Despite Dogecoin’s recent price decline, the meme-inspired cryptocurrency is witnessing an unexpected surge in network activity. Blockchain data reveals that active addresses have reached a four-month high, signaling sustained user engagement even as DOGE’s price tumbles. This paradox raises critical questions: Is the increase in network activity an early indicator of a market rebound, or does it simply reflect the dedication of Dogecoin’s community? Meanwhile, financial experts warn that DOGE’s speculative nature, combined with declining prices and growing whale accumulation, could contribute to broader market instability.

Price Decline and Whale Accumulation: A Contradictory Landscape

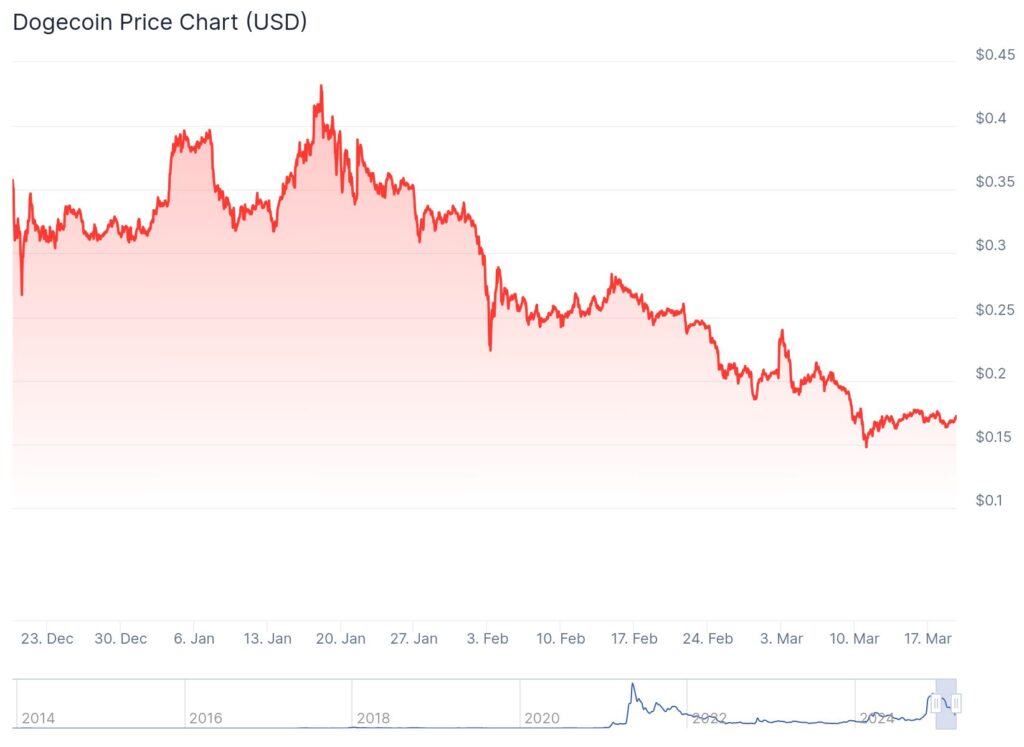

Dogecoin has been on a downward trajectory in recent weeks, aligning with the broader bearish trend in the cryptocurrency market. As of March 18, 2025, DOGE is trading at approximately $0.1683, a sharp decline from its November 2024 peak of $0.47. This drop follows Bitcoin’s 12.71% decrease in Q1 2025, as macroeconomic concerns – such as inflation fears and geopolitical instability – continue to impact risk-on assets.

However, while retail investors have been exiting positions, on-chain data shows that large DOGE whales have aggressively accumulated the token. In the past 72 hours, whales have acquired approximately 1.7 billion DOGE, signaling confidence in the asset’s potential recovery. Historically, increased whale accumulation has preceded significant price swings. It remains uncertain whether this trend points to a rebound or a strategic accumulation before another speculative cycle.

Dogecoin’s Surging Network Activity: A Positive Signal?

Despite its price struggles, Dogecoin’s blockchain metrics tell a different story. The number of active DOGE addresses has reached a four-month high, indicating increased transactional activity on the network. This suggests that more users are interacting with Dogecoin, whether for trading, payments, or transfers.

The increase in active addresses could be attributed to several factors:

- Retail Participation: Lower prices may attract smaller investors, taking advantage of what they perceive as a discount.

- On-Chain Transactions: With the rise in whale activity, large-scale transactions might be driving up address activity.

- Memecoin Popularity: Despite its volatility, Dogecoin remains one of the most recognizable cryptocurrencies. It maintains a strong user base even in bearish conditions.

These network fundamentals present a compelling argument that Dogecoin’s utility and community-driven nature continue to sustain interest, regardless of price action.

Concerns Over Dogecoin’s Speculative Nature

While increased activity suggests resilience, financial analysts caution against interpreting this as a bullish sign. Some experts argue that Dogecoin’s lack of fundamental utility beyond speculation makes it a volatile asset. It’s prone to dramatic price swings.

Additionally, DOGE’s speculative nature has historically contributed to excessive market volatility, drawing comparisons to previous meme coin rallies that ended in sharp corrections. The concern is that while Dogecoin’s blockchain is active, much of this activity might not translate to long-term adoption but rather short-term speculation driven by whale accumulation and market hype.

What’s Next for Dogecoin?

The divergence between Dogecoin’s price drop and its rising network activity leaves the market at a crossroads. If whale accumulation continues and network engagement remains strong, DOGE could be setting the stage for another price surge. However, if broader market conditions remain bearish, this increase in activity could be a fleeting trend rather than a fundamental shift.

>>> Read more: Dogecoin Mania: Is the $1 Dream a Reality or Just Hype?

For now, traders and investors should monitor Dogecoin’s on-chain activity, whale movements, and macroeconomic trends to gauge whether this surge in engagement is a sign of recovery or just another chapter in Dogecoin’s unpredictable journey.

Readers’ frequently asked questions

What does it mean when active Dogecoin addresses reach a four-month high?

The increasing number of active addresses on the Dogecoin blockchain means more wallets are being used to send or receive DOGE within a specific timeframe. This could indicate that more people are trading or using Dogecoin for transactions. However, an increase in active addresses does not necessarily mean the price will rise. It only shows that more transactions are happening on the network. That could be due to various reasons such as increased trading activity, transfers between exchanges, or automated transactions by bots or large investors.

Why do large investors (whales) buy Dogecoin when the price is dropping?

Large investors, or “whales,” sometimes buy more Dogecoin when the price is falling because they believe it is undervalued and expect it to recover in the future. This strategy is known as accumulation, where investors purchase assets at lower prices to sell later at a profit. Another possible reason is that whales could be preparing for a future price movement, such as a rally driven by market events or social media trends. However, their actions do not guarantee price increases. They can also sell off their holdings later, leading to price drops.

Can Dogecoin’s price drop impact the overall crypto market?

Dogecoin’s price movements generally do not substantially impact the broader cryptocurrency market compared to Bitcoin or Ethereum, which have much larger market capitalizations and influence. However, Dogecoin is one of the most popular meme coins. Its volatility can affect market sentiment, particularly for similar cryptocurrencies like Shiba Inu. If Dogecoin experiences extreme price swings, it may influence short-term trading behavior among retail investors, but it is unlikely to trigger significant market-wide effects on its own.

What Is In It For You? Action Items You Might Want to Consider

Keep an Eye on Whale Activity

Large investors have been accumulating Dogecoin despite its recent price decline, signaling a potential price movement shortly. Monitoring on-chain data for large transactions and whale wallet activity can help you anticipate market trends and make informed trading decisions. If accumulation continues, it may indicate a future price recovery. But, if whales start offloading, be cautious of potential downward pressure.

Watch Key Resistance and Support Levels

Dogecoin’s price is currently facing resistance around the $0.19 level, with a potential downside risk if it breaks below $0.14. If you’re considering an entry or exit position, setting alerts for these price levels can help you react promptly to market shifts. Traders looking for a short-term opportunity might wait for confirmation of a breakout above resistance before entering, while those managing risk should be prepared for possible declines.

Stay Updated on Market Sentiment and External Influences

Dogecoin remains highly reactive to broader market trends, social media movements, and Bitcoin’s price action. Keeping track of macroeconomic news, regulatory updates, and sentiment shifts within the crypto community can provide valuable context for your trades. Since Dogecoin’s network activity is rising despite price drops, it’s worth monitoring whether this trend continues or fades. It could indicate either increasing adoption or short-lived speculative interest.