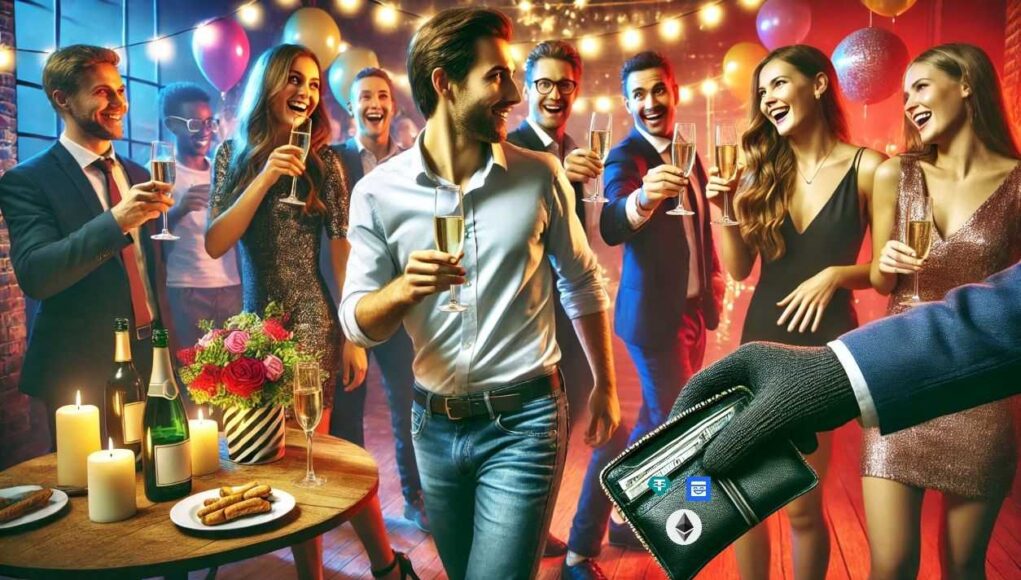

For Suji Yan, the founder of Mask Network, his 29th birthday was supposed to be a moment of celebration. Instead, it turned into a financial disaster. Just hours after marking the occasion, Yan fell victim to a devastating crypto heist. He saw his personal wallet drained of approximately $4 million in digital assets – all within a matter of minutes.

The attack has sent shockwaves through the crypto community. Firstly, because of the amount stolen, but also due to it targeting the high-profile founder of a blockchain company valued at over a billion dollars. If someone as experienced as Yan can be compromised, what does this mean for the security of everyday crypto holders?

The Mechanics of the Hack: How It Happened

Details of how the hack occurred remain unclear, but initial reports suggest the attack was highly coordinated and executed with precision. The breach came shortly after Yan’s birthday celebration, where he allegedly left his phone briefly unattended. This has raised speculation that the hacker may have accessed his private key or executed an offline attack during this window of vulnerability.

Security analysts have confirmed that the stolen funds included a mix of Ethereum-based assets, stablecoins, and Mask Network tokens. Among them were 113 ETH, 923 WETH, 301 ezETH, 156 weETH, 90 pufET, 48,400 MASK tokens, 50,000 USDT, and 15 swETH. Shortly after the theft, the perpetrators swiftly converted the assets into approximately 1,690 ETH and distributed them across at least six different wallets. That made it significantly more difficult to trace and recover the funds.

Tracing the Stolen Crypto: Is Recovery Possible?

The attack has mobilized top blockchain security experts, including teams from SlowMist and ZachXBT, who have begun analyzing on-chain data to track the movements of the stolen assets. While blockchain technology provides a transparent ledger for tracking transactions, the pseudonymous nature of crypto wallets means that identifying the hacker remains a major challenge.

At this stage, no recovery of funds has been reported, and law enforcement agencies continue their investigation. However, in a recent development, Yan has issued a stern ultimatum to the perpetrator. He demanded the return of the stolen funds within 72 hours, warning that failure to comply would result in escalated legal actions involving international law enforcement agencies such as the FBI, Hong Kong Police, and Interpol. Yan has indicated that these agencies are already collaborating on the case and have gathered substantial evidence against the hacker. Additionally, he has offered a bounty for the safe return of the assets, stating that compliance will lead to the cessation of all tracking efforts and closure of the case. If the hacker fails to cooperate, law enforcement actions will intensify. They will blacklist the hacker’s wallet address globally, potentially exposing them and any accomplices to severe legal consequences.

A Wake-Up Call for Crypto Security

Yan has not publicly speculated on who might be behind the attack. He said he would wait for a full analysis from security firms before making further comments. However, the incident raises broader questions about the safety of personal crypto wallets, the security of private keys, and the growing sophistication of cybercriminals.

>>> Read more: How Blockchain Fights Deepfake Scams in Crypto and Media

With billions of dollars in digital assets stored in self-custody wallets, how secure is a private key when even industry leaders fall victim to theft? This event will likely reignite discussions around multi-signature wallets, hardware security measures, and the role of third-party custody solutions in protecting high-value assets.

As the investigation continues, one thing is clear: no one in the crypto space is immune to hacks. Yan’s loss is a harsh reminder that security needs to be an ongoing priority, not an afterthought.

Readers’ frequently asked questions

What is a private key, and why is it so important in crypto security?

A private key is a secret alphanumeric code allowing users to access and control their cryptocurrency. Think of it like the PIN to a bank account. But there is one major difference: if someone gets access to your private key, they have complete control over your funds, and there is no way to reverse a transaction or reset the key. Unlike traditional banking systems where you can dispute fraud, crypto transactions are final. In Suji Yan’s case, the hacker likely obtained his private key and used it to move funds instantly. This is why keeping private keys secure and never sharing them with anyone is crucial for protecting crypto assets.

Why can’t crypto transactions be reversed or blocked like bank transfers?

Traditional financial institutions, such as banks, can freeze accounts, reverse fraudulent transactions, or dispute unauthorized payments. In contrast, cryptocurrencies operate on decentralized blockchain networks. Once a transaction is broadcasted and confirmed on the blockchain, it is permanent and cannot be undone. This design ensures that no single entity (such as a bank or government) can alter records. However, it also means that if funds are stolen, there is no central authority to recover them. This is why crypto users must take proactive security measures to prevent unauthorized access to their wallets.

How can someone tell if their crypto wallet has been compromised?

Signs of a compromised wallet can include unexpected transactions, a sudden drop in balance, or unauthorized access alerts if the wallet provider offers security notifications. Some blockchain explorers, such as Etherscan for Ethereum-based wallets, allow users to check their transaction history and identify suspicious activity. If a wallet is compromised, immediately moving any remaining funds to a secure wallet is the best course of action. Enabling two-factor authentication (2FA) (for wallets that support it), revoking access to unknown third-party applications, and checking for any exposed private keys in past data breaches can also help prevent future attacks.

What Is In It For You? Action Items You Might Want to Consider

Upgrade Your Wallet Security Before It’s Too Late

If a billion-dollar founder like Suji Yan can lose $4 million in minutes, it’s a wake-up call for every crypto trader. Make sure you store your private keys securely. Preferably use a hardware wallet instead of a hot wallet connected to the internet. If you’re using a mobile or browser-based wallet, consider switching to one with multi-signature support or passphrase encryption to add extra protection. The last thing you want is to realize your security setup was weak after an attack.

Monitor Your Wallet Activity Like a Pro

Hacks happen fast – often in minutes – so you need to stay one step ahead. Set up real-time transaction alerts using blockchain explorers (like Etherscan or Solscan). Alternatively, use crypto security services that notify you of suspicious activity. If your funds ever move unexpectedly, you might still be able to transfer the remaining assets to a safe wallet before they’re completely drained. Staying proactive is key.

Don’t Wait for a Hack – Strengthen Your Access Controls Now

Think about who or what has access to your wallets. If you’re logging into exchanges or Web3 platforms from multiple devices, audit your connected apps and revoke unnecessary permissions. Use a separate, secure device for high-value transactions. If you’re really serious about protection, consider a multi-signature wallet requiring multiple confirmations before executing a transfer. Security isn’t something to set and forget – it’s a habit that could save your portfolio one day.