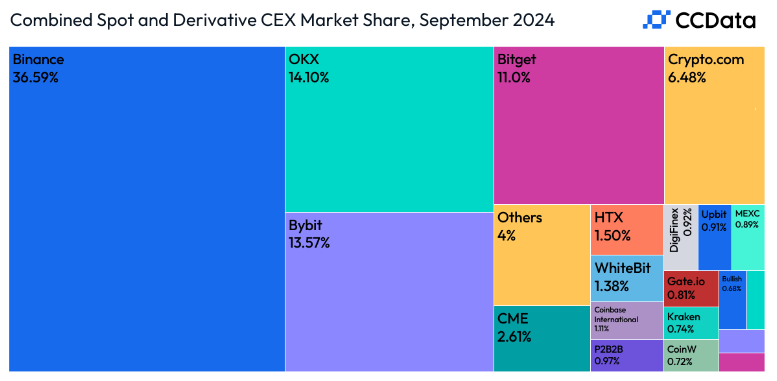

With Binance’s overall market share sinking to approximately 36.6%, rival exchanges seize the opportunity to capture market share and redefine the competitive landscape. Reports indicate that Binance has experienced a decline in its market share due to increasing regulatory scrutiny and a general drop in trading volumes across centralized exchanges (CEXs). As traders increasingly seek alternatives amid these challenges, competitors like Crypto.com and others are emerging as formidable challengers. This article examines the shifting dynamics within the cryptocurrency exchange market and the strategies these competitors employ to attract former Binance users.

The Regulatory Landscape

The regulatory environment has been a significant factor in Binance’s market decline. Increased scrutiny from governments worldwide has impacted Binance’s operations, forcing the exchange to adapt to new compliance requirements. According to multiple sources, this regulatory pressure has affected Binance’s ability to retain users but has also influenced public perception of its trustworthiness. As a result, traders are exploring other options, fueling the growth of rival platforms.

Rising Competitors

As Binance struggles to maintain its position, competitors are stepping in to fill the void. Platforms like Crypto.com are capitalizing on Binance’s challenges by offering appealing features and incentives designed to attract former Binance users. Reports indicate that these exchanges are implementing marketing strategies, lowering fees, and enhancing user experience to draw in traders seeking more stable and compliant platforms.

For instance, Crypto.com has focused on expanding its product offerings, including staking and a diverse range of cryptocurrencies. By providing a more user-friendly interface and improved customer service, it aims to capture the interest of users disillusioned with Binance’s current trajectory. Other exchanges, such as Kraken and KuCoin, are also positioning themselves as viable alternatives. They are enhancing their liquidity and services to appeal to a wider audience.

>>> Read more: Crypto.com Exchange Earns VASP Approval in Ireland

Shifting Market Dynamics

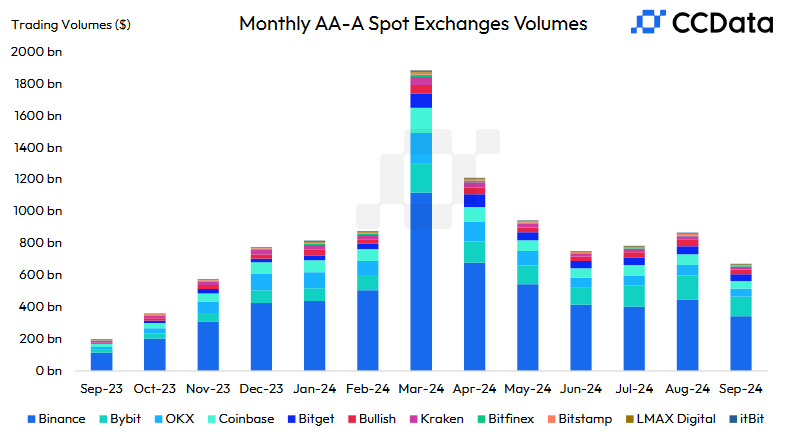

The decline of Binance is indicative of broader shifts within the cryptocurrency exchange market. Data reveals a general decrease in trading volumes across CEXs, which fell by 17% in September 2024. This decline is not only affecting Binance but is also reshaping the entire market landscape. As traders become more selective and discerning, the need for exchanges to adapt to their evolving preferences has never been more critical.

In this environment, customer trust and regulatory compliance are paramount. Exchanges that can effectively communicate their commitment to user security and regulatory adherence are likely to gain a competitive edge. This focus on compliance is essential for attracting users who are increasingly cautious about the platforms they choose.

>>> Read more: Crypto Trading Hits $1.2 Trillion in August Amid Futures Decline

As Binance navigates its challenges, the competitive landscape in the cryptocurrency exchange market is becoming more dynamic. The decline of a once-dominant player is opening doors for rivals to redefine their strategies and capture market share. With competitors like Crypto.com leading the charge, the implications of this shift could significantly alter the future of cryptocurrency trading. As the industry continues to evolve, only those exchanges prioritizing compliance, customer trust, and innovation will thrive in this increasingly competitive arena.

Readers’ frequently asked questions

What specific regulatory challenges has Binance faced, and how have they impacted its operations?

Binance has been under intense regulatory scrutiny from several jurisdictions around the world. For instance, regulatory bodies in the United States, United Kingdom, and Europe have all taken action against the exchange due to concerns over its compliance with anti-money laundering (AML) regulations, Know Your Customer (KYC) practices, and unlicensed operations. This regulatory pressure has forced Binance to withdraw or limit services in certain regions. For example, they halted derivatives trading in parts of Europe and reduced its leverage offerings. Furthermore, Binance has faced fines and investigations from multiple authorities. That hurt its reputation and led to a loss of trust among some users. These issues have contributed to a noticeable drop in trading volumes on its platform. Many users have opted to migrate to exchanges that are more compliant with regional regulations.

Why are competitors like Crypto.com successfully attracting Binance users, and what are they offering that Binance cannot?

Competitors like Crypto.com are attracting Binance users by capitalizing on the weaknesses in Binance’s regulatory standing. At the same time, they are also offering services perceived to be more secure and stable. One key area where Crypto.com excels is its focus on compliance with global regulations. It gives it an edge in regions where regulatory concerns have made users wary of Binance. Additionally, Crypto.com has invested heavily in user experience. They are offering lower transaction fees, higher security, and a range of products like staking and crypto-backed credit cards. All these features appeal to traders looking for more versatile offerings. Another factor is Crypto.com’s aggressive marketing strategies, including partnerships with major sports leagues and celebrities. These activities have boosted its brand recognition. For users looking for alternatives to Binance, Crypto.com’s solid reputation for regulatory compliance and its extensive product range make it an attractive choice.

How does Binance’s decline reflect broader trends in the cryptocurrency exchange market?

Binance’s decline is part of a larger trend affecting the entire cryptocurrency exchange market. Trading volumes across centralized exchanges (CEXs) have been declining, with a reported 17% drop in September 2024. This trend indicates a cooling off in the previously high levels of cryptocurrency trading, which may be due to several factors. One reason is the increased scrutiny from regulators globally. It dampened enthusiasm among some traders, particularly those concerned about legal risks. Additionally, the rise of decentralized finance (DeFi) platforms is another important trend; these platforms allow users to trade and invest without relying on centralized exchanges like Binance, offering more autonomy and privacy. As traders become more selective and cautious in their choices of platforms, the broader market is shifting toward platforms that can offer competitive trading features but also strong regulatory compliance and security, further intensifying competition.

What Is In It For You? Action Items You Might Want to Consider

Evaluate Your Trading Platform

Take a moment to assess your current trading platform. With Binance’s recent decline in market share due to regulatory challenges, now might be the perfect time to explore alternative exchanges. Research platforms like Crypto.com, Kraken, or KuCoin to see which one aligns best with your trading needs. Look for features such as lower fees, robust security measures, and a diverse range of trading options that can enhance your trading experience.

Diversify Your Trading Strategies

Given the shifting market landscape and decreasing trading volumes, consider diversifying your trading strategies. Rather than relying solely on spot trading, explore options like staking or trading on decentralized platforms. Engaging in various strategies can help mitigate risks and potentially improve returns. Keep an eye on emerging trends and platforms that are gaining traction in the market, as these may present new profit opportunities.

Stay Informed About Regulatory Changes

As a trader, staying updated on the evolving regulatory landscape is crucial. Follow reputable news sources and industry updates to keep abreast of any changes that may affect the exchanges you use or the broader market. Understanding regulatory shifts will not only help you make informed trading decisions but also assist you in choosing platforms that prioritize compliance and security, ultimately protecting your investments.