The cryptocurrency community is on the edge of its seat as we approach the Bitcoin Halving event set for April 2024, a pivotal moment that reduces the block reward for miners by half and has historically influenced Bitcoin’s price and market dynamics significantly. This event, embedded in Bitcoin’s protocol, occurs roughly every four years and has been a cornerstone in maintaining Bitcoin’s scarcity and value. The anticipation around this event is palpable, given its potential to reshape the market landscape.

Predictions and Historical Context

Past Bitcoin halvings have shown a notable pattern of price increases following these events. For instance, after the first halving in 2012, Bitcoin’s price saw a dramatic increase, a trend that continued with the subsequent halving in 2016 and 2020. These precedents fueled a wide array of predictions for the 2024 halving, with analysts and models forecasting significant price movements post-halving. CoinCodex suggests a possibility of a minor retracement a month after the 2024 halving, followed by a 14-month rally leading to a new all-time high of approximately $179,000 by August 2025.

Short-term vs. Long-term Impact

While the short-term effects of the halving on Bitcoin’s price can be volatile and uncertain, the long-term outlook remains bullish according to several predictions. For instance, ARK Invest predicts that Bitcoin’s price could reach $1.5 million by 2030 under certain global asset allocation scenarios. Similarly, Standard Chartered and Bernstein Research have also projected significant price milestones for Bitcoin by the end of 2024 and 2025, respectively, with predictions reaching up to $120,000 and $150,000.

Market Sentiment and Speculation

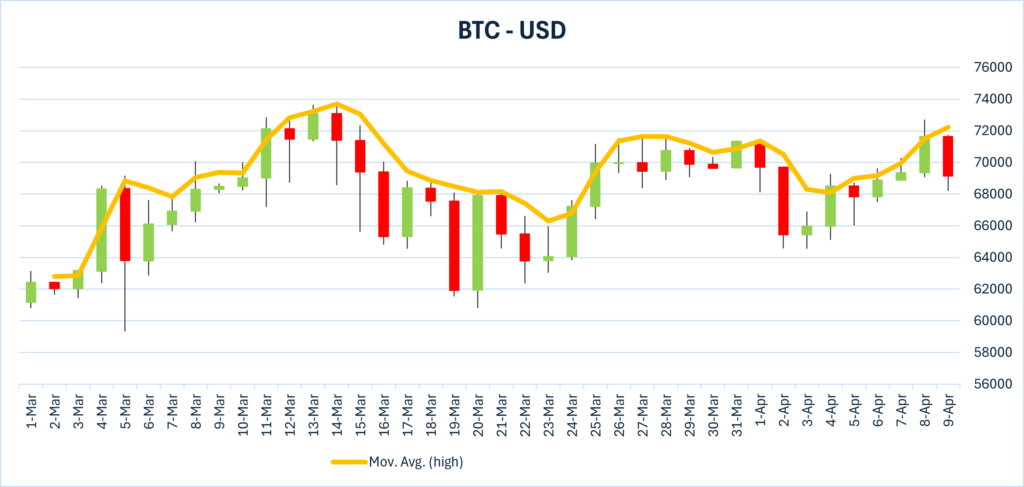

From the 1st of March to the 9th of April 2024, Bitcoin’s market behavior illustrated its volatility, albeit within a relatively contained range compared to its historical fluctuations. The month of March began with Bitcoin at $61,168.06, showing an early peak at $63,155.10, and importantly, the currency managed to maintain its value at around the $60,000 mark throughout the period. The subsequent weeks saw Bitcoin’s price oscillating, but by early April, there was a noticeable consolidation, with values consistently tracking in the high $60,000s to low $70,000s.

As the halving draws closer, the market’s sentiment tends to lean bullish, buoyed by historical performance and the reduction in new Bitcoin supply that the event guarantees. This optimism is tempered by caution, however, with reminders that past performance is not always indicative of future results and that the cryptocurrency market remains inherently volatile.

The Road Ahead

As we inch closer to halving, the debate intensifies: will Bitcoin follow the historical precedent and soar to new heights, or will market dynamics shift, leading to a different outcome? While the predictions provide a broad spectrum of possibilities, the actual impact remains to be seen, contingent on a myriad of factors including technological advancements, regulatory developments, and macroeconomic conditions.

As investors and enthusiasts watch the countdown to the halving, one thing is clear: Bitcoin remains at the heart of the cryptocurrency conversation, with its halving events serving as significant milestones that not only reflect on its scarcity and value proposition but also on the broader crypto ecosystem’s evolution and maturity. Whether these predictions will come to fruition or not, the halving is a reminder of the innovative design of Bitcoin and its profound impact on the financial landscape.