Could rethinking Bitcoin’s unit structure be the key to mass adoption? A proposal to use Satoshi as the primary unit of Bitcoin transactions aims to simplify the user experience by eliminating decimals. Advocates argue that this change could make Bitcoin more accessible for everyday use. Critics, however, caution that the transition might disrupt existing systems and confuse current users. The debate highlights a growing push to make cryptocurrencies more practical for real-world applications.

The Proposal

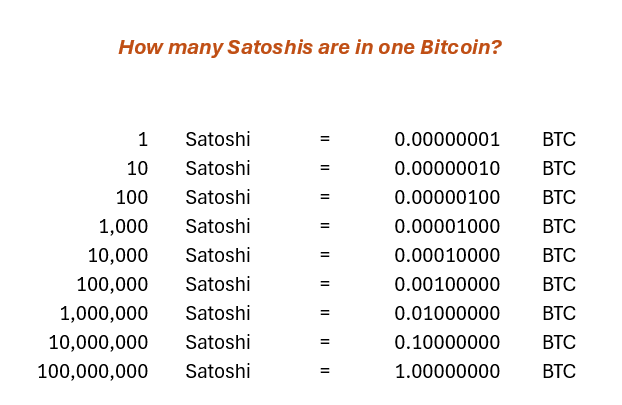

Bitcoin advocate John Carvalho has introduced a Bitcoin Improvement Proposal (BIP) to redefine the smallest unit of Bitcoin—the satoshi—as the standard for transactions. Under the current system, one Bitcoin is divisible into 100 million satoshis (sats), with transactions often displayed as fractional BTC values (e.g., 0.0001 BTC). Carvalho’s proposal suggests reversing this, where one Bitcoin equals one satoshi. For instance, a transaction now seen as 0.00010000 BTC would instead be displayed as 10,000 BTC under the new structure.

The primary goal is to make Bitcoin more intuitive by eliminating confusing decimal points. According to supporters, this shift aligns Bitcoin’s representation with traditional financial systems, where numbers are generally expressed as whole integers, easing adoption by everyday users.

Historical Context and Comparison

This is not the first time Bitcoin’s unit structure has come under scrutiny. In 2017, developer Jimmy Song proposed BIP 176, advocating for the use of “bits” as the standard unit to address similar usability issues. However, that initiative failed to gain traction within the community.

Carvalho’s proposal revives this discussion, suggesting that framing Bitcoin transactions in whole numbers could overcome barriers that have hindered adoption.

The Debate

While the proposal has garnered interest, it also faces criticism. Skeptics argue that redefining Bitcoin’s unit structure could create significant disruptions for wallets, exchanges, and other infrastructure relying on the current system. A transition to a satoshi-based standard may also confuse users already accustomed to Bitcoin’s established terminology.

Critics additionally warn of potential risks for businesses and developers, who may need to adjust pricing, accounting, and transaction systems to accommodate the change. For Bitcoin purists, this redefinition challenges the cryptocurrency’s historical identity.

Broader Implications

The proposal reflects a growing trend within the cryptocurrency space: simplifying complex systems to make digital currencies more user-friendly. As Bitcoin’s price continues to rise, fractional values will become increasingly common in everyday transactions. By addressing these issues now, the Bitcoin community could pave the way for more seamless adoption.

Whether this proposal gains traction remains to be seen, but it underscores a critical challenge for Bitcoin: balancing innovation with stability and tradition. For now, the debate highlights the dynamic and evolving nature of the cryptocurrency space.

Readers’ frequently asked questions

What exactly is a Satoshi, and why is it important to make it the standard unit for Bitcoin transactions?

A satoshi is the smallest unit of Bitcoin, representing one hundred millionths of a single Bitcoin (0.00000001 BTC). It is crucial because as Bitcoin’s price rises, using full Bitcoins in everyday transactions becomes less practical, leading to confusing fractional values like 0.0001 BTC for small purchases. By making satoshis the standard unit, transactions can be expressed in whole numbers, such as 10,000 sats, instead of fractions. This shift could simplify the user experience, making Bitcoin easier to understand and use, especially for people unfamiliar with cryptocurrencies.

If this proposal is implemented, what happens to existing Bitcoin wallets and exchange platforms?

Implementing this proposal would require significant updates to existing wallets and exchange platforms. These systems would need to adjust how they display Bitcoin balances and transaction amounts to align with the new satoshi-based standard. For users, the change might involve updating software and adapting to the new way balances are presented. While this might create temporary confusion, developers would likely offer tools and resources to ensure a smooth transition. Importantly, the value of Bitcoin holdings would not change; it would simply be represented differently.

How does this proposal affect Bitcoin’s broader adoption as a payment system?

This proposal aims to remove a key barrier to adoption: the difficulty of understanding fractional Bitcoin transactions. By aligning Bitcoin with traditional financial systems, where amounts are typically expressed in whole numbers, the change could make Bitcoin more intuitive for everyday use, particularly for retail payments. However, broader adoption will also depend on other factors, such as regulatory clarity, improved transaction speeds, and reduced fees. While simplifying units is a step forward, it is not a standalone solution for making Bitcoin a widely accepted payment method.

What Is In It For You? Action Items You Might Want to Consider

Reevaluate Your Unit Preferences

As discussions around satoshis gain traction, consider shifting your mindset to think in satoshis rather than full Bitcoins. This perspective can help you better navigate potential changes in the market and simplify transaction calculations, particularly as Bitcoin’s value continues to rise.

Stay Informed About Wallet Updates

If the proposal to standardize satoshis moves forward, wallet providers and exchanges will likely roll out updates to reflect the new unit structure. Keep an eye on announcements from your preferred platforms to ensure you’re ready to adapt without disruptions to your trading activities.

Anticipate Behavioral Shifts in the Market

A transition to satoshis as the primary unit could influence how new traders and retail users engage with Bitcoin. Monitor market sentiment and trading volumes to spot emerging trends that could signal opportunities, especially as accessibility improves for smaller-scale investors.

[…] the spotlight. If you’re new to the lingo, one Bitcoin equals 100 million satoshis. Carvalho’s plan is simple: let’s flip the script so one satoshi equals one Bitcoin in how we talk about […]

Yea sure, it’s unreal how many ppl i meet that think you have to buy bitcoin in whole even quantities so at least one whole bitcoin to even buy any. I always try to explain that if btc doubled in price then $100 worth of btc as well as one whole btc, would both double equally in terms of percentGe gain. People mainly prefer to own a bajillion tokens of something worth a tiny fraction of a cent each, rather than a small fraction (or less than one whole) of something like bitcoin. Idc personally since i know that nominal prices alone are largely irrelevant To evaluating value unlike the market-cap of an asset for instance which holds much mote significance to it.

I think a gradual reduction of 3 decimals should be done, similar to what is done, but in reverse, for many currencies:

1 BTC = 1,000 BTC/K

The new BTC could be called BTC/K.

1 BTC/K = 105 US$

21 million BTC = 21 billion BTC/K