In the thrilling world of cryptocurrencies, the recent approval of spot Bitcoin Exchange-Traded Funds (ETFs) was anticipated to be a game-changer. It fueled expectations of a major bullrun in the market. However, as the dust settles, it seems that the path to the much-anticipated bullrun has hit unexpected roadblocks. It left investors and enthusiasts questioning the trajectory of the market.

A Glimpse of Optimism

When the U.S. Securities and Exchange Commission (SEC) reluctantly approved 11 spot Bitcoin ETFs, the crypto community erupted with excitement. This watershed moment marked a significant shift in the industry, with total assets under management reaching an impressive $27.9 billion. BlackRock and Fidelity quickly emerged as front runners, attracting substantial funds of nearly $500 million and $423 million, respectively, within the first two days of trading.

The market sentiment was overwhelmingly positive. The hopes were high that the ETF approval would trigger a new wave of capital inflow into the cryptocurrency space. Bitcoin, the world’s largest digital asset, had already surged nearly 60% since September, driven by speculation that regulatory approval would bring in fresh capital and simplify exposure to the cryptocurrency through regulated exchanges.

The Unraveling

However, the initial exuberance soon gave way to unexpected challenges. The $26.53 billion Grayscale Bitcoin Trust, despite being the largest player, experienced significant outflows of $478 million in the first two days. Analysts had predicted profit-taking from early investors, considering the fund’s previous status as a closed-end fund trading at a discount to its underlying bitcoin assets. J.P. Morgan’s earlier estimate of potential outflows nearing $3 billion seemed to be materializing.

The market dynamics took an unexpected turn as Bitcoin ETFs faced headwinds despite substantial trading volumes. Grayscale, BlackRock, and Fidelity dominated trading activity on the debut day, but the overall market sentiment started to waver.

Was the Bullrun Derailed?

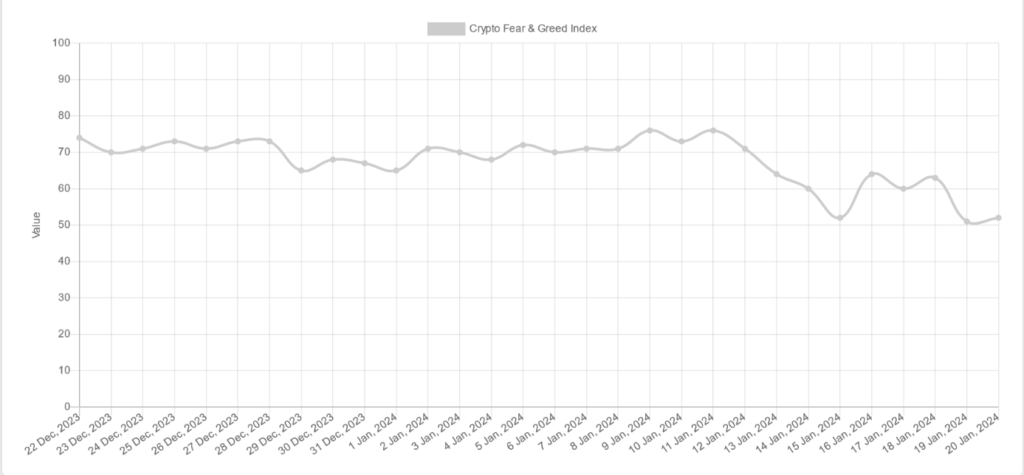

As the spot Bitcoin ETFs encountered challenges, the broader crypto market felt the impact. Bitcoin’s market sentiment, as reflected by the Crypto Fear and Greed Index, dropped from “extreme greed” to a neutral level. This sudden shift left investors pondering whether the much-anticipated bullrun got derailed or if it’s merely a temporary setback.

On a scale from 0 to 100, zero means “Extreme Fear”, 100 means “Extreme Greed”

The decline in Bitcoin prices and the struggles of publicly-listed crypto companies, such as Marathon Digital Holdings and Coinbase Global, further contribute to the uncertainty. The market, which initially seemed poised for a sustained upward trajectory, is now grappling with the complexities of investor behavior, fund flows, and the interplay of traditional and crypto financial markets.

In conclusion, the approval of spot Bitcoin ETFs was expected to be a catalyst for a crypto bullrun, but the market’s reaction introduced a level of unpredictability. While hopes were high for an influx of new capital and sustained upward momentum, the challenges faced by existing crypto products, coupled with profit-taking tendencies, have created an environment of caution.

As the crypto community navigates these uncertainties, the fate of the anticipated bullrun hangs in the balance. Investors and enthusiasts are now closely monitoring market dynamics, regulatory developments, and institutional responses to gauge the future direction of the cryptocurrency market. The journey to mainstream adoption and market maturation continues, with each development shaping the narrative of the crypto space.

Read more: Crypto Market Reflection – Bitcoin ETF Buzz Or Bust?