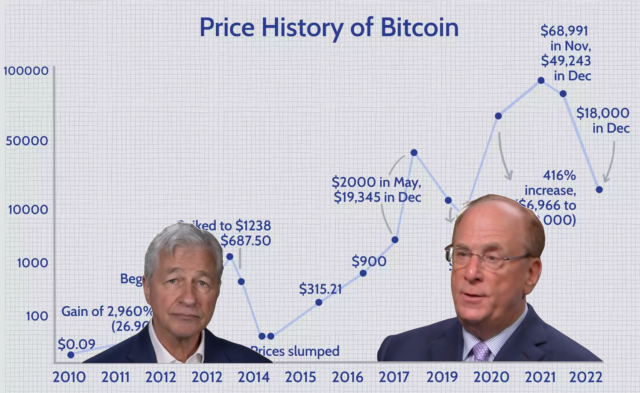

In the ever-evolving landscape of cryptocurrencies, two financial titans have emerged with starkly contrasting views. BlackRock’s CEO, Larry Fink, and JPMorgan’s Jamie Dimon, both influential figures in the finance world, present a fascinating study in the divergence of opinions on the future of digital assets. As crypto skeptics continue to weigh in on the viability of cryptocurrencies, the battle between these two heavyweights captures the essence of an industry at a crossroads.

Larry Fink: Navigating the Digital Frontier

Larry Fink, the visionary behind BlackRock, the world’s largest asset manager, has made waves with his cautiously optimistic stance on cryptocurrencies. While admitting to sharing some sentiments with Jamie Dimon, Fink sees beyond the volatility of Bitcoin, envisioning a digitized currency and blockchain revolution. His recent endorsement of blockchain’s potential and BlackRock’s venture into cryptocurrency investments reflect a forward-thinking approach that contrasts sharply with traditional skepticism.

Jamie Dimon: A Vocal Critic

On the flip side, Jamie Dimon, CEO of JPMorgan Chase, remains a vocal critic of cryptocurrencies, notably Bitcoin. Dimon’s unyielding skepticism was recently reaffirmed during a Senate hearing where he went so far as to suggest banning crypto. Despite his personal reservations, JPMorgan’s strategic involvement in BlackRock’s spot Bitcoin ETF raises eyebrows, showcasing a nuanced relationship between personal opinions and corporate strategies.

Read more: Who Is Calling the Shots at JP Morgan? Jamie Dimon Or …?

The Duel Unfolds: Impact on the Crypto Market

This clash of perspectives between Fink and Dimon extends beyond personal beliefs, influencing market sentiment and investor confidence. The crypto skeptics’ debate reverberates through the industry, prompting questions about the authenticity of Dimon’s anti-crypto stance while actively participating in crypto-related ventures. Investors now face the challenge of deciphering the true motivations behind these contrasting viewpoints.

Crypto Skeptics: A Blessing in Disguise?

Contrary to traditional wisdom, skepticism from major players like Dimon may serve as a catalyst for market growth. Santiment’s data analytics suggest that when a majority of traders express skepticism, it often precedes a bullish trend. This paradoxical relationship between crypto skeptics and market performance highlights the unpredictable nature of the digital asset space.

The Path Forward: Navigating Uncertainty

As the crypto market continues to mature, the clash of perspectives between Larry Fink and Jamie Dimon underscores the industry’s dynamic nature. Investors and enthusiasts must navigate this uncertainty, understanding that the dichotomy between optimism and skepticism is an integral part of the crypto journey. The coming months will likely shed light on whether Fink’s bullish outlook or Dimon’s cautious skepticism will have a more profound impact on the market.

In the battle of crypto titans, Larry Fink and Jamie Dimon stand at the forefront, representing opposing views on the future of digital assets. As the crypto skeptics’ debate unfolds, the market watches keenly, poised for the next chapter in this ongoing narrative. Whether the skeptics inadvertently fuel a crypto surge or the cautious approach prevails, one thing remains certain – the crypto landscape is anything but predictable, and its evolution will continue to shape the future of finance.

[…] Read more: Crypto Controversy: BlackRock vs. JPMorgan – Dueling Visions […]

[…] >>> Read More: Crypto Controversy: BlackRock vs. JPMorgan – Dueling Visions […]