Imagine the entire cryptocurrency market as a big pie. Bitcoin dominance is essentially the size of Bitcoin’s slice of that pie, compared to all other cryptocurrencies. If you’re new to crypto, terms like “Bitcoin dominance” might sound technical. But the idea is simple: it measures how much of the total crypto market value is made up by Bitcoin. Let’s explore what it is, why it’s important in the crypto market, and how investors can use it to inform their strategies. All in friendly, easy-to-understand language.

What is Bitcoin Dominance?

Bitcoin dominance is basically Bitcoin’s market share in the crypto market. In more technical terms, it’s the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies. (A coin’s market capitalization is its price multiplied by the number of coins in circulation, essentially the total value of that coin.) So when people talk about Bitcoin dominance, they usually express it as a percentage. For example, if all cryptocurrencies combined are worth $1 trillion and Bitcoin accounts for $500 billion, then BTC’s dominance would be 50%.

In plain English, Bitcoin dominance tells us what portion of the crypto market’s value belongs to Bitcoin. In its early days, the dominance was close to 100%. Bitcoin was the crypto market, since hardly any other coins existed. Today, with thousands of altcoins (alternative cryptocurrencies) existing, Bitcoin’s dominance isn’t anywhere near 100%. It fluctuates as the crypto market evolves. Over the past five years, it has typically ranged roughly between 40% and 70%. It can go higher or lower, though, during extreme market events. The key point is that dominance changes over time, depending on how the value of Bitcoin is growing compared to the rest of the crypto market.

Why Does It Matter?

You might wonder why this percentage is such a big deal. Bitcoin dominance matters because it offers insight into market sentiment and the balance of money between Bitcoin and the rest of crypto. Traders and investors watch this metric as a “health check” for the market. It serves as a critical indicator to gauge whether investors favor the relative safety of Bitcoin or chase opportunities in altcoins. In other words, changes in Bitcoin dominance can hint at what phase of the market cycle we’re in and how people feel about risk.

When Bitcoin’s dominance is rising, it means Bitcoin is capturing a larger share of the overall market value. This could happen for a couple of reasons. One common scenario is that Bitcoin’s price is climbing faster than other coins, drawing more investment into Bitcoin itself. Another scenario is during market downturns, when Bitcoin’s price might decline less sharply than riskier altcoins. In that case, Bitcoin’s share of the pie grows simply because the rest of the pie is shrinking faster. A high or growing dominance often suggests investors are playing it safe with the crypto market’s most established asset (Bitcoin). Or, that Bitcoin is in the middle of a strong rally, pulling ahead of the pack.

On the other hand, when Bitcoin’s dominance falls, the rest of the cryptocurrencies (the altcoins) gain value relative to Bitcoin. This often indicates investors are feeling bold, putting money into smaller coins, searching for bigger gains. A significant drop in Bitcoin dominance is usually a sign of an “altcoin season”, which is a period when many altcoins are shooting up in price faster than Bitcoin.

Bitcoin Dominance and Altcoins

To understand Bitcoin dominance, we have to talk about altcoins, the term for any cryptocurrency that isn’t Bitcoin. Today’s crypto market consists of Bitcoin plus a huge array of altcoins – from well-known ones like Ethereum, Binance Coin, and Cardano to countless smaller projects. Bitcoin dominance essentially compares Bitcoin to all these others combined. So whenever the altcoin side of the market gets hotter, Bitcoin’s dominance will go down, and vice versa.

Think back to our pie analogy. If Bitcoin’s slice gets smaller, someone else’s piece (all the altcoins together) gets bigger. One of the biggest challengers in that pie is Ethereum, the second-largest cryptocurrency. Ethereum has grown so much in value and popularity that it now often makes up a significant chunk of the market. In fact, during the bull run of 2021, Ethereum’s rise (fueled by things like DeFi and NFTs) pushed its market share to around 16% by that year’s peak. Naturally, this contributed to a drop in Bitcoin’s dominance at the time, since Ethereum (and other rising altcoins) were claiming a larger portion of the total crypto market.

Bitcoin Dominance Through the Years

Bitcoin’s dominance isn’t just a percentage on a screen — it tells a story. Looking back at how it has changed over time, we can trace the ebb and flow of market sentiment, innovation, hype, and investor caution.

A historical Bitcoin dominance chart shows clear patterns. Bitcoin’s market share was close to 100% when there were few other cryptocurrencies. As altcoins emerged, dominance dropped, especially during major market shifts. For example, dominance declined sharply during the 2017 ICO boom. It rebounded in bear markets and fluctuated during key turning points such as the early 2018 crash and the 2022 market turmoil.

These cycles illustrate several notable shifts in dominance:

- 2017: A wave of new altcoins, launched through initial coin offerings (ICOs), caused Bitcoin’s dominance to fall from about 86% to around 38% in a matter of months.

- 2018: When the ICO bubble burst, many altcoins lost value or collapsed entirely. Investors moved capital back into Bitcoin, driving its dominance up to roughly 70% by mid-2019.

- 2020–2021: Bitcoin rallied from around $8,000 to over $60,000. Meanwhile, altcoins surged on narratives like decentralized finance (DeFi), non-fungible tokens (NFTs), and meme coins. Bitcoin’s dominance hovered around 60% but declined again as other tokens outperformed.

- 2022: Industry-wide shocks—including the collapse of the Terra/UST stablecoin ecosystem and the FTX exchange—led to renewed caution. Investors rotated funds out of altcoins and back into Bitcoin, driving dominance higher once more.

2023–2024 was a quieter period by comparison. The market consolidated, with fewer speculative bubbles or collapses. Bitcoin’s dominance remained relatively steady, fluctuating between 40% and 50% depending on moderate altcoin cycles and investor sentiment.

By early 2025, Bitcoin dominance climbed to over 64%, its highest level in several years. This surge was driven by renewed interest in Bitcoin following the latest halving, increased institutional participation, and macroeconomic uncertainty. However, as of May 2025, the trend has shown early signs of reversing. Altcoins such as Ethereum, Solana, Cardano, and Dogecoin have recently outperformed Bitcoin, suggesting a possible rotation into higher-risk assets and the beginning of a new altcoin season.

In summary, Bitcoin dominance increases when Bitcoin is seen as the most attractive or safest investment in crypto. It decreases when investors chase growth across the broader altcoin landscape. It remains one of the most widely watched metrics to gauge where money is flowing in the digital asset market.

Note: Bitcoin dominance also accounts for stablecoins like USDT and USDC in the “altcoin” category. When traders move capital into stablecoins, those funds count against Bitcoin’s market share, even though they are not being redirected into other speculative assets. This effect can cause Bitcoin dominance to decline even in periods of broad market caution.

Using BTC Dominance to Inform Your Strategy

Knowing about Bitcoin dominance is useful, but how do people actually use this knowledge? For investors and crypto enthusiasts, Bitcoin dominance can be a guidepost for making portfolio decisions or reading the market’s mood. It’s not a crystal ball, but it can hint at whether it might be a good time to focus on Bitcoin or explore altcoins.

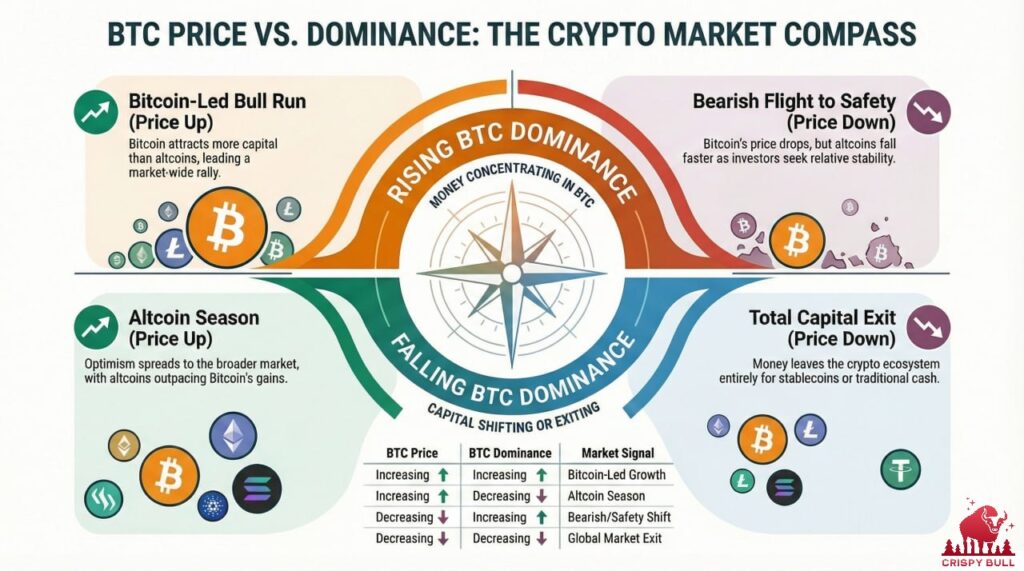

Context is important: Bitcoin dominance is most insightful when considered alongside Bitcoin’s price movements. By looking at both, you get a clearer picture of what’s going on. Let’s break down a few common scenarios:

- BTC Price Up + Dominance Up: Bitcoin is gaining value and outpacing the rest of the market. This often means Bitcoin is leading a rally. In this scenario, Bitcoin is attracting proportionally more money than altcoins. It’s a sign of a Bitcoin-led bull run, where confidence (and capital) is concentrated in BTC. An investor seeing this trend might lean more into Bitcoin, since it’s currently the market leader in growth.

- BTC Price Down + Dominance Up: Bitcoin’s price is dropping, but altcoins are dropping even faster. Bitcoin’s market share grows because it’s falling less (or recovering faster) than the rest. This pattern suggests a bearish market overall – investors are pulling back from smaller coins first (a flight to safety). People might be selling altcoins to hold Bitcoin (or even cash) because they view Bitcoin as the safer asset in a crypto downturn. Traders might become cautious about holding too many risky altcoins during this period.

- BTC Price Up + Dominance Down: Bitcoin’s price is rising, but the rest of the crypto market is rising even more. This is a classic altcoin season signal. It means optimism (and money) is flooding into many crypto projects, not just Bitcoin. You might see Ethereum, for example, outpacing Bitcoin’s gains along with a bunch of other coins rallying. In this scenario, an investor might diversify into strong altcoins to ride the broader wave, since the market’s appetite for risk is high.

- BTC Price Down + Dominance Down: Bitcoin is losing value, and at the same time, its market share is shrinking. This one is less common, and it usually means money is exiting crypto in general. If Bitcoin and most altcoins are falling (with altcoins perhaps not falling quite as much percentage-wise), investors could be moving funds into something like stablecoins or out of crypto entirely. It’s basically a sign of extreme caution – people aren’t even using Bitcoin as a safe haven; they’re cashing out. In such times, investors might reduce exposure across the board and wait for the storm to pass.

Using Bitcoin dominance as part of your strategy comes down to understanding these trends. For example, if you believe an altcoin season is starting (dominance falling while BTC’s price is holding up or rising), you might increase exposure to select altcoins. If you see dominance rising during a market rally, you might stick with Bitcoin since it’s the frontrunner at that moment.

However, always remember that Bitcoin dominance is just one tool. It’s best used alongside other indicators and a broader analysis of market conditions. Think of Bitcoin dominance as a wide-angle lens for viewing the crypto market. It gives a big-picture overview of where value is flowing. Nevertheless, you’ll still want to zoom in on specific coins and news before making major investment moves.

Conclusion

Bitcoin dominance might sound like jargon at first, but it’s really a straightforward concept. It shows how much of the crypto universe is Bitcoin. This single percentage figure can tell a story about market dynamics. Is Bitcoin taking center stage or sharing the spotlight with a crowd of altcoins? For newcomers to crypto, understanding Bitcoin dominance provides a great foundation for grasping the bigger picture of how the crypto market ebbs and flows.

Even beginners can get a feel for the market’s overall mood by keeping an eye on Bitcoin’s market share. Is Bitcoin pulling ahead of the pack (hinting that investors are cautious or that Bitcoin is driving the rally)? Or are the smaller coins collectively gaining ground (hinting that the market is in a risk-taking, altcoin-friendly phase)? Bitcoin dominance offers a handy lens to view these shifts. In the crypto landscape, knowledge is power. Bitcoin dominance is one piece of the puzzle that can help you make sense of the ups and downs. Armed with this understanding, you’ll be better equipped to navigate the crypto market’s changes. Whether you’re a casual observer or building a crypto portfolio, knowing about Bitcoin dominance will help you see the forest for the trees in the crypto world.