Reinstating USD services on Binance.US isn’t just a corporate milestone – it’s a barometer of shifting political and regulatory tides in the United States. After months of financial isolation due to SEC litigation, the platform’s renewed access to banking channels suggests a broader re-assessment of crypto regulation under new political leadership. While users welcome the return of fiat functionality, industry observers note that the move could signal a softening regulatory environment. It raises hopes for other embattled crypto companies operating stateside.

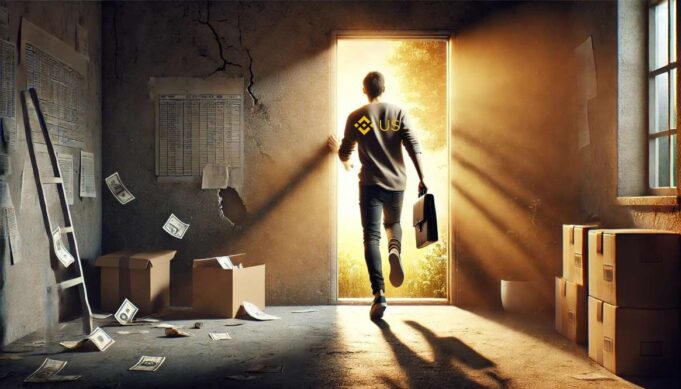

USD Services Restored: A Key Turning Point for Binance.US

Binance.US announced on February 19, 2025, that it has reinstated USD deposits and withdrawals after an almost two-year suspension caused by regulatory complications. The suspension, which began in June 2023, stemmed from a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) accusing the exchange of operating an unregistered securities platform and violating investor protection laws. During this period, Binance.US operated solely as a crypto-to-crypto trading platform, significantly limiting user options for fiat transactions.

The restoration of fiat services includes zero-fee Automated Clearing House (ACH) bank transfers. This enables users to deposit and withdraw U.S. dollars and access over 160 cryptocurrencies for trading. Binance.US has also revived additional features, including staking rewards, recurring purchases via its “Auto-Buy” function, and over-the-counter (OTC) trading for large-volume transactions.

Interim CEO Norman Reed stressed the company’s commitment to navigating regulatory hurdles. He stated, “Today’s news would not be possible without the incredible work of our team, who have been tirelessly committed to re-enabling this important function, and our customers for remaining supportive.”

Regulatory Shifts: A Softer Stance on Crypto?

While Binance.US’s operational recovery is significant, the broader narrative centers around what this development signals for U.S. cryptocurrency regulation. Over the past year, the regulatory landscape has been marked by heightened scrutiny. Federal agencies significantly ramped up enforcement actions against prominent crypto platforms. The SEC’s legal action against Binance.US was one of the most high-profile cases, reflecting a broader push to classify several crypto assets as securities.

However, recent political shifts may be softening this regulatory posture. Analysts point to changes in congressional leadership and increasing bipartisan discussions on the need for clear, crypto-friendly legislation. These changes, coupled with growing institutional interest in digital assets, suggest that U.S. regulators could be moving toward a more balanced approach that encourages innovation while maintaining investor protection.

Several crypto industry insiders believe that Binance.US’s renewed access to banking services – an element often crippled by regulatory pressure under what some have called “Chokepoint 2.0” – reflects behind-the-scenes negotiations and evolving regulatory attitudes. While the SEC lawsuit remains unsettled, the platform’s ability to re-establish banking partnerships seems to indicate that regulators acknowledge the importance of fiat on-ramps for legitimate crypto businesses.

Implications for the U.S. Crypto Market

Binance.US resuming USD services by Binance.US could have far-reaching implications beyond the platform itself. Other cryptocurrency companies that have faced similar fiat access restrictions may find new opportunities to re-engage with U.S. banking institutions. This development comes as global competitors expand their U.S. footprints, emphasizing the need for domestic platforms to regain competitive ground.

For users, restoring fiat services enhances market liquidity and trading convenience. It allows for smoother capital flows between traditional finance and digital assets. For regulators, the move provides a case study on balancing enforcement with market stability.

Industry observers caution, however, that while Binance.US’s comeback is a positive signal, the regulatory environment remains complex and fluid. Ongoing legal challenges, both for Binance.US and the broader crypto ecosystem, highlight the need for comprehensive legislation to clarify the classification and oversight of digital assets.

Looking Ahead: Is This a New Era for U.S. Crypto Regulation?

Binance.US’s successfully restoring USD services marks a pivotal moment for the exchange and the broader U.S. crypto industry. It reflects not just a company overcoming operational setbacks but a potential shift in how regulators and policymakers approach the maturing digital asset space.

As discussions on crypto regulation continue in Washington, the Binance.US case could catalyze more constructive engagement between industry stakeholders and regulators. Whether this development represents a long-term trend toward regulatory clarity or a temporary easing of restrictions remains to be seen.

One thing is clear: the interplay between regulation, political will, and market demand will continue to shape the future of cryptocurrency in the United States.

Readers’ frequently asked questions

Why were USD services on Binance.US suspended in the first place?

USD services on Binance.US were suspended in June 2023 due to a lawsuit filed by the U.S. Securities and Exchange Commission (SEC). The SEC accused Binance.US of operating without proper registration and violating securities laws. This legal action led to regulatory pressures, cutting off the platform’s banking partnerships. It effectively halted users’ ability to deposit or withdraw U.S. dollars. During the pause, Binance.US continued operating as a crypto-to-crypto exchange. However, users could not convert their holdings into fiat currency, which made accessing funds more challenging.

How does restoring USD services affect everyday Binance.US users?

After reinstating USD services on Binance.US users can now deposit and withdraw U.S. dollars via bank transfers, including fee-free ACH transfers. This change improves the platform’s accessibility, allowing users to buy and sell cryptocurrencies with fiat money rather than having to rely solely on crypto-to-crypto transactions. For users, this translates to more convenience and smoother transitions between traditional bank accounts and cryptocurrency investments. The restoration also brings back features like automated recurring buys and staking rewards, making it easier for both new and existing users to manage their digital assets.

What concrete changes allowed Binance.US to restore USD services?

Binance.US was able to restore USD services by re-establishing partnerships with banking institutions that facilitate fiat transactions. This reinstatement allows users to deposit and withdraw U.S. dollars through ACH bank transfers and other supported methods. The change follows internal efforts by Binance.US to address compliance issues raised during the SEC lawsuit. While the lawsuit remains ongoing, the platform’s renewed access to banking services indicates it has met certain operational and regulatory requirements necessary to support fiat transactions again.

What Is In It For You? Action Items You Might Want to Consider

Take advantage of renewed fiat access on Binance.US

With USD deposits and withdrawals back online, now’s the time to streamline your trading strategies. Use the zero-fee ACH transfers to quickly move funds into the platform and capitalize on market volatility. Rebalancing your portfolio just got easier with direct fiat access—don’t let the opportunity to optimize your positions pass you by.

Explore staking and recurring purchase options

Binance.US has revived staking rewards and the Auto-Buy feature. Consider setting up recurring purchases to dollar-cost average into your preferred assets, especially during market dips. Plus, staking certain proof-of-stake cryptocurrencies could offer you passive income while you hold—why not let your assets work for you?

Monitor regulatory developments closely

While restoring USD services is a positive step, the regulatory landscape is still evolving. Stay updated on the SEC lawsuit and potential new policies that could impact trading conditions. Traders who keep an eye on legal developments can better anticipate market sentiment shifts—and position themselves ahead of the curve.