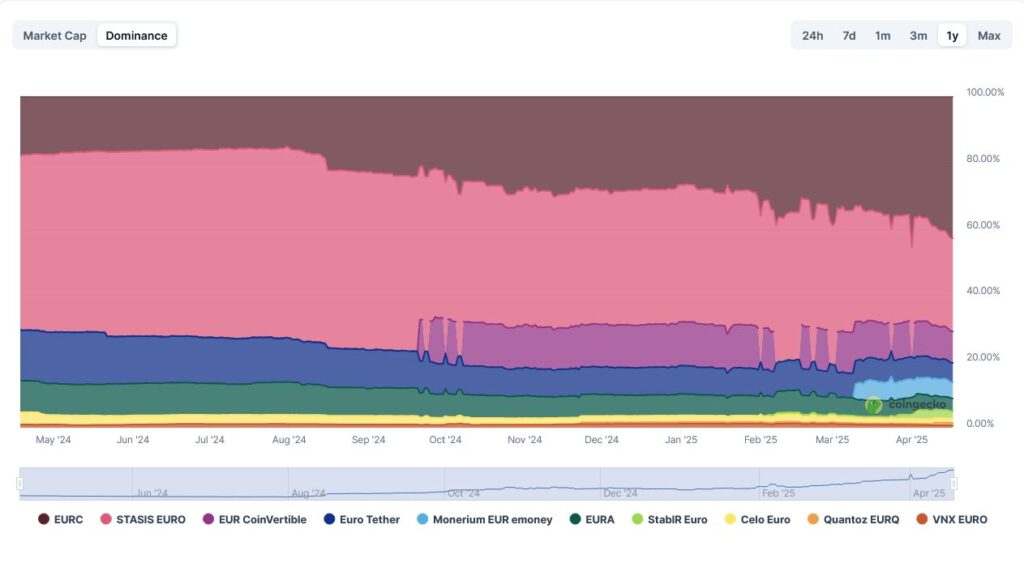

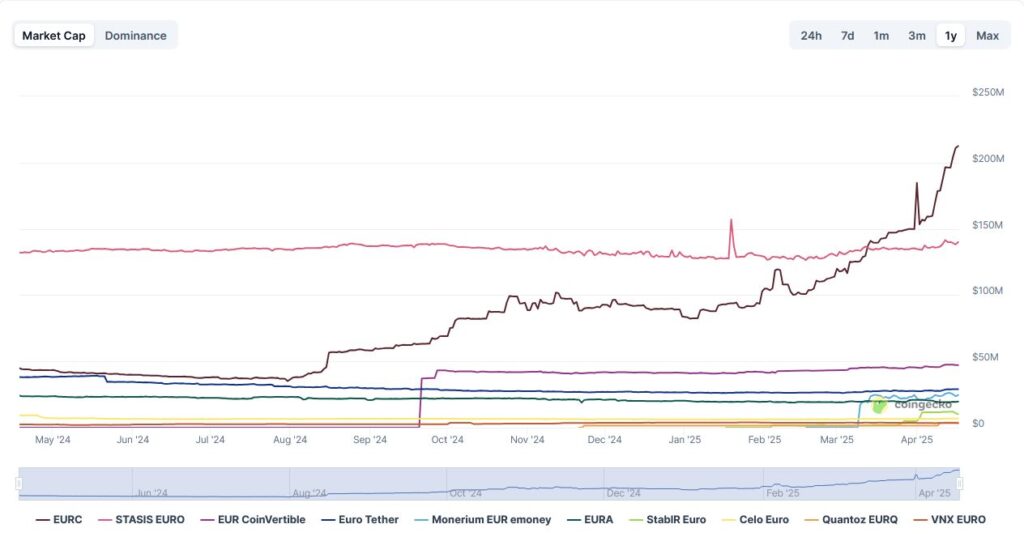

The Missing Pillar: Euro-Pegged Stablecoins

For Europe to compete in this new environment, it needs its own stablecoin ecosystem, backed by euros, regulated under MiCA, and widely integrated across DeFi and fintech platforms. While several euro-denominated stablecoins exist, such as EURS by Stasis, agEUR by Angle Protocol, and EUROC by Circle, none have achieved a meaningful market share.

Liquidity is low, DeFi adoption is fragmented, and institutional trust remains cautious. Without a strong network effect or coordinated support, these tokens struggle to find relevance in a stablecoin market still overwhelmingly tilted toward the U.S. dollar.

What Would a Sovereign Digital Strategy Look Like?

Europe’s path to true payment sovereignty likely won’t hinge on a single solution. A holistic strategy might involve the limited rollout of the digital euro for public-sector and wholesale use, promotion of MiCA-compliant euro stablecoins through bank and fintech partnerships, and deeper integration of euro-backed digital assets with decentralized finance platforms. Meanwhile, infrastructure like TIPS must evolve to support programmable digital money in real-time settlement environments.

The stakes are high. Sovereignty in digital finance means not just issuing currency, but shaping how it is programmed, transferred, and stored. Without strong European alternatives, the value infrastructure in the 21st century will continue to be governed from outside the bloc.

Conclusion: Digital Euro vs Stablecoins – A Defining Contest

The contest between the digital euro and stablecoins reflects a broader geopolitical tension. Europe desires to maintain monetary autonomy in a world where code rewrites finance. Stablecoins have proven what’s possible. They are fast, flexible, and borderless. But they are also built atop a U.S.-centric system of reserves, rules, and risks.

Europe must act swiftly if the euro is to remain a relevant currency in the digital era. It must not just issue new forms of money, but ensure that the rules governing them reflect European values, privacy standards, and economic priorities. Otherwise, the future of European payments may be settled, not in Frankfurt or Brussels, but in Washington, New York, or on a smart contract running in the cloud.

Readers’ frequently asked questions

What is the difference between a CBDC and a stablecoin?

A Central Bank Digital Currency (CBDC) is a digital version of a country’s official currency, issued and guaranteed by its central bank. It’s like cash in digital form, fully controlled by public monetary authorities. In contrast, a stablecoin is issued by a private entity (such as Tether or Circle) and typically backed by assets like U.S. Treasury bonds or fiat deposits held in commercial banks. While both are designed to maintain a stable value and can be used for digital payments, the key difference is that CBDCs are sovereign money. They are legal tender backed by the state, whereas stablecoins are private instruments that may be regulated but are not state-issued. This distinction affects everything from trust and legal status to how they function in cross-border payments or emergency interventions.

Why hasn’t a popular euro-pegged stablecoin emerged yet?

Despite regulatory clarity in the EU through frameworks like MiCA, euro-pegged stablecoins haven’t taken off mainly due to weak network effects and a lack of liquidity. The global crypto economy is mostly priced and paired in U.S. dollars, so exchanges and DeFi protocols prioritize USD-backed stablecoins. Additionally, there has been limited participation from major European banks or fintechs in issuing or promoting euro-backed digital assets. Trust also plays a role. Issuers of euro stablecoins haven’t yet established the scale or transparency to rival USDT or USDC. Without a large trading volume or compelling use cases specifically demanding euro-denominated liquidity, these tokens struggle to gain relevance in global markets.

If stablecoins are so dominant, why doesn’t Europe just use them?

Using USD-backed stablecoins might seem practical, but it poses long-term risks for the EU. These assets are tied to the U.S. financial system. They’re backed by U.S. dollars, rely on American banks, and operate under U.S. regulatory influence. That means U.S. authorities can exert control over how and where they’re used, even freezing assets or blacklisting wallets. For Europe, depending on these instruments would replicate the vulnerabilities it already faces with Visa, Mastercard, and SWIFT. The EU wants to build digital infrastructure aligning with its own legal standards, privacy protections, and monetary policy. It will not achieve this goal through outsourcing critical financial rails to foreign-controlled stablecoins.

What Is In It For You? Action Items You Might Want to Consider

Start tracking euro-pegged stablecoins before the crowd does

While USD-backed stablecoins dominate for now, euro-denominated options like agEUR and EUROC could see renewed interest if Europe ramps up its regulatory support. Consider adding them to your watchlist; not for immediate trades, but as long-term positioning in case liquidity and utility pick up.

Don’t overlook TRON’s role in stablecoin flows

Tether on TRON continues to lead in transaction volume, especially in remittance-heavy corridors. If you’re active in arbitrage, cross-chain DeFi, or even OTC flows, TRON-based USDT might offer faster and cheaper settlement routes than Ethereum-based assets. Time to check your bridge strategies.

Stay alert to CBDC policy shifts – they’re a market signal

The Digital Euro may be slow-moving, but when central banks speak, markets listen. Keep an eye on ECB statements and pilot programs. Any serious push toward a retail CBDC, even with restrictions, could impact euro stablecoin demand, EUR-denominated trading pairs, and regional on/off-ramps. Think macro, position micro.

[…] discussed in this perspective on Europe’s payment future. The digital euro is not only a financial but also a geopolitical necessity. With China’s […]

[…] >>> Read more: EU Payments at a Crossroads: Digital Euro vs Stablecoins […]