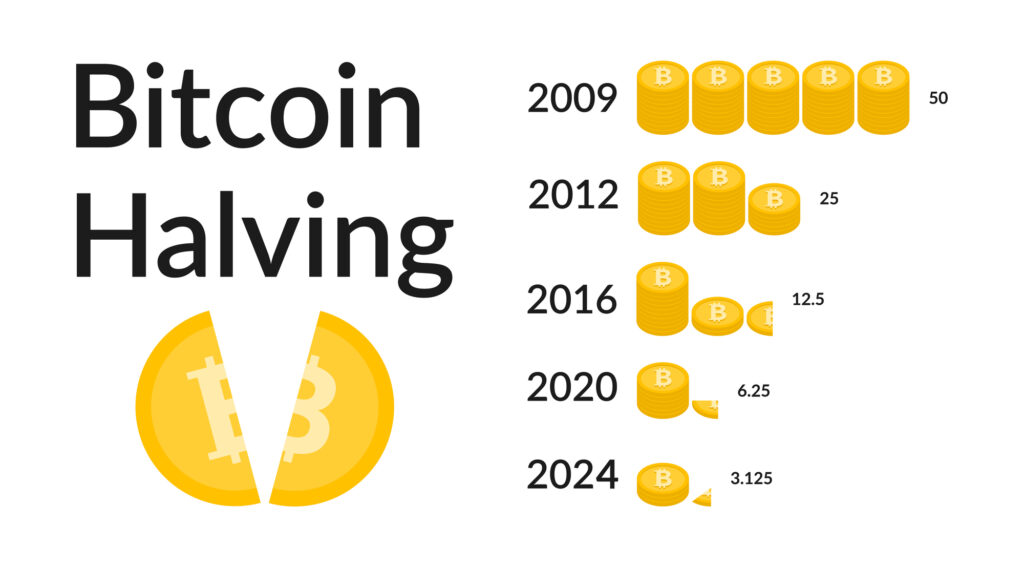

Bitcoin mining, a fundamental process in the cryptocurrency ecosystem, involves validating transactions and minting new bitcoins. Central to this process is the concept of halving, where the mining reward is reduced by half at regular intervals. This phenomenon has a profound impact on the profitability of Bitcoin mining operations.

The upcoming halving, scheduled for April 2024, is poised to decrease mining rewards from 6.25 to 3.125 bitcoins per block. This reduction directly affects miners, who will receive fewer bitcoins for their efforts. The question arises: will Bitcoin mining remain profitable after halving?

Understanding the Post-Halving Landscape

Post-halving profitability hinges on a multitude of factors, with Bitcoin’s price being of paramount importance. The halving event reduces the supply of new bitcoins, potentially driving prices upwards due to increased scarcity. However, market sentiment, regulatory developments, and technological advancements also play significant roles in shaping Bitcoin’s price trajectory.

Mining difficulty, another crucial factor, adjusts every 2016 blocks to maintain a consistent block time. This adjustment reflects the overall competitiveness within the mining network and directly impacts miners’ profitability. Higher mining difficulty translates to increased competition, potentially squeezing profit margins for individual miners.

The Indirect Effects of Halving on Mining Operations

Halving not only directly impacts mining rewards but also indirectly affects mining difficulty and hash rate. Post-halving, miners operating at high electricity costs with outdated equipment may find their operations no longer profitable. Consequently, some miners may opt to sell their equipment, switch to alternative cryptocurrencies, or cease operations altogether.

Conversely, forward-thinking miners may seize the opportunity presented by the halving to invest in more efficient mining equipment or secure affordable energy sources. By doing so, they can bolster their hash rate and remain competitive in the post-halving landscape.

Long-term Strategies for Sustained Profitability

In navigating the challenges posed by halving, miners must adopt long-term strategies to ensure sustained profitability. Scaling up and diversifying operations can help increase the hash rate and revenue streams. Additionally, investing in innovative technologies and upgrading equipment can enhance efficiency and reduce operational costs.

Collaborating with other miners through mining pools can also provide benefits such as increased security and stability. However, miners must carefully weigh the trade-offs, as joining a mining pool may entail reduced individual earnings.

Navigating the Post-Halving Era

While halving marks a significant milestone in the Bitcoin ecosystem, its impact on mining profitability is multifaceted. Miners must remain vigilant and adapt to the evolving landscape by implementing strategic measures to ensure sustained profitability. By leveraging technological advancements, collaborating with peers, and staying informed about market dynamics, miners can confidently navigate the post-halving era.

In summary, while halving poses challenges to Bitcoin mining profitability, it also presents opportunities for innovation and growth. By embracing change and adopting forward-thinking strategies, miners can thrive in the dynamic and ever-evolving world of cryptocurrency mining.

Read more: Where Bitcoin Is Going in 2024 and Beyond

[…] unfolds, miners are repositioning themselves as financially disciplined operators, attuned to the realities of a post-halving, high-cost environment. For investors and analysts, this transformation offers both challenges and […]