TL;DR

- Bitcoin ETF flows remain closely linked to price momentum, suggesting that much of the activity in spot ETFs is still tactical rather than driven by long-term strategic allocation.

- The institutional wrapper is real, but allocation sizes, governance constraints, and short-horizon positioning mean the “institutional era” still behaves more like Retail 2.0 than a stable pension-driven market.

Two years ago, Bitwise CIO Matt Hougan put a number on what many suspected: a $100 trillion investor class was “just starting to move into crypto,” and the process would take “years, not months.” In that framework, the arrival of Spot Bitcoin ETF products wasn’t simply another listing; it was the missing bridge between traditional portfolios and digital assets.

The market’s expectation followed naturally. If ETFs could remove operational friction, meaning custody, key management, and counterparty risk, then the marginal buyer should begin to resemble traditional ETF allocators. That would mean slower rebalancing, longer holding periods, and more resilience during volatility. In that world, Bitcoin ETF flows would function more like a portfolio base, and less like a short-term sentiment gauge.

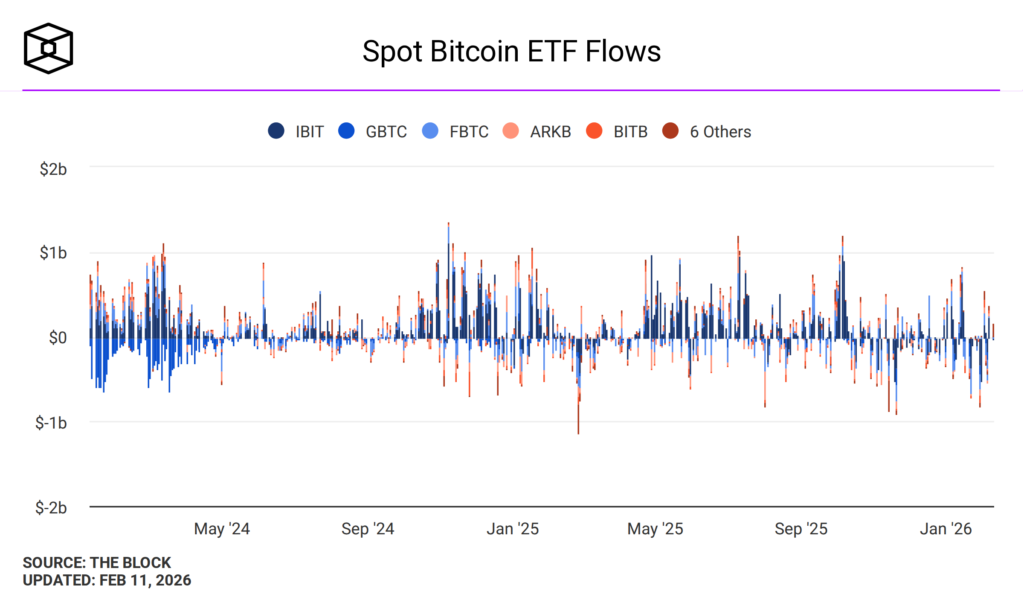

Recent months have tested that assumption. Weakness in price has coincided with sharp outflows. Inflows have tended to accelerate during rallies, while redemptions intensified as momentum faded. The pattern of these Bitcoin ETF inflows and outflows increasingly mirrors price momentum rather than long-horizon allocation behavior. That raises a clear question: what if the ETF era represents real infrastructure progress, but investor behavior remains early-cycle and highly tactical?

Understanding the ETF Promise

The ETF story was always about friction.

For years, many professional investors had views on Bitcoin, but no clean implementation path within standard policy constraints. Operational complexity mattered. So did exchange exposure, custody frameworks, and approval processes that can take quarters, not days.

Spot ETFs changed that. A portfolio manager can buy exposure through a standard broker. An adviser can allocate without building a bespoke custody stack. Committees can approve a familiar instrument and measure it within established reporting systems.

That shift made the “institutional access” narrative powerful. The institutional ETF wrapper made Bitcoin easier to own within traditional portfolios. The implied next step was that ownership behavior would begin to resemble long-term portfolio allocation rather than reflexive risk-on/risk-off positioning.

Implicit in that narrative was the now-familiar $100 trillion figure, the approximate size of global institutional assets. No one expected all of it to flow into crypto. The point was addressable capital. Even a low single-digit allocation across pensions, endowments, sovereign wealth funds, and insurers would imply trillions of dollars gradually rotating into digital assets over time.

The assumption was not a flood, but a slow, sticky seep. Something closer to SPY or GLD than a high-beta tech stock.

What Flows Are Actually Showing

If ETFs were dominated by strategic allocators, the correlation between Bitcoin ETF flows and price would gradually weaken rather than remain statistically significant. There would still be profit-taking and rebalancing, but not repeated “in on strength, out on weakness” patterns.

Empirically, research points to a consistent link between ETF demand and Bitcoin price, though the interpretation depends on horizon and regime. FalconX‘s October 2024 analysis found a statistically significant yet modest relationship between changes in spot ETF flows and Bitcoin price moves. In one specification, the correlation was around 0.30, with a rolling 60-day range spanning roughly 0.10 to just above 0.50 over a ten-month window, an explicit reminder that the relationship is variable rather than stable.

A separate 2025 Ledger study analyzed daily data from January 2024 through May 2025 and identified a strong positive long-run association between Bitcoin spot ETF net assets and Bitcoin price, with cointegration confirmed at the 10% level.

Taken together, these findings do not suggest that flows determine price. However, they show that Bitcoin ETF flows are embedded in price formation, particularly when marginal positioning is short-horizon and reflexive.

Outflow episodes reinforce the point. On January 21, 2026, U.S. spot Bitcoin ETFs recorded about $708 million of net outflows in a single day, and a three-day streak totaled roughly $1.59 billion. Amberdata’s market note for the Jan 20–26 window similarly described heavy weekly outflows.

These are not the slow reallocations typical of a predominantly strategic allocator base. They resemble rapid risk resizing. Exactly the type of dynamic that helps explain why bitcoin ETF outflows can intensify during a market crash, amplifying volatility through redemptions and forced selling pressure.

>>> Related: Bitcoin ETF Outflows Trigger BTC Drop Toward $80K

Who Is Buying the ETFs and Why That Matters

A large part of the confusion stems from one word: “institutional.”

An ETF is an institutional-grade wrapper. That does not mean the typical holder is a pension fund. ETFs are also the easiest vehicle for self-directed investors and advisers managing retail wealth. Anyone with access to a brokerage account, trading app, or neo-broker platform can now buy or sell Bitcoin exposure in seconds.

Before spot ETFs, participation required navigating exchanges, custody solutions, and private keys. Those frictions acted as a filter. Investors who were curious but uncomfortable with operational complexity often stayed on the sidelines. The ETF structure removed that barrier.

That shift matters. In mature markets, many retail investors treat broad equity or bond ETFs as long-term holdings. Crypto is different. For a large segment of market participants, it remains an opportunistic or high-beta trade rather than a strategic allocation. The same investor who passively holds an S&P 500 ETF for years may actively trade Bitcoin exposure when it is available in the same account.

In other words, the institutional wrapper widened access faster than it reshaped behavior. Some investors who previously avoided direct custody now express their crypto view through ETFs, not because their time horizon changed, but because the implementation became easier.

The more useful distinction, then, is not simply retail versus institutional. It is strategic allocator versus tactical participant. If a large share of the buyer base is tactical, whether individual traders, wealth-platform clients, or hedge funds, ETF activity will amplify prevailing trends. If the base shifts toward allocators with explicit policy mandates, flows will look more stable and rebalancing-driven.

Early in a new product cycle, it is common for tactical capital to dominate marginal activity.

>>> Related: PlanB Ditches Self-Custody for Bitcoin ETF

Why ETF Plumbing Can Amplify the Cycle

ETFs rely on creation and redemption mechanisms that link share flows to underlying exposure.

In calm markets, authorized participants create and redeem shares efficiently, helping the ETF trade near net asset value. In volatile markets, the same mechanism can transmit urgency into underlying buying or selling. Heavy redemptions can translate into net selling pressure; heavy creations can accelerate buying.

This dynamic is not unique to crypto. But Bitcoin’s volatility profile and reflexive narrative cycles can make these feedback loops more visible.

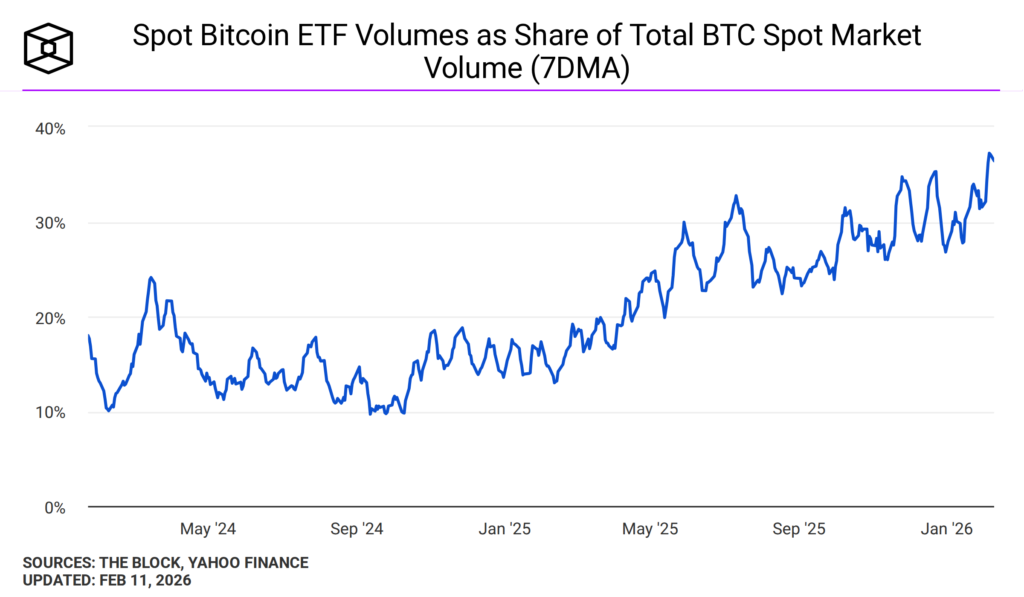

One indirect proxy for this dynamic is the implied ETF turnover rate: when turnover is high, short-horizon positioning tends to dominate price discovery.

The wrapper is not a lockbox. It is a highly liquid doorway that reflects the behavior of whoever is walking through it.

Myth vs. Fact: The Institutional ETF Era

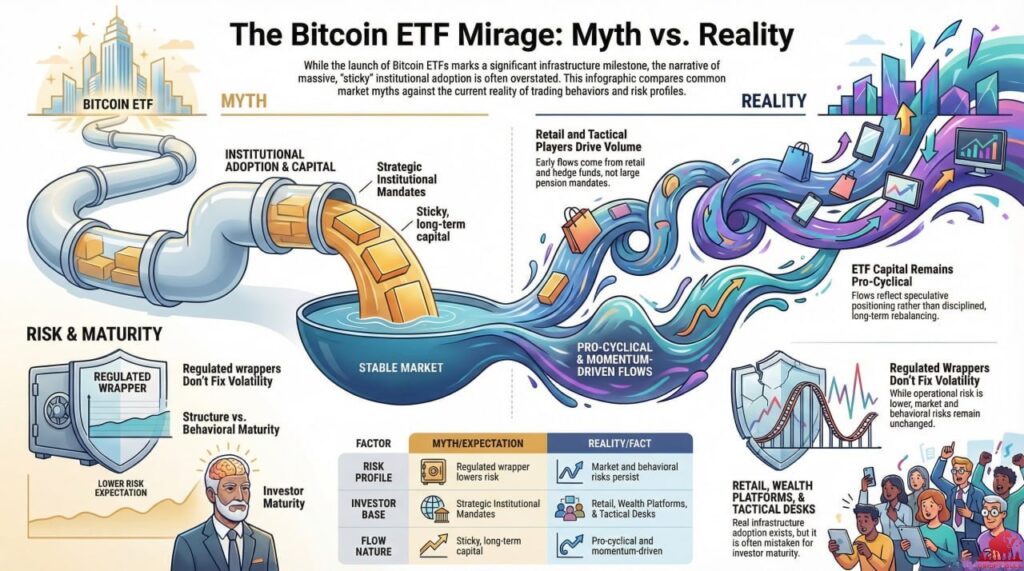

Myth 1: ETFs mean institutions are finally all-in on crypto.

Fact: Early volume has been driven heavily by retail investors, wealth platforms, tactical hedge funds, and systematic desks, not giant pension mandates making strategic allocations.

Myth 2: ETF capital is sticky and long-term.

Fact: The structure of Bitcoin ETF flows still reflects pro-cyclical positioning more than disciplined rebalancing.

Myth 3: A regulated wrapper lowers overall risk.

Fact: Product risk may be lower (custody, compliance, operational friction), but market and behavioral risks remain unchanged. Easier trading can amplify volatility.

Myth 4: Price crashes prove institutional adoption has failed.

Fact: Infrastructure adoption is real. But the persistent myth around institutional adoption in the Bitcoin ETF market shows how easily structure can be mistaken for behavioral maturity.

Why Institutions Still Behave Like Tourists

Even among professional investors, crypto allocations are often measured in basis points rather than percentages. A 50-basis-point sleeve is easy to add and as easy to cut.

Governance structures matter. New asset classes face tighter scrutiny and lower tolerance for drawdowns. A pension fund can justify equity volatility. It is far harder to justify a 40% drawdown in a recently approved digital asset allocation.

Political and reputational constraints also play a role, particularly for public pensions and insurers. Crypto is still frequently categorized as opportunistic or speculative exposure, instead of a core strategic allocation alongside equities, bonds, or real assets.

When allocations are small, oversight is intense, and conviction is developing, behavior tends to resemble tourism.

What Real Institutionalization Would Look Like

The shift from tactical ETF trading to strategic allocation will be observable.

First, the correlation between Bitcoin ETF flows and BTC price should weaken over time as a larger share of assets sits in long-horizon portfolios.

Second, markets should show more evidence of rebalancing into weakness rather than exiting during volatility.

Third, ETF ownership should broaden toward long-term mandates, transforming how Bitcoin ETF investors behave across cycles.

Finally, the broader institutional crypto stack should deepen: tokenized cash instruments, tokenized treasuries, and regulated stablecoin infrastructure.

The clearest signal of maturation will not be ETF approval headlines. It will be durable allocation policy, observable rebalancing behavior, and a measurable decline in flow-price sensitivity.

Closing Thoughts

The original ETF optimism was not wrong, but it may have been early. The infrastructure thesis proved correct because access scaled rapidly. However, the narrative was too optimistic in assuming that product design alone would reshape institutional behavior.

Hougan’s framework, a $100 trillion investor base moving over years, remains directionally intact. But the current phase shows that structure evolves faster than psychology.

We have built the on-ramp. The next phase will determine whether Bitcoin ETF flows begin to resemble strategic capital or remain a tactical trade.