In a strategic move aimed at global expansion, South Korean cryptocurrency exchange Bithumb has announced plans to spin off its non-core business units into a separate entity, “Bithumb A,” by July 31, 2025. This restructuring is a key step toward a potential Initial Public Offering (IPO) in the second half of 2025. The company considers listings on both South Korea’s Kosdaq and the U.S.-based Nasdaq stock exchange.

Strategic Restructuring for Global Ambitions

The spin-off will separate Bithumb’s investment and holding operations from its core cryptocurrency exchange business. Bithumb Korea will maintain a 56% stake in the original exchange, while the new entity, Bithumb A, will hold the remaining 44%. The goal is to enhance operational efficiency, reduce risk exposure, and streamline corporate governance. All are critical factors for attracting investors and meeting regulatory standards in global markets.

Samsung Securities has been appointed as the lead underwriter, underscoring Bithumb’s commitment to a well-structured IPO. While a domestic listing is still under consideration, a potential Nasdaq debut signals the company’s broader ambition to become a globally recognized crypto trading platform.

Financial Momentum Fuels IPO Push

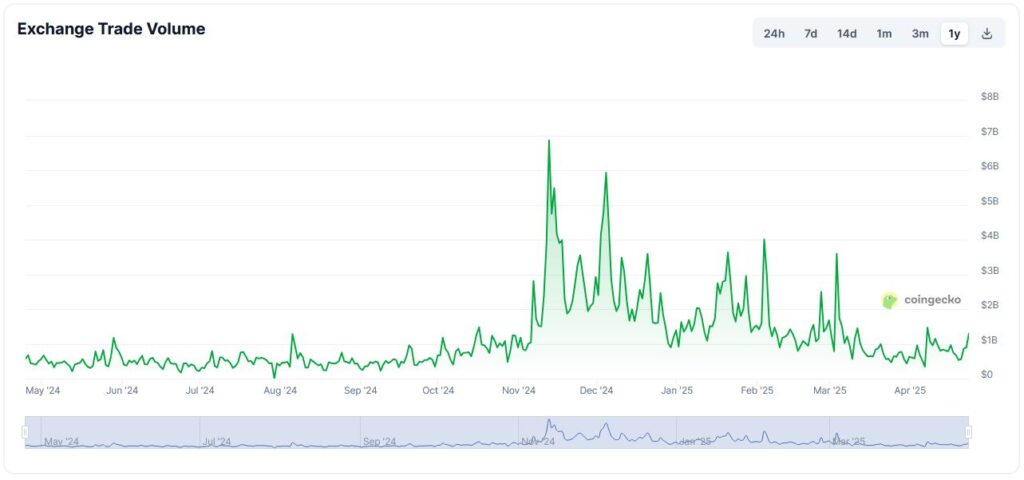

Bithumb’s financial performance in 2024 supports its IPO ambitions. The company reported a net profit of $110 million, a 560% year-over-year increase. The surge reflects both the market recovery and internal operational improvements. However, Bithumb still trails its closest rival, Upbit, which generated over six times that amount in net profits. This emphasizes the competitive pressure in South Korea’s digital asset sector.

The spin-off aims to strengthen Bithumb’s positioning by enabling each business arm to focus on distinct goals. Growth for the exchange and innovation for the investment and holding division.

Regulatory Hurdles Ahead of Bithumb IPO

While the restructuring demonstrates strategic foresight, Bithumb must still overcome significant regulatory obstacles. The exchange has recently faced compliance issues, including a suspension related to lapses in Know Your Customer (KYC) procedures and connections to unregistered foreign platforms. These challenges have led to increased scrutiny from South Korea’s Financial Intelligence Unit. They could well complicate the path to a successful IPO, particularly if Bithumb seeks approval from U.S. regulators for a Nasdaq listing.

Nevertheless, separating the business units may serve to mitigate regulatory risk. It creates clearer operational boundaries and enables each entity to implement focused compliance strategies.

Looking Forward

Bithumb’s corporate overhaul and renewed IPO push mark a pivotal moment in its evolution from a regional exchange to a contender on the global stage. Realigning its structure and sharpening its compliance efforts, the company is betting that streamlined governance and international visibility will resonate with investors and regulators alike.

>>> Read more: BitGo Crypto Custodian Eyes IPO

Whether it can clear the regulatory hurdles and deliver a successful public debut, domestically or abroad, will be a key narrative to watch in the second half of 2025.