Bitcoin’s hashrate drop in late June sent shock waves through the crypto industry. It marked the most severe network contraction since China’s 2021 mining ban. Yet despite falling revenues and a turbulent geopolitical backdrop, Bitcoin miners are HODLing, not capitulating. This signals a structural shift in the mining economy, raising new questions about Bitcoin’s network health.

The Numbers: Historic Hashrate Drop Followed by Rapid Rebound

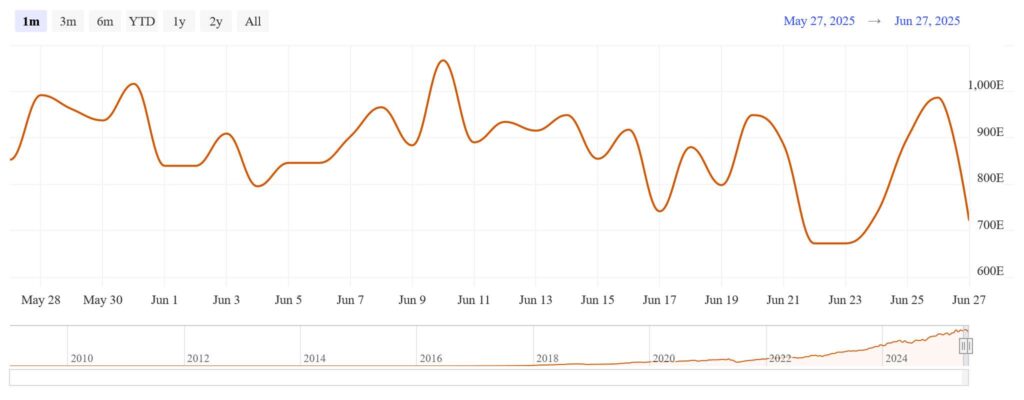

Between June 15 and June 24, the Bitcoin hashrate dropped by roughly 15%. It fell from around 944 EH/s to just under 800 EH/s. This marked its lowest levels in eight months. The plunge triggered expectations of a 9% downward adjustment in Bitcoin mining difficulty, the largest since mid-2021.

Then, on June 26, the network rebounded sharply, pushing the hashrate metric up by nearly 30% in a single day. It was one of the fastest recoveries in recent memory.

Root Causes: More Than Just a Power Bill Problem

What caused the sharp network contraction? Several overlapping factors likely contributed:

- Energy cost pressures: Skyrocketing electricity prices have squeezed Bitcoin mining profitability. This hit miners in regions reliant on fossil fuel infrastructure.

- Geopolitical instability: Some analysts have linked the mid-June network disruption to reported U.S. cyber or military actions targeting Iranian infrastructure. While Iran accounts for an estimated 6–7% of global Bitcoin hashrate, there is no hard evidence confirming a direct outage. However, the timing of the decline overlapped with the regional escalation, making it a credible if unverified factor behind the Bitcoin hashrate drop. This has fueled speculation that Iran’s Bitcoin mining may have been temporarily disrupted during the crisis.

- Operational bottlenecks: Grid constraints in Central Asia and delays in China may have caused temporary reductions in hashpower.

Revenues Sink, But Miner Selling Stalls

Miner revenue is falling. On June 22, daily Bitcoin miner revenue dropped to $34 million, a two-month low. Transaction fees have also declined. This has further reduced profitability.

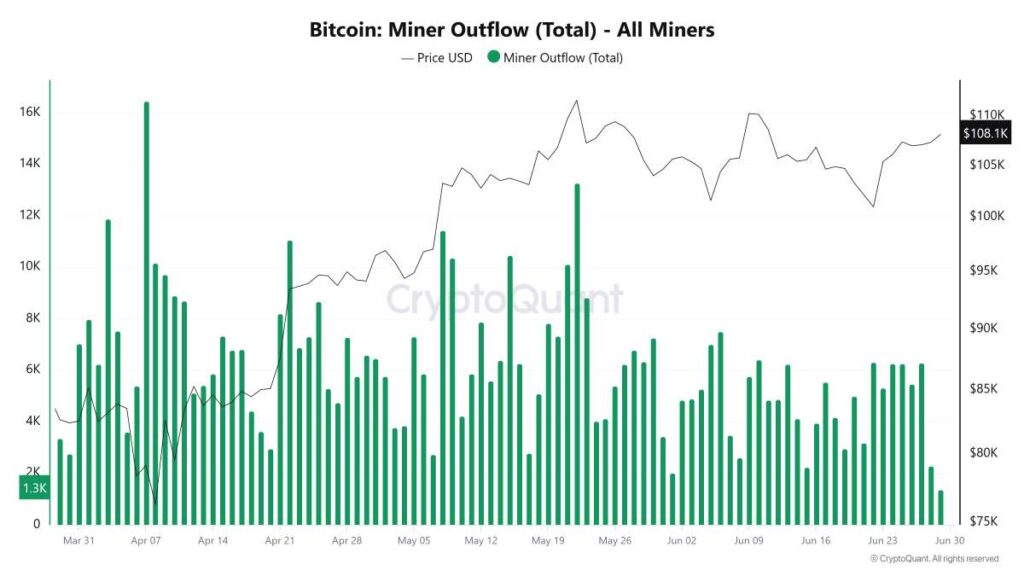

Yet miners are not rushing to sell. Bitcoin miners’ selling remains minimal. Outflows from miner wallets dropped from 23,000 BTC per day in February to only 6,000 BTC by late June. Even early Satoshi-era wallets stayed quiet, with less than 150 BTC sold so far in 2025.

The decline in Bitcoin miner revenue has not triggered widespread selloffs. This stands in contrast to earlier periods of Bitcoin miners selling, especially in early 2024.

>>> Read more: Bitcoin Miners Selling Off BTC Holdings Now

Why Are Miners HODLing?

This is not April 2024 all over again. After the halving, weaker miners sold heavily. But now, the landscape has changed. Miners with efficient operations and large treasuries are staying patient.

- Low-cost miners dominate: Companies like CleanSpark and Marathon maintain profitability. They operate with breakevens far below market price, even during the Bitcoin hashrate drop.

- Difficulty relief is imminent: A 5–6% Bitcoin mining difficulty adjustment is expected. This could improve Bitcoin mining profitability by reducing energy demands.

- Accumulation strategy: Wallets holding 100 to 1,000 BTC have added over 4,000 BTC since April. This suggests a broader mid-tier accumulation trend.

Consolidation, Not Capitulation

This shake-up looks more like a reset than a collapse. Unprofitable operators are exiting quietly. Stronger miners are consolidating their network share. This ongoing consolidation shows crypto mining is a maturing industry. Operational resilience now matters more than sheer scale.

Risks still remain. Energy prices could rise further. Political tensions could escalate in mining regions like Iran or Kazakhstan. If that happens, a delayed miner capitulation is still possible.

Conclusion: Miner Patience May Signal Bullish Intent

While the Bitcoin hashrate drop drew headlines, the real story lies in what didn’t happen. There was no panic selloff. Bitcoin miners are HODLing, even with falling revenue. That shows confidence — or at least a calculated bet on future gains.

The unexpected Bitcoin hashrate rebound provided temporary relief. But Bitcoin’s long-term network health will depend on how the network responds to economic and regional pressure.

Readers’ frequently asked questions

Did the Iran attack cause the Bitcoin hashrate drop?

Possibly, but not conclusively. Some analysts linked the timing of the drop to reported U.S. actions targeting Iranian infrastructure. Iran is estimated to contribute 6–7% of the global Bitcoin hashrate. However, no direct outage has been confirmed, and other global factors were also at play.

Where are most Bitcoin miners located today?

The majority of Bitcoin miners operate in the United States, particularly in Texas and other energy-abundant states. Other notable mining hubs include Kazakhstan, Russia, and parts of Canada. These regions offer favorable electricity costs, regulatory frameworks, or access to stranded energy, all critical for maintaining competitive margins in mining.

How will the difficulty adjustment affect miners?

The expected 5–6% drop in mining difficulty will reduce the average energy cost per block. This should increase profitability for the remaining miners and could encourage some to bring machines back online, stabilizing the network.

What is in it for you? Action items you might want to consider

Understand why hashrate matters for Bitcoin’s stability

A sharp drop in Bitcoin’s hashrate can slow down transactions and signal miner stress. Awareness of these shifts helps you read the market beyond price charts.

Watch how miner behavior influences supply pressure

When miners hold onto their Bitcoin instead of selling, it can reduce selling pressure in the market. That’s often seen as a bullish signal, but only if it lasts.

Stay informed about global events that affect mining regions

Geopolitical events, energy crises, or regulations in countries like the U.S., Iran, or Kazakhstan can all impact mining operations. These changes may influence Bitcoin’s security, decentralization, or price trends over time.

[…] >>> Read more: Bitcoin Hashrate Drop: Why Miners Are Still Holding […]

[…] >>> Read more: Bitcoin Hashrate Drop: Why Miners Are Still Holding […]