The Bitcoin market has been experiencing a prolonged depletion of its reserves on centralized exchanges, with levels now approaching the lows of 2018. For several months, a steady flow of Bitcoin has been moving off exchanges and into cold storage. What initially appeared to be a reaction to high-profile exchange failures, such as those of FTX and Terra, has evolved into a broader market trend. Investors, both retail and institutional, are increasingly opting for long-term self-custody of their assets. As a result, Bitcoin’s liquid supply has shrunk considerably, raising questions about the potential implications for the market’s liquidity and price dynamics.

A Shift in Investor Behavior

The withdrawal of Bitcoin from exchanges is driven by several factors. After the collapses of major platforms like FTX, trust in centralized exchanges has been shaken. Investors are moving their assets to cold storage to enhance security and take control of their private keys. Additionally, the rising preference for non-custodial solutions aligns with Bitcoin’s decentralized ethos, further reinforcing the shift away from exchanges.

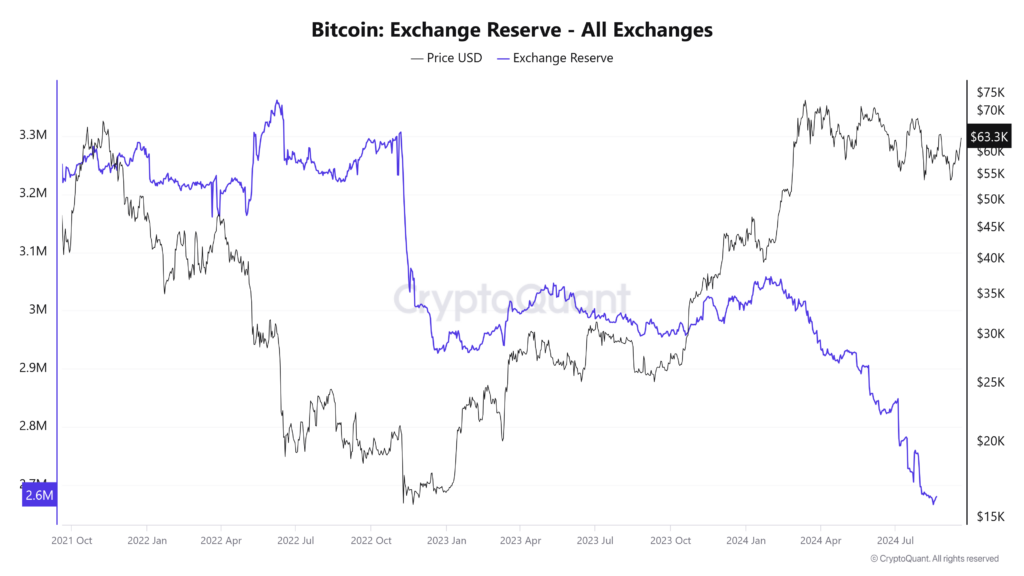

Data from CryptoQuant reveals that Bitcoin reserves on exchanges have declined to just 2.6 million BTC as of mid-September 2024, marking a significant drop from a peak of over 3.3 million BTC in 2021. This ongoing drain has been particularly notable over the past six months, with around $5.96 billion worth of Bitcoin withdrawn from exchanges in just 30 days between mid-July to mid-August. This decline echoes the market dynamics seen in 2018, when reserves fell to similar lows.

Impact on Liquidity and Market Volatility

The diminishing reserves have sparked debate within the market. On one hand, reduced Bitcoin on exchanges typically signals a bullish outlook, as it suggests that holders are preparing for long-term gains rather than looking to sell in the short term. Analysts argue that this trend could limit selling pressure, making Bitcoin less prone to market downturns. Historically, such reserve reductions have preceded major price rallies, reinforcing the idea that scarcity could drive up prices.

On the other hand, the ongoing drain raises concerns about liquidity. Bitcoin’s reduced availability on exchanges means there is less liquidity for immediate trades, particularly for institutional investors looking to execute large transactions. As the pool of liquid Bitcoin shrinks, the market becomes more vulnerable to volatility. Smaller movements could trigger outsized price swings. While this dynamic has not yet caused severe disruptions, the continuous outflow suggests that the market may be heading toward a critical point. Liquidity shortages could become more pronounced.

The Whale Factor

Another important element in this trend is the behavior of so-called “whales” — entities holding large amounts of Bitcoin. The whale ratio, which measures the proportion of Bitcoin held by these large players on exchanges, has risen in 2024. This suggests that while reserves are dwindling overall, whales are still active in the market. This dynamic could further exacerbate liquidity challenges, as large buy or sell orders by whales can have a disproportionate impact on price stability.

At the same time, the number of small and medium-sized wallets holding Bitcoin has continued to grow. That reflects broader adoption among retail investors. This rising demand adds another layer of complexity, as the growing interest from smaller holders could clash with the shrinking supply, amplifying price pressures in both directions.

Can the Market Sustain This Trend?

The central question remains: How long can the market sustain this decline in exchange reserves before the effects on liquidity and price stability become critical? While many analysts believe that the scarcity created by shrinking reserves will bolster Bitcoin’s price in the long term, the short-term impact on liquidity could be problematic. If large players or institutional investors struggle to find sufficient liquidity for trading, it could lead to more volatility or price spikes that are not driven by organic market forces.

Ultimately, the sustainability of this trend will depend on several factors. If the trust in centralized exchanges continues to erode and cold storage remains the preferred option for the majority of investors, reserves may continue to dwindle. On the flip side, if exchange platforms can regain investor confidence through enhanced security and transparency measures, some of this Bitcoin could flow back into exchanges, alleviating some of the liquidity concerns.

>>> Read more: Crypto Whales Diversify Portfolios in July

For now, Bitcoin’s shrinking reserves represent a fundamental shift in market dynamics, one that signals both growing confidence in Bitcoin’s long-term potential and emerging risks related to liquidity and volatility. How the market adapts to these changes will be critical in determining Bitcoin’s future price trajectory.

Readers’ frequently asked questions

What are the broader implications of shrinking Bitcoin reserves beyond price and liquidity?

The continuous decline in Bitcoin reserves on exchanges doesn’t just affect price and liquidity; it also signals a larger shift in market behavior. Investors moving their assets into cold storage reflect an increasing trend toward self-custody and a preference for decentralized control of assets. This is important for Bitcoin but also for the broader cryptocurrency ecosystem. After all, it aligns with the principles of decentralization and security that many in the industry advocate for. Additionally, as more Bitcoin is removed from circulation on exchanges, the market could see a greater emphasis on long-term value retention rather than short-term speculation. Over time, this could foster a more stable investor base, less prone to the panic selling that has sometimes characterized crypto markets.

What safeguards are in place to prevent major disruptions if liquidity continues to shrink?

To mitigate risks from shrinking liquidity, exchanges and institutional products have introduced new safeguards. For example, Bitcoin futures and exchange-traded funds (ETFs) offer alternative ways for investors to gain exposure to Bitcoin without directly affecting the spot market. These financial instruments provide liquidity without requiring actual Bitcoin to change hands, reducing pressure on reserves. Additionally, larger exchanges are bolstering their internal liquidity pools to ensure that they can handle large orders without causing significant market disruptions. Market makers and algorithmic trading systems also help to maintain order flow, reducing the risk of sharp price movements due to a sudden imbalance in buying or selling pressure.

Could this trend of declining reserves reverse, and what would trigger that?

Yes, the trend of declining reserves could reverse under specific conditions. One key factor would be a resurgence of trust in centralized exchanges. If exchanges improve their security protocols and offer enhanced transparency, more investors might feel comfortable keeping their assets there for trading purposes. Another potential trigger could be a significant bull run, tempting long-term holders to move their Bitcoin back onto exchanges to realize profits. Regulatory clarity around cryptocurrency holdings and the introduction of more institutional investment products could also drive Bitcoin back into exchange reserves. Both retail and institutional investors would need access to liquidity for trading in a more regulated market environment.

What Is In It For You? Action Items You Might Want to Consider

Keep a close eye on liquidity levels across exchanges.

With Bitcoin reserves steadily declining, the market’s ability to handle large buy or sell orders becomes more fragile. As a trader, it’s essential to monitor liquidity metrics on major exchanges. If liquidity becomes too thin, it could amplify price volatility, presenting both risks and opportunities. Ensure you’re trading on exchanges with solid liquidity pools to avoid slippage or sudden price shocks.

Consider adjusting your strategy for long-term holding.

The steady outflow of Bitcoin from exchanges into cold storage suggests many investors are adopting a long-term holding mindset. If your strategy has been more short-term focused, this might be a good time to reconsider and potentially allocate a portion of your portfolio to long-term holds. With supply on exchanges shrinking, scarcity could drive prices upward, offering long-term growth potential.

Diversify your market exposure with alternative financial products.

As Bitcoin reserves on exchanges continue to dwindle, liquidity risks increase. To hedge against these risks, consider using Bitcoin futures, ETFs, or other financial products that offer exposure to Bitcoin without directly requiring on-exchange liquidity. These alternatives can provide smoother trading opportunities during periods of high volatility while still allowing you to capitalize on Bitcoin price movements.

[…] trend of dwindling Bitcoin reserves on cryptocurrency exchanges, first noted months ago, shows no signs of slowing. As of November 2024, exchange-held reserves have plunged to their […]