After a well-hyped but uncertain lead-up, Circle’s debut on the New York Stock Exchange has turned into one of the most surprising crypto market wins of 2025. Within two trading days of its IPO, the Circle stock surge sent the company’s valuation soaring past $25 billion. That’s more than triple its initial target of $6.7 billion.

While many saw the IPO as a much-needed liquidity event for the USDC issuer, its explosive performance has redefined how investors are pricing the future of regulated stablecoins and crypto-native financial infrastructure.

From $6.7B to $25B: The Surge Explained

Circle’s stock opened with a 168.5% gain on its first day of trading. By the second day, it had climbed another 44.7%, propelling the company’s market cap to nearly $25 billion. That’s a remarkable turn from its original IPO pricing, which had been relatively modest given recent crypto market volatility.

The Circle stock surge surprised many market watchers, especially those who had written off stablecoin issuers as regulatory targets rather than growth assets. Trading volumes spiked as institutional investors jumped in, betting that Circle’s compliance-first approach to USDC would pay off in the long term.

Ripple Effects Across the Crypto Stock Landscape

Circle’s blockbuster listing had an immediate spillover effect on other public crypto companies. Coinbase, a stakeholder in Circle and USDC’s primary exchange partner, saw its shares climb in tandem. Other crypto-exposed firms, including MicroStrategy and Marathon Digital, posted double-digit gains amid renewed bullishness on the sector.

For a market still recovering from the reputational fallout of 2022–2023, the IPO wasn’t just a win for Circle. It was a broader signal of crypto market confidence. Investors appear to be recalibrating their outlook on firms that have regulatory clarity and enterprise-level infrastructure.

Stablecoins Gain New Legitimacy

Circle’s NYSE listing marks the first successful public listing of a major stablecoin issuer. The performance validates, at least in the short term, a model of transparency, dollar reserves, and U.S. regulatory engagement. In contrast to offshore competitors like Tether, Circle’s pitch to regulators has always been one of compliance-first financial integration.

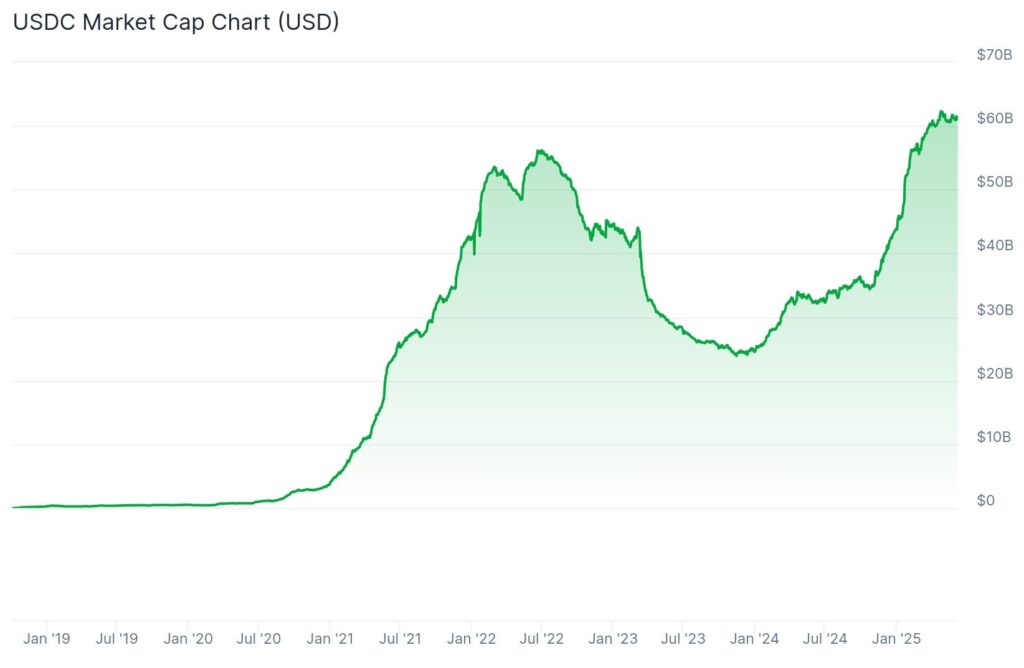

The stock surge has placed Circle’s USDC in a new strategic position. While its market cap is still below its 2022 peak, the IPO gives Circle new capital to reinvest in product development and policy engagement. It also boosts the visibility of stablecoin regulation as a mainstream policy issue in financial markets.

What Comes Next for Circle, and for the Industry?

Circle’s newfound war chest raises questions about what comes next. Expansion into payments, cross-border finance, or enterprise blockchain infrastructure is likely. There’s also speculation about future public crypto companies following suit, especially those involved in tokenization, trading, or custody.

Whether Circle’s success can be replicated remains unclear, but it’s already changing the conversation. The IPO has put a spotlight on investor appetite for compliant digital asset businesses. It may well reignite discussions around mergers and acquisitions that had previously stalled.

>>> Read more: Gemini IPO Filing: Winklevoss Crypto Exchange Eyes Listing

The Circle stock surge has redefined what success looks like for crypto firms entering public markets. With a $25 billion valuation now in play and institutional sentiment shifting, Circle’s IPO has become a milestone. For the company and the broader maturation of the crypto industry. Regulated digital asset companies may finally be ready for prime time – and the market is listening.

Readers’ frequently asked questions

Why did Circle’s stock price surge so dramatically after the IPO?

The sharp price movement was driven by investor optimism about Circle’s regulatory position, the perceived stability of USDC, and the company’s role in compliant crypto infrastructure. Strong demand for exposure to crypto firms with regulatory clarity helped drive the rally.

How does this affect USDC users and holders?

While the stock surge doesn’t directly change how USDC functions, it strengthens Circle’s financial position and credibility. That could lead to more institutional integrations and user confidence in the stablecoin’s long-term reliability.

Where can I track Circle’s stock performance going forward?

Circle trades on the New York Stock Exchange under the ticker symbol CRCL. Investors can follow its stock performance through financial platforms, brokerage apps, or directly on the NYSE website.

What Is In It For You? Action Items You Might Want to Consider

Monitor how Circle uses its IPO capital

Watch for announcements about new products, global expansion, or lobbying initiatives. Circle’s financial strength post-IPO could influence stablecoin development and regulatory negotiations.

Assess changing sentiment toward public crypto companies

Circle’s performance may mark a turning point in how investors evaluate crypto stocks. Keep an eye on trading volumes and price movements of other listed firms like Coinbase and MicroStrategy.

Stay informed on upcoming stablecoin regulation

As Circle gains visibility, U.S. and international regulators may sharpen their focus on the stablecoin space. Traders, developers, and fintech operators should follow related policy developments closely.

[…] >>> Read more: Circle Stock Surge Hits $25B Reigniting Crypto Confidence […]

[…] Circle posted $658 million in revenue, though it recorded a $482 million net loss tied largely to post-IPO accounting […]

[…] power. The company can bankroll expansion without relying on an IPO or outside investors. While Circle has taken the public company route, Tether insists it will remain a private company, keeping control in the hands of its small group […]

[…] >>> Read more: Circle Stock Surge Hits $25B Reigniting Crypto Confidence […]