El Salvador, a nation of just over six million people, captured global attention with its audacious adoption of Bitcoin as legal tender in 2021. This experiment, spearheaded by President Nayib Bukele, has evolved into a broader strategy that extends beyond national borders. The country’s latest moves – forming partnerships with Argentina and engaging with 25 other nations – signal an ambition to establish itself as a leader in blockchain-driven diplomacy and economic innovation. At the heart of this effort is an attempt to position cryptocurrencies not only as tools for domestic economic reform but also as instruments of international collaboration.

A Strategic Partnership with Argentina

El Salvador recently signed a collaboration agreement with Argentina, focusing on digital asset technology and regulation. This partnership aims to combine Argentina’s robust blockchain ecosystem with El Salvador’s technological expertise and unique regulatory environment. The collaboration underscores the potential for cross-border cooperation to create a global framework for cryptocurrencies and digital assets.

Juan Carlos Reyes, president of El Salvador’s National Commission of Digital Assets (NCDA), emphasized the importance of shared knowledge and resources. By pooling expertise, the two nations aim to foster innovation while mitigating risks associated with crypto adoption, such as market volatility and regulatory gaps.

Talks with 25 Nations: A Blockchain Consortium in the Making?

Building on its partnership with Argentina, El Salvador has initiated discussions with over 25 nations to form similar agreements. These discussions aim to create a cohesive approach to cryptocurrency regulation and adoption. By aligning with other countries, El Salvador hopes to set the stage for a cooperative blockchain-driven future.

This initiative signals a shift from isolated national policies to collective international efforts. Proponents argue that such collaborations could pave the way for standardized regulations, increased transparency, and reduced risks in the global crypto market.

Leveraging Natural Resources: The “Rent Your Volcano” Proposal

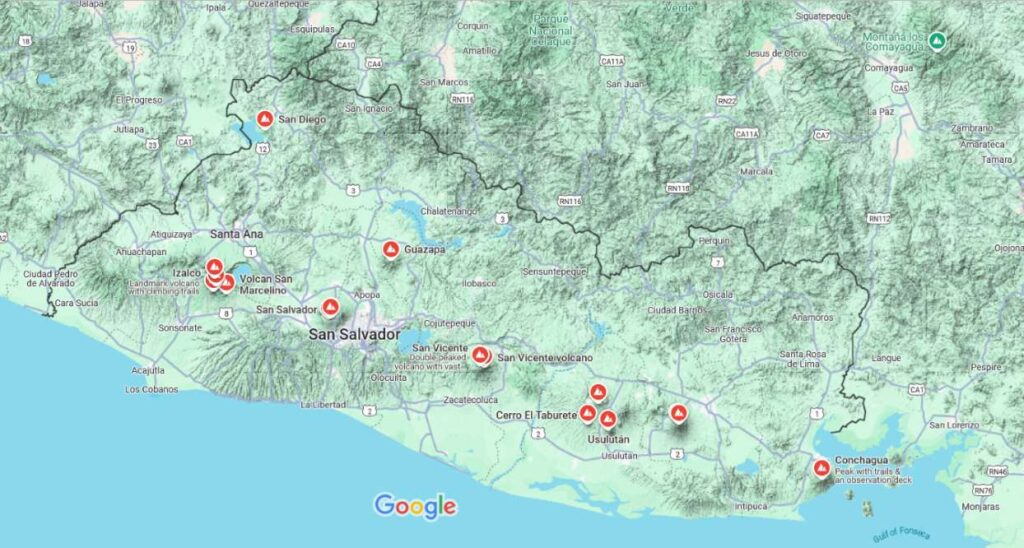

In addition to its diplomatic efforts, El Salvador is exploring innovative ways to integrate cryptocurrency into its economy. President Bukele’s “rent your volcano” initiative proposes leasing the country’s geothermal energy – derived from its numerous volcanoes – to Bitcoin mining operations. This move capitalizes on El Salvador’s natural resources to promote sustainable energy use in the highly energy-intensive crypto-mining industry.

The proposal builds on El Salvador’s existing geothermal Bitcoin mining ventures, which have already produced tangible results. By expanding this program, the government aims to attract foreign investment while reinforcing its commitment to green energy solutions.

Balancing Risks and Rewards

Despite the promise of these initiatives, El Salvador’s crypto strategy has drawn mixed reactions. Supporters praise the country’s pioneering approach. They argue that its efforts could boost economic growth, attract foreign investment, and position El Salvador as a global leader in digital innovation.

Critics, however, caution against the inherent risks of relying heavily on Bitcoin and other cryptocurrencies. Bitcoin’s price volatility remains a significant concern, particularly as the country faces challenges in repaying International Monetary Fund (IMF) loans. Skeptics also question the feasibility of scaling crypto adoption in a country with limited financial literacy and infrastructure.

The Geopolitical Implications

El Salvador’s bold embrace of blockchain and cryptocurrency has far-reaching geopolitical implications. By using digital assets as tools of diplomacy, the country is challenging traditional economic paradigms and fostering new alliances. Its partnerships with Argentina and other nations demonstrate the potential of blockchain technology to reshape international relations.

However, the success of this strategy hinges on navigating the complex landscape of global regulation. Domestic policies must align with international standards. As El Salvador charts this uncharted territory, it serves as a case study for other nations considering similar paths.

>>> Read more: From Ban to Boom – Bolivia Shifts Crypto Strategy

El Salvador’s crypto experiment represents a bold gamble with the potential to redefine the role of digital assets in national and international economies. While the country has made significant strides in leveraging Bitcoin and blockchain technology, its success depends on balancing innovation with practicality. The world will be watching closely as El Salvador continues its journey from a Bitcoin pioneer to a blockchain diplomat.

Readers’ frequently asked questions

What is Bitcoin mining, and how does it work with geothermal energy in El Salvador?

Bitcoin mining is the process of using powerful computers to solve complex mathematical problems that validate and secure transactions on the Bitcoin network. These computers require large amounts of electricity to operate. In El Salvador, geothermal energy—produced from the Earth’s internal heat—is harnessed to power these mining operations. This renewable energy source is both sustainable and cost-effective, making it an ideal choice for running energy-intensive Bitcoin mining activities. El Salvador’s geothermal energy comes from its volcanic activity, giving rise to initiatives like the “rent your volcano” program.

What is a blockchain, and why is it important for these partnerships?

A blockchain is a digital ledger where transactions are recorded in a secure, transparent, and immutable manner. Each transaction is stored in a “block,” and these blocks are linked in chronological order to form a “chain.” This technology is vital for cryptocurrencies like Bitcoin because it ensures decentralized and tamper-proof operations. In the context of El Salvador’s partnerships, blockchain technology enables countries to explore new ways of managing digital assets, improving transparency, and creating secure, efficient systems for cross-border trade and collaboration.

How does El Salvador benefit economically from using Bitcoin?

El Salvador benefits from Bitcoin in several ways. By adopting Bitcoin as a legal tender, the country has attracted international attention and investment, fostering tourism and business interest in its growing crypto ecosystem. Additionally, initiatives like geothermal-powered Bitcoin mining generate revenue and create job opportunities. The government also saves on remittance fees, as citizens can send and receive money using Bitcoin wallets instead of traditional banking systems, which often charge high transfer fees. These benefits collectively contribute to diversifying El Salvador’s economy and promoting technological advancement.

What Is In It For You? Action Items You Might Want to Consider

Monitor the Impact of Global Crypto Collaborations on Regulations

El Salvador’s partnerships with Argentina and talks with 25 other nations signal a move toward standardized international crypto regulations. As a trader, stay informed about developments from these collaborations. They could influence market dynamics, taxation, and compliance requirements in different countries. Keeping an eye on regulatory trends can help you adjust your strategies to remain compliant and capitalize on emerging opportunities.

Explore Opportunities in Renewable Energy-Driven Cryptos

El Salvador’s innovative use of geothermal energy for Bitcoin mining highlights the growing trend toward sustainable crypto practices. Research cryptocurrencies and blockchain projects that prioritize green energy solutions, as they may gain increased attention and investment. Understanding this niche could help you diversify your portfolio into projects aligning with the sustainability movement.

Stay Updated on Bitcoin’s Role in El Salvador’s Economy

El Salvador’s reliance on Bitcoin as a legal tender and its economic experiments provide insights into how cryptocurrencies can integrate with national economies. Pay attention to how Bitcoin’s price movements affect El Salvador’s financial standing. This could create ripple effects in the broader crypto market. Understanding the interplay between Bitcoin and macroeconomic policies may help you anticipate market trends and make informed trading decisions.

[…] have further normalized Bitcoin by enabling seamless transactions for everyday users. In 2021, El Salvador made history as the first country to adopt Bitcoin as legal tender. The move sparked global debate and showcased […]

[…] El Salvador: The first country to adopt Bitcoin as legal tender, El Salvador has continued to invest in Bitcoin and is developing “Bitcoin City” as a crypto-friendly economic hub. The country has also issued Bitcoin-backed bonds, known as “Volcano Bonds,” to attract f… […]

[…] establish a national Bitcoin reserve within a fiat-currency bloc. That would contrast sharply with El Salvador’s 2021 experiment and could reposition Europe as an early institutional adopter. For traders, the message matters […]