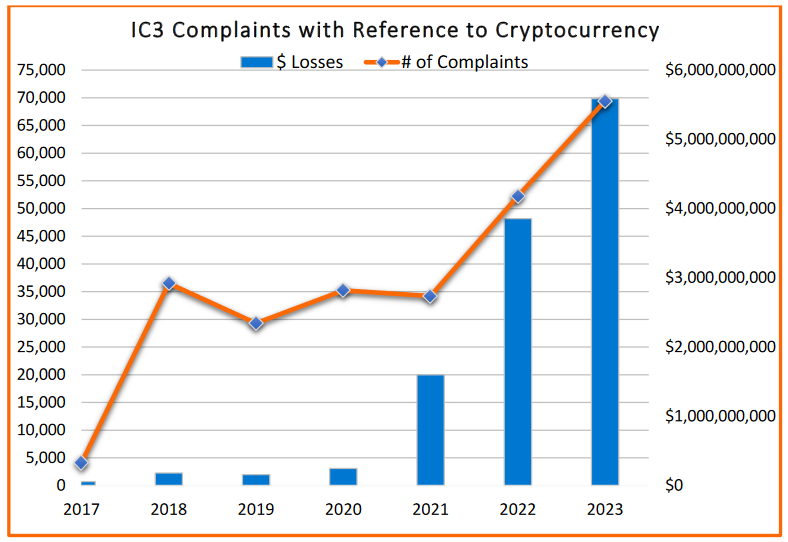

As cryptocurrencies become more mainstream, they also become a prime target for fraud. In 2023, Americans lost more than $5.6 billion in crypto scams, according to an FBI report. Investment fraud made up 71% of these losses, revealing that blockchain technology’s decentralized and anonymous nature has enabled criminals to act with near impunity. The victims, often lured through social media or dating apps, have seen their investments vanish into thin air, leaving them with little recourse. The decentralized system behind cryptocurrencies – once praised for promoting financial freedom – has now emerged as a double-edged sword, making it harder for law enforcement and regulators to tackle the growing wave of crypto-related scams.

Decentralization: A Boon and a Curse

Cryptocurrencies like Bitcoin, Ether, and other digital assets operate on decentralized networks, designed to be transparent, peer-to-peer, and independent of central authorities. This lack of central control was celebrated as a revolutionary way to transfer value without intermediaries, promising greater financial autonomy. However, the same features that make cryptocurrencies appealing to users also make them attractive to criminals.

The anonymity of blockchain transactions – where users’ identities are masked by cryptographic addresses – presents a major challenge for law enforcement. Scammers can transfer funds across borders within seconds, erasing any chance of reversing fraudulent transactions. Unlike traditional financial systems, where centralized institutions like banks can track and freeze suspicious accounts, cryptocurrencies lack these safeguards. This decentralization complicates the recovery of lost funds and reduces the traceability of fraudulent activities.

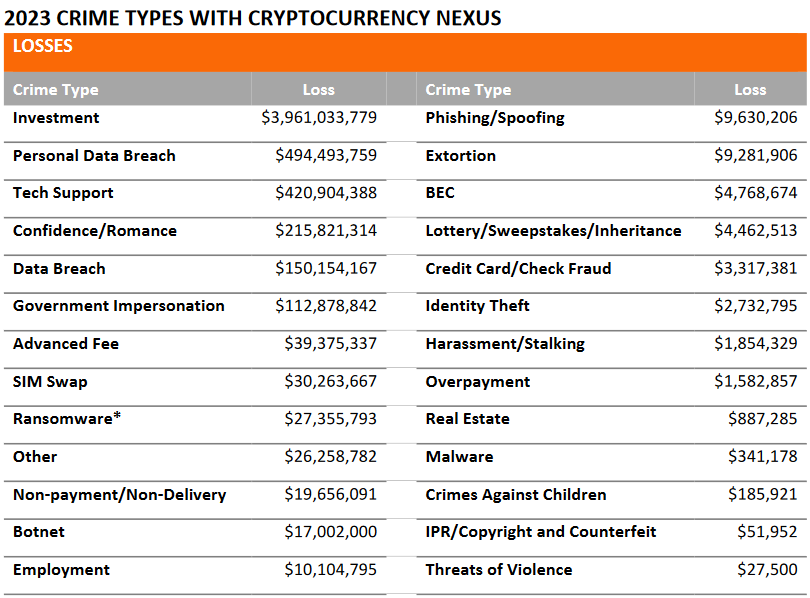

The Investment Fraud Surge

In 2023, investment fraud was by far the most common form of crypto scams, accounting for nearly $3.96 billion in losses. These schemes typically involve criminals posing as legitimate investment advisors or companies, promising extraordinary returns through cryptocurrency investments. They often allow the victims to initially withdraw small amounts, fostering trust before they persuade them to invest larger sums that ultimately disappear. “Pig butchering” scams – where fraudsters build long-term trust through social media or dating apps before draining victims’ assets – are particularly rampant.

The fraudsters exploit the irreversible nature of cryptocurrency transactions. Once the funds are transferred, they cannot be retrieved, even if the fraud is discovered quickly. That is a stark contrast to traditional banking systems, where chargebacks and fraud detection mechanisms provide a level of consumer protection. Scammers also frequently deploy fake recovery services. They lure victims into paying additional money under the false promise of retrieving lost funds.

Who Are the Victims?

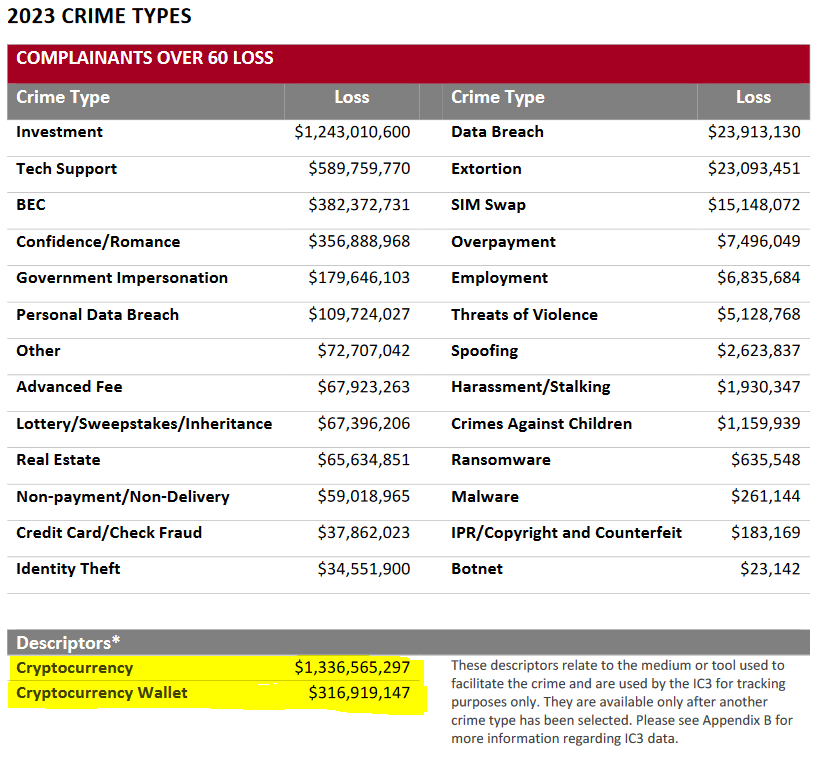

Although crypto scams target a wide range of demographics, older Americans are particularly vulnerable. The FBI reports that individuals over 60 lost approximately $1.6 billion to crypto fraud in 2023. This age group is often less familiar with the intricacies of digital currencies. It makes them prime targets for scammers who capitalize on their lack of knowledge. However, younger individuals, though more technologically adept, are not immune. Scammers tailor their tactics to the strengths and weaknesses of their victims.

The Regulatory Challenge

For regulators and law enforcement agencies, tackling cryptocurrency fraud is an uphill battle. The decentralized architecture of blockchain technology creates jurisdictional challenges since criminals can operate across multiple countries without ever leaving their home base. Additionally, the pseudonymous nature of crypto transactions limits the ability of authorities to identify perpetrators.

Despite these challenges, global regulators and law enforcement are increasingly stepping up efforts to address the issue. The FBI’s Internet Crime Complaint Center (IC3) has intensified its focus on crypto-related fraud. However, the rapid evolution of the crypto landscape means that law enforcement must continuously adapt its strategies.

While blockchain technology has significant potential for positive disruption in areas like finance and supply chains, its decentralized, unregulated nature creates fertile ground for fraudulent schemes. With cryptocurrencies here to stay, creating legal frameworks that balance innovation and security is more pressing than ever.

The rise of cryptocurrency scams highlights the darker side of decentralization. While blockchain’s independence from centralized control has made it an exciting technological advancement, it has also fostered an environment where criminals can exploit users with relative ease. The anonymity, speed, and irreversibility of crypto transactions make it increasingly difficult for law enforcement to trace, recover, or prevent such fraud. As the use of digital assets grows, both users and regulators must grapple with the question of how to protect against these evolving threats without compromising the very freedoms that cryptocurrencies were designed to provide.

Readers’ frequently asked questions

Is it possible to recover lost cryptocurrency funds after being scammed?

Recovering lost cryptocurrency is extremely difficult due to the decentralized and anonymous nature of blockchain technology. Once a transaction is confirmed on the blockchain, it is typically irreversible, unlike traditional bank transfers where funds can sometimes be recalled or frozen. Scammers often take advantage of this by quickly moving stolen funds across different wallets and exchanges to obfuscate their origin. Some victims seek help from recovery services, but these can be scams themselves, further preying on individuals who have already been defrauded. Law enforcement, like the FBI, does make efforts to track and trace larger criminal operations. However, the success rate for recovering individual losses is low due to the international and unregulated nature of many cryptocurrency exchanges.

What can individuals do to protect themselves from falling victim to cryptocurrency scams?

The best protection against cryptocurrency scams is vigilance and skepticism, especially when approached online about investment opportunities. Avoid engaging with unsolicited offers from individuals or platforms promoting too-good-to-be-true returns. One common tactic scammers use is building trust through social media or dating platforms before pitching fraudulent investments. Additionally, it’s crucial to do thorough research before investing in any cryptocurrency or platform. Using well-established, regulated exchanges and wallets with security measures like two-factor authentication can reduce the risk of being scammed. Keeping up with trends in crypto scams, such as “pig butchering” schemes, can help individuals recognize red flags and avoid becoming a victim.

Are governments and regulators doing anything to combat cryptocurrency fraud?

Yes, governments and regulatory bodies are increasingly aware of the need to address the rise in cryptocurrency fraud. The FBI, for instance, has been actively investigating large-scale scams and raising public awareness about the different methods criminals use to defraud people. On a broader scale, countries like the U.S. are working toward clearer regulatory frameworks that could help prevent fraud. However, one of the major challenges regulators face is the global, decentralized nature of blockchain. Cryptocurrency transactions can span multiple countries, making it difficult for a single jurisdiction to enforce anti-fraud measures. Additionally, because many cryptocurrency platforms operate outside traditional financial systems, they may not comply with standard anti-money laundering (AML) or know-your-customer (KYC) regulations, complicating efforts to combat fraud on a global scale. Despite these challenges, collaboration between international agencies is growing, and the regulatory environment is slowly evolving to better address these issues.

What Is In It For You? Action Items You Might Want to Consider

Diversify your research before making any investment

Always research thoroughly before committing to any cryptocurrency investment. Look beyond the enticing promises of quick profits, especially when the offer comes from unsolicited sources online or on social media. Verify the legitimacy of the platform by checking for user reviews, news coverage, or regulatory registrations. Legitimate crypto projects often have clear, verifiable roadmaps, active development communities, and transparent governance structures. Use well-established exchanges and wallets with strong reputations to minimize exposure to fraudulent schemes.

Use cold storage for long-term crypto holdings

To better protect your digital assets from scammers, consider using cold storage options like hardware wallets for long-term crypto holdings. Unlike online wallets or exchanges, cold storage keeps your assets offline and reduces the risk of them being compromised by hackers or scammers through phishing attacks. If you’re an active trader and need to keep some funds online, ensure you’re using platforms with two-factor authentication. Regularly update your security settings!

Stay informed about the latest scam trends

Crypto scams evolve as quickly as the market itself. Stay updated on the latest fraud tactics, such as “pig butchering” scams, where criminals establish relationships with victims before encouraging fraudulent investments. Follow trusted news sources and regulatory announcements to learn about emerging threats and scam types. Being proactive and knowledgeable about the risks will give you the upper hand in identifying red flags before they become costly mistakes.

[…] >>> Read more: Crypto Scams Exploit Decentralization and Cost Victims Billions […]

[…] >>> Read more: Crypto Scams Exploit Decentralization and Cost Victims Billions […]