The cryptocurrency market witnessed a significant milestone with the approval and launch of spot Bitcoin Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). While this development promises broader market adoption and increased investor participation, it has also set the stage for Coinbase, the world’s largest crypto-trading platform, to face both opportunities and challenges.

The Rise of Spot Bitcoin ETFs

After a prolonged wait, the SEC approved the launch of 11 spot Bitcoin ETFs. The decision marked a pivotal moment for the crypto market. Notable asset management firms, including BlackRock, Franklin Templeton, and WisdomTree, are now entering the digital asset ecosystem. Coinbase is positioned as a custodial partner for these industry heavyweights.

The approval of spot Bitcoin ETFs is expected to expand the investor base, bring institutional players into the crypto space, and enhance market credibility. Coinbase boasts a robust infrastructure and reputation for low transaction costs. It stands as a key player in facilitating the storage and safekeeping of digital assets for these ETFs.

Coinbase’s Legal Battle with the SEC

While the approval of spot Bitcoin ETFs presents a positive outlook for Coinbase, the platform is concurrently embroiled in a legal battle with the SEC. The regulatory body accuses Coinbase of operating as an “unregistered broker-dealer,” a claim vehemently denied by the exchange.

The outcome of this legal dispute holds significant implications for Coinbase’s regulatory standing. If the court rules in favor of Coinbase, it could limit the SEC’s ability to regulate the platform through enforcement actions. However, a contrary decision might introduce uncertainties and challenges for Coinbase’s operations.

Potential Impact on Coinbase’s Stock

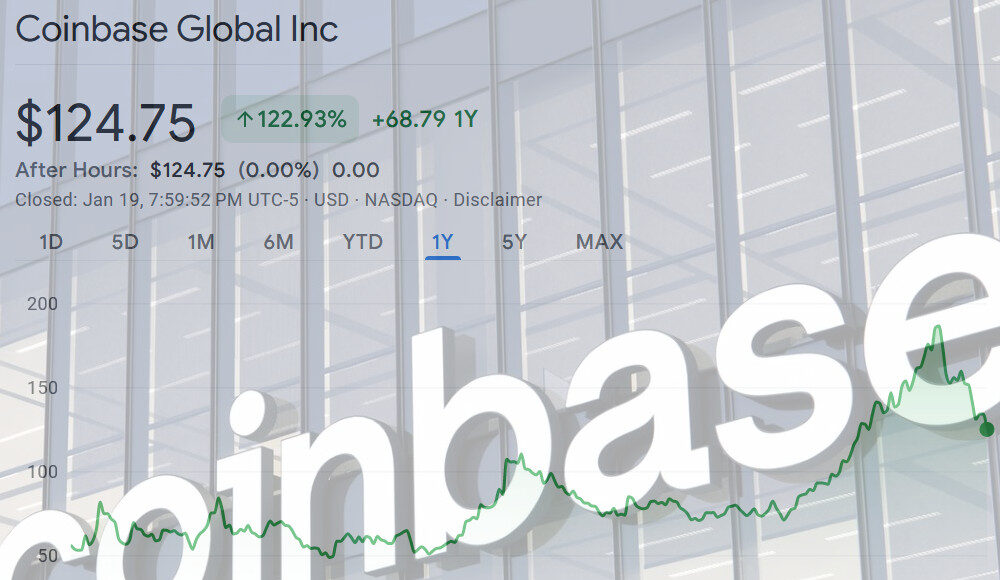

The approval of spot Bitcoin ETFs has undeniably fueled Coinbase’s stock, with its value surging amid increased market anticipation. However, concerns have emerged regarding the potential impact on Coinbase’s core transaction business. As investors gain alternative avenues to access Bitcoin through ETFs, Coinbase’s transaction revenue may face challenges.

Analysts predict that ETFs will manage 10% of the global supply of Bitcoin within five years. This significant shift, equivalent to approximately $300 billion, raises questions about the sustainability of Coinbase’s transaction-based revenue model.

Coinbase’s Response and Strategic Moves

Coinbase remains proactive in diversifying its revenue streams to mitigate potential risks. The company has expanded its services beyond transactions. Subscriptions and services, including custody, interest-earning assets, and staking, now constitute half of its revenue.

Despite concerns about potential revenue impact, Coinbase’s CFO, Alesia Haas, emphasized the positive catalyst that spot Bitcoin ETFs bring to the entire crypto space. The company asserts its commitment to mitigating conflicts of interest and maintaining a positive trajectory.

Looking Ahead

As Coinbase navigates the dual challenges of regulatory scrutiny and the evolving landscape of spot Bitcoin ETFs, the coming months will be crucial. It will determine the platform’s future. Investors and industry observers are closely watching how Coinbase adapts to the changing dynamics of the crypto market and regulatory environment.

In a landscape where legal battles and market innovations converge, Coinbase’s ability to strike a balance between compliance and innovation is crucial. It will shape its role in the ever-evolving cryptocurrency ecosystem.

Coinbase stands at a crossroads, fueled by the excitement of spot Bitcoin ETFs and challenged by regulatory uncertainties. The unfolding events will determine whether Coinbase maintains its stronghold as a leading crypto-trading platform or faces headwinds in the wake of evolving market dynamics.

Read more: Regulatory Showdown – Coinbase Challenges SEC’s Jurisdiction