When Tether’s CEO, Paolo Ardoino, posted a photo of goods priced in USDT at a Bolivian airport duty-free shop, it looked like a crypto marketing stunt. But behind the polished shelf lies a deeper truth. In Bolivia, the national currency is collapsing, inflation is climbing, and citizens are turning to stablecoins; out of necessity, not speculation.

As the economy deteriorates, stablecoin dollarization in Bolivia is no longer hypothetical. Tether (USDT) is quietly becoming the functional currency of choice. What began as a workaround is now shaping how people store value, transact, and survive.

The Boliviano Is Breaking Down

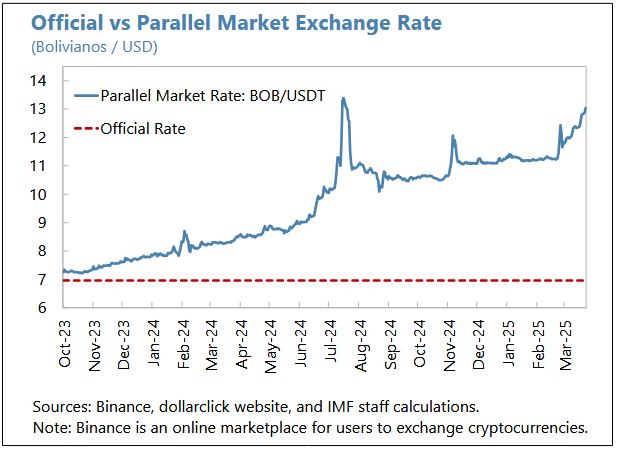

Bolivia is facing a severe economic crisis. Inflation reached 15% year-over-year in early 2025. The black-market rate for U.S. dollars is more than 80% higher than the official rate. Confidence in the Boliviano has evaporated.

The country’s foreign reserves are almost gone. Public debt now stands at 95% of GDP, with deficits over 10% annually. The government is covering these gaps by printing money. Gas exports have collapsed, and Bolivia is now importing fuel, often without enough dollars to pay.

Crypto Moves from Fringe to Everyday

In June 2024, Bolivia lifted its long-standing crypto ban. By October, Banco Bisa launched a USDT custody platform. Users can legally buy, hold, and send stablecoins using a licensed interface. Crypto is now integrated into traditional banking.

Adoption began slowly. But by early 2025, even the state oil firm, YPFB, had started using USDT to import fuel. Though the move was later reversed, it showed something important: crypto was useful, even at the highest levels of government.

At the same time, everyday Bolivians were turning to Tether. Informal merchants and shopkeepers started using it. With the Boliviano losing value and physical dollars scarce, USDT became the next best option.

Stablecoin Dollarization Without a Policy

Bolivia has not officially dollarized. But in practice, citizens are doing it themselves, with smartphones and crypto wallets.

Tether’s appearance at an airport shop may seem symbolic. Yet it mirrors what’s happening across border towns, cities, and informal markets. More businesses are pricing goods in USDT. More consumers are using it to protect their income.

This trend mirrors developments in countries like Argentina and Venezuela, where stablecoins have become a trusted hedge against currency collapse. The difference in Bolivia is speed: stablecoin dollarization unfolded in just a matter of months, with USDT moving from fringe asset to functional currency.

The numbers tell the story. Monthly trading volume via Banco Bisa now exceeds $15 million. Wallet apps like Binance and WhiteBIT have doubled their download rates in the past year. Over 250,000 Bolivians now hold digital assets, mostly stablecoins.

>>> Read more: Argentina Sets New Course with Crypto Registry Initiative

A Lifeboat, Not a Revolution

Most Bolivians aren’t buying crypto for ideological reasons. They are doing it because it works. USDT offers price stability, fast transfers, and functions like a digital dollar in a country that desperately needs one.

When food and fuel are harder to find, crypto becomes a tool. It helps families preserve their savings, bypass unstable banks, and trade in something they can trust. In Bolivia, crypto is not a revolution. It’s a lifeboat.

This shift wasn’t planned. It wasn’t driven by lawmakers. It happened because people needed a way to survive. And in that, it became powerful.

Pushback from the State

The Bolivian government is uneasy. In May 2025, it banned YPFB from using crypto for energy payments. Officials cited fears of losing monetary control and undermining the Boliviano.

But the timing was telling. The ban came just weeks after the government had authorized the same activity. This back-and-forth highlights the tension. Citizens want functionality. The state wants control.

And as crypto use grows, so will this conflict.

A Warning – and a Roadmap

Bolivia is one of the first countries to undergo informal dollarization via stablecoins. But it may not be the last. In other fragile economies, where inflation is high and reserves are low, this could be the future.

What Bolivia shows is simple: dollarization no longer needs a policy. It needs a wallet app.

>>> Read more: El Salvador Bitcoin Policy Shift: IMF Influence at Play?

Those price tags in USDT weren’t just clever marketing. They were a signal. They showed that Bolivia’s national currency has lost its role. Trust has moved to the blockchain.

In a broken economy, trust becomes the currency. And today, in Bolivia, that currency is Tether.

Readers’ frequently asked questions

Is it legal to use USDT in Bolivia?

Yes. Since June 2024, the Central Bank of Bolivia has allowed regulated financial institutions to offer crypto services. USDT is not legal tender, but individuals can hold and transact it through licensed channels like Banco Bisa.

Can I pay in USDT at regular shops in Bolivia?

There is no official mandate requiring merchants to accept USDT, but anecdotal evidence suggests growing informal acceptance, particularly in border towns, urban centers, and duty-free outlets.

What does stablecoin dollarization mean in practice?

It refers to the informal use of stablecoins like USDT as a substitute for the national currency. In Bolivia, this means people are storing value, quoting prices, and settling transactions in stablecoins instead of the boliviano or physical USD.

What Is In It For You? Action items you might want to consider

Monitor stablecoin policy reactions in Latin America

Bolivia’s case could influence how other emerging markets approach crypto in inflationary environments. Watch for regulatory shifts in Argentina, Peru, and Paraguay.

Track merchant acceptance of USDT in Bolivia

Keep an eye on whether more Bolivian retailers display prices in USDT. This can signal deeper informal dollarization and opportunities for wallet providers and fintech startups.

Evaluate risk vs. functionality in stablecoin use

Stablecoins offer convenience but exist in a gray zone in many jurisdictions. Users and businesses in Bolivia and similar economies should assess regulatory risk, custody options, and platform reliability.

[…] >>> Read more: Bolivia Stablecoin Dollarization: Tether as Lifeline […]