Underscoring the growing integration of traditional finance and blockchain technology, BlackRock recently committed €100 million to Ethereum. This marks a significant step for the tokenization of real-world assets. The strategic alliance with Securitize is poised to reshape the financial landscape. It offers unprecedented opportunities for liquidity and transparency in asset management. As Ethereum’s robust infrastructure gains favor over permissioned blockchains, the implications for investors and the broader market are profound.

BlackRock, the world’s largest asset manager, has been a pivotal force in traditional finance for decades. Their recent venture into the blockchain space signifies a major shift in how institutional investors view and utilize decentralized technologies. The decision to leverage Ethereum’s blockchain for asset tokenization over more controlled, permissioned blockchains highlights a growing confidence in Ethereum’s security, scalability, and widespread developer support.

Strategic Alliance and Objectives

BlackRock has entered into a strategic alliance with Securitize. They are a leading digital asset securities firm specializing in the tokenization of real-world assets. This partnership aims to create a tokenized money market fund on the Ethereum blockchain. It will be one of the first of its kind in the financial industry. The fund will utilize Securitize’s technology to digitize shares, making them more accessible and easier to trade.

By partnering with Securitize, BlackRock leverages its expertise in digital securities and Ethereum’s decentralized infrastructure. It enhances the liquidity and transparency of traditional financial assets. The tokenized fund will allow investors to purchase and trade shares more easily. This can reduce the friction and costs associated with traditional asset management processes.

The Case for Ethereum

Ethereum, the second-largest cryptocurrency by market capitalization, has long been recognized for its smart contract capabilities and decentralized applications (dApps). Unlike permissioned blockchains, which are controlled by a single entity or a consortium, Ethereum operates on a decentralized network. That ensures greater transparency and security. This decentralized nature is a key factor in BlackRock’s choice. It aligns with the principles of trust and openness that customers and investors increasingly value in modern financial systems.

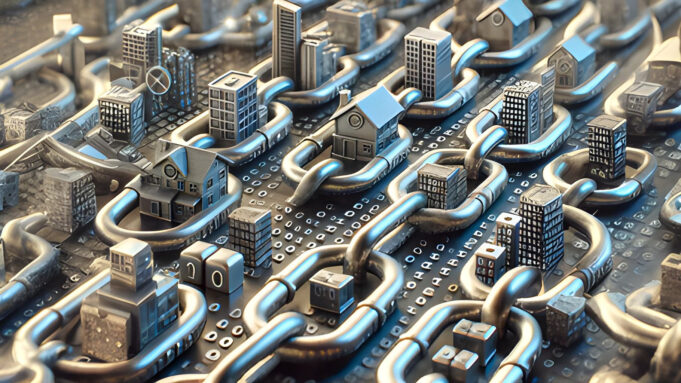

By tokenizing assets on Ethereum, BlackRock aims to enhance liquidity and accessibility. Tokenization refers to the process of converting physical or financial assets into digital tokens on a blockchain. These tokens can represent ownership in assets such as real estate, commodities, or even shares in a fund. The benefits are manifold. It increases liquidity, as tokens can be traded 24/7 on global markets. It improves transparency, as blockchain records are immutable and accessible to all participants. Minimizing intermediaries reduces costs.

Financial Innovation and Market Impact

The endorsement of Ethereum by such a heavyweight in the financial industry is expected to have significant ripple effects. For one, it could lead to a broader acceptance and adoption of blockchain technology in traditional finance. As other institutional investors observe BlackRock’s success, they may be encouraged to explore similar ventures, further driving the integration of blockchain and finance.

Moreover, this move is likely to influence Ethereum’s market dynamics. Historically, major endorsements from influential players have positively impacted the value and perception of cryptocurrencies. Ethereum’s price has already shown signs of bullish behavior following the announcement. Many analysts predict a sustained upward trajectory as the full potential of this partnership unfolds.

A New Era in Asset Management

The tokenization of assets represents a fundamental shift in asset management. Traditional systems often suffer from inefficiencies, lack of transparency, and high intermediary costs. Blockchain technology provides a secure, transparent, and efficient platform to manage assets, addressing those concerns. BlackRock’s commitment to Ethereum is a testament to the technology’s maturity and readiness for mainstream adoption.

Larry Fink, BlackRock’s CEO, has previously expressed interest in the transformative potential of cryptocurrencies and blockchain technology. This latest move aligns with his vision and sets a precedent, too. It demonstrates how traditional financial institutions can innovate by integrating cutting-edge technologies.

>>> Read More: Crypto Controversy: BlackRock vs. JPMorgan – Dueling Visions

BlackRock’s €100 million commitment to Ethereum is more than just a significant investment; it is a strong endorsement of blockchain technology’s future role in finance. By choosing Ethereum and partnering with Securitize, BlackRock is embracing a decentralized, transparent, and efficient model for asset management. This strategic move is set to revolutionize how assets are managed and traded, paving the way for a more integrated and innovative financial ecosystem.

As the financial world watches closely, BlackRock’s bold bet on Ethereum could very well be the catalyst that drives the next wave of blockchain adoption in traditional finance, unlocking new possibilities for investors and institutions alike.

Readers’ frequently asked questions

What exactly is asset tokenization, and how does it work on Ethereum?

Asset tokenization converts physical or financial assets into digital tokens on a blockchain. On Ethereum, smart contracts represent the asset, issuing tokens that signify ownership shares. These tokens can be traded on blockchain exchanges, ensuring transparency and security through immutable transaction records.

Why did BlackRock choose Ethereum over other blockchain platforms for asset tokenization?

BlackRock chose Ethereum for its decentralization, advanced smart contract capabilities, large developer support, and proven track record. Ethereum’s robust infrastructure and reliability make it ideal for institutional investors.

How will BlackRock’s move to tokenize assets on Ethereum benefit investors?

Tokenization on Ethereum offers increased liquidity. It enhances accessibility through fractional ownership, transparency, security, and reduced transaction costs. It enables the creation of innovative financial products, providing new investment opportunities and efficiency in asset management.

What Is In It For You? Action Items You Might Want to Consider

Diversify with Tokenized Assets

Consider exploring tokenized assets as part of your investment portfolio. With BlackRock endorsing and the growing trend towards asset tokenization on Ethereum, these digital assets offer increased liquidity and transparency. Look for opportunities to invest in tokenized real estate, funds, or other traditional assets to diversify your holdings and potentially enhance your returns.

Monitor Ethereum Price Movements

Keep a close eye on Ethereum’s price trends following BlackRock’s substantial investment. Major endorsements from institutional players like BlackRock can significantly influence market dynamics. Stay informed about market news and price analysis to identify potential entry points for buying Ethereum or related assets.

Explore DeFi Platforms

With Ethereum’s growing adoption of asset tokenization, the broader decentralized finance (DeFi) ecosystem is likely to benefit. Investigate DeFi platforms that leverage Ethereum’s infrastructure for innovative financial products and services. Participating in DeFi can provide opportunities for yield farming, staking, and other income-generating activities.

[…] >>> Read more: BlackRock Bets On Ethereum For Asset Tokenization […]

[…] >>> Read more: BlackRock Bets On Ethereum For Asset Tokenization […]

[…] >>> Read more: BlackRock Bets On Ethereum For Asset Tokenization […]

[…] how properties get listed to how payment transactions happen, it is adding speed, clarity, and reliability to a field often bogged down by piles of paperwork, […]