Coinbase is reportedly in advanced negotiations to acquire Deribit, the world’s largest crypto options exchange. The deal is valued between $4 billion and $5 billion. If finalized, the acquisition would mark a major strategic leap for the U.S.-based exchange. It would thrust Coinbase into a dominant position within the highly lucrative crypto derivatives sector. With rivals like Binance and OKX leading the space, Coinbase’s move signals an aggressive push to diversify revenue. It must meet the growing demand for sophisticated trading products among institutional and retail clients alike.

Closing the Derivatives Gap

According to multiple reports, including Bloomberg and Coindesk, the two firms are in the final stages of negotiation. However, to date, they have not signed a formal agreement. The talks highlight Coinbase’s ambition to expand beyond spot trading, where it currently derives most of its revenue. It wants to establish a stronghold in the global derivatives market, a segment that accounted for over 75% of total crypto trading volume in 2024.

Inside Deribit’s Market Dominance

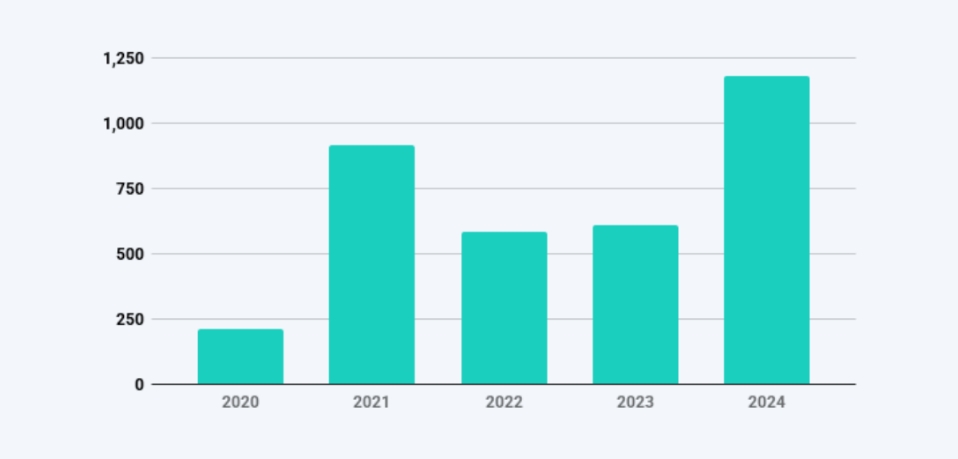

Founded in 2016 and based in Panama, Deribit is a leading platform for crypto options and futures trading. It particularly focuses on Bitcoin and Ethereum derivatives. It commands the lion’s share of the options market, with a reported trading volume of $1.2 trillion in 2024. Its robust infrastructure and deep liquidity have made it the go-to venue for professional and institutional traders seeking leveraged exposure to crypto assets.

A Game-Changing Acquisition for Coinbase

For Coinbase, acquiring Deribit could be a game-changer. While the company already operates a derivatives platform out of Bermuda, its offerings remain limited compared to those of global competitors. Integrating Deribit’s infrastructure and client base could enable Coinbase to instantly scale its derivatives operations. It could quickly close the gap with established leaders like Binance, Bybit, and OKX.

Industry Consolidation and Competitive Pressure

Strategically, this acquisition fits within a broader consolidation trend in the crypto exchange space, particularly around derivatives. Kraken, another U.S.-based exchange, recently acquired futures platform NinjaTrader for a reported $1.5 billion, reinforcing the view that derivatives are the new frontier for growth.

Regulatory Oversight and Jurisdictional Challenges

Regulatory considerations are also central to the deal. Deribit holds a license in Dubai, and both companies have reportedly informed local regulators of the ongoing talks. The handling of this license, including any transfer or reassessment under Coinbase’s ownership, will be a key determinant in the deal’s finalization. Coinbase, which is publicly traded and operates under U.S. regulatory scrutiny, must also weigh the compliance risks of integrating a non-U.S. entity that serves global clients.

A Bet on Market Maturity and Institutional Growth

The move comes amid a resurgence in institutional interest in digital assets, fueled by the approval of U.S. spot Bitcoin ETFs and a general thaw in crypto market sentiment. Derivatives, particularly options and perpetual futures, are increasingly used as essential tools for hedging, speculation, and risk management in a maturing market.

>>> Read more: Deribit Expands with Election-Tied Options

Should the acquisition go through, it would significantly expand Coinbase’s product offering and reshape the competitive landscape of the global crypto market. With Deribit under its wing, Coinbase would position itself to better serve sophisticated traders, boost revenue diversification, and strengthen its footing in a market increasingly defined by advanced financial instruments and regulatory complexity.

[…] and relevance in both spot and derivatives markets continue to expand. A notable development is its recent Deribit acquisition, one of the leading crypto derivatives exchanges. Though the acquisition is still in process, […]