The 2024 Bitcoin halving cycle promised a familiar pattern: reduced supply, skyrocketing prices, and a crescendo of retail euphoria. But this time, the script flipped. One year later, Bitcoin delivered a modest return, institutional capital dominated the market, and macroeconomic forces, not just blockchain mechanics, seemed to steer sentiment. Is Bitcoin entering a fundamentally new era?

Halving Delivered, But the Rally Didn’t Roar

In previous halving cycles, Bitcoin reliably posted triple-digit gains within a year. After the 2012, 2016, and 2020 events, prices soared by over 400% in the following 12 months. By contrast, the 2024 cycle has brought a far more muted outcome: a roughly 33% gain year-on-year, despite briefly reaching a new all-time high.

Rather than triggering another euphoric bull run, the latest halving has unfolded amid tempered expectations and measured growth. The cycle hasn’t been absent of milestones but has clearly deviated from the historical script.

Institutional Capital Rewrites Market Behavior

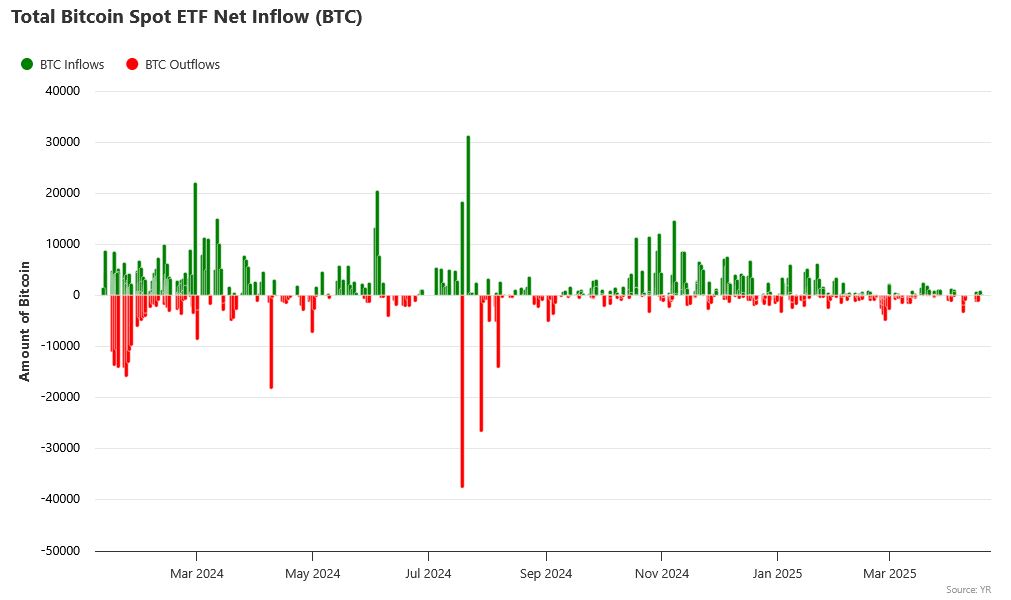

A major shift in this cycle is the growing presence of institutional investors. With spot Bitcoin ETFs approved and launched in major markets, capital inflows from traditional finance have become a defining feature of the current landscape.

As a result, Bitcoin’s volatility has diminished. Retail participation, once the dominant market driver, has taken a back seat to more conservative, long-term holders. Speculation hasn’t disappeared, but it has become more subdued. The result is a market that feels more structured, and arguably, more stable.

For the first time, Bitcoin behaves less like a speculative asset and more like a maturing financial instrument.

Macro Trumps Halving

Another key factor in this cycle’s deviation is the outsized role of macroeconomic conditions. In past years, Bitcoin’s price action was largely attributed to supply dynamics and internal crypto sentiment. Today, it’s increasingly tied to global trends: interest rate decisions, inflation outlooks, and liquidity in the broader economy.

Bitcoin has shown heightened sensitivity to central bank policies, equity market performance, and risk appetite among institutional players. This alignment with macro forces suggests that halving events may no longer be the primary catalyst for market direction.

A Compressed, Front-Loaded Cycle?

Interestingly, while the current post-halving rally appears less explosive, it may simply be operating on a different timeline. Bitcoin reached new all-time highs earlier in the cycle than in any previous post-halving period. In that sense, the market may have “priced in” the halving sooner due to increased efficiency in capital deployment and faster information flow.

With ETF inflows continuing and long-term holders maintaining strong conviction, there’s still a case to be made for further upside, especially if macro headwinds begin to ease in the second half of 2025.

Maturity or Monotony?

The most debated question is whether this more disciplined cycle signals Bitcoin’s maturation or its stagnation. For advocates of long-term adoption, the shift toward stability and institutional alignment is a welcome evolution. It positions Bitcoin as a credible asset class, less vulnerable to boom-and-bust dynamics.

For others, however, the lack of retail excitement and speculative energy raises concerns. The 2024 cycle, so far, lacks the narrative momentum that has historically fueled parabolic growth.

>>> Read more: BlackRock Bitcoin ETF Redemptions: Market Impact

One year after the 2024 halving, Bitcoin stands at a crossroads. The once-reliable four-year cycle appears to be evolving—no longer the sole driver of price action. Instead, institutional participation and macroeconomic trends have become dominant forces.

This doesn’t mean the halving has lost all relevance, but it does suggest a shift in how markets interpret its impact. Bitcoin is no longer just a frontier experiment—it’s a maturing asset in a complex global system. And that might be the biggest transformation of all.

Readers’ frequently asked questions

What exactly is a Bitcoin halving, and why does it happen every four years?

A Bitcoin halving is a scheduled event where the reward given to miners for validating new blocks is cut in half. This happens approximately every four years, or every 210,000 blocks. It’s built into Bitcoin’s code as a way to control inflation and gradually reduce the total number of new bitcoins introduced into circulation. Originally, miners received 50 BTC per block; after the most recent halving in April 2024, they now receive 3.125 BTC. The halving will continue until the maximum supply of 21 million bitcoins is reached, expected around the year 2140. The purpose is to create scarcity over time, similar to how commodities like gold become more difficult to extract.

What is a Bitcoin ETF, and how does it allow institutions to invest in Bitcoin?

A Bitcoin ETF (Exchange-Traded Fund) is a financial product that allows investors to gain exposure to the price of Bitcoin without having to buy or store it directly. It’s traded on traditional stock exchanges, just like shares in a company. When institutions invest in a Bitcoin ETF, they’re purchasing a regulated, simplified way to access Bitcoin’s price performance. This avoids the technical and security complexities of using crypto wallets or exchanges. ETFs have made it easier for pension funds, mutual funds, and professional investors to include Bitcoin in their portfolios under existing compliance rules.

What does it mean that Bitcoin is now affected by macroeconomic factors like interest rates?

As Bitcoin becomes more integrated into the global financial system, its price increasingly reacts to economic policies and trends that affect traditional assets. For example, when central banks raise interest rates to control inflation, borrowing becomes more expensive, and cash flow tightens. This can lead investors to pull money from riskier assets like Bitcoin and stocks. Similarly, when interest rates fall or when economic stimulus increases liquidity, Bitcoin may benefit from higher demand. This means Bitcoin no longer moves independently of global markets; it now behaves like a financial asset influenced by broader economic conditions.

What Is In It For You? Action Items You Might Want to Consider

Rethink your timing strategy – don’t rely solely on the halving narrative

This Bitcoin cycle has shown that the traditional four-year halving pattern is no longer a dependable timing signal. If you’ve based your buy-sell windows around post-halving rallies in the past, it’s time to recalibrate. Consider integrating macroeconomic indicators, like interest rate trends and ETF inflow data, into your market timing decisions.

Follow institutional activity – it’s shaping the new price structure

With ETFs and long-term institutional holders now controlling major market flows, retail sentiment no longer drives short-term volatility. Track ETF volume, fund allocations, and custody data. When institutional momentum shifts, it often sets the tone for the broader market.

Shift toward longer time horizons and structured entries.

This maturing cycle favors disciplined positioning over aggressive speculation. If you’re trading short-term, be prepared for tighter ranges and slower setups. For swing or position traders, consider dollar-cost averaging and holding through macro cycles. The wild parabolic runs might be fading, but the trend, backed by fundamentals, may still favor long-term accumulation.