The 2024 Global Crypto Adoption Index from blockchain analytics firm Chainalysis underscores a profound shift in the world of digital currencies. Emerging markets, particularly India, Nigeria, and Indonesia, have claimed the top three spots in global cryptocurrency adoption. This reflects a growing trend of cryptocurrencies serving as critical financial tools in economies that lack traditional banking infrastructure. As these regions grapple with economic challenges like inflation, remittance costs, and limited financial inclusion, digital currencies are stepping in as alternative solutions.

India: Crypto Powerhouse Amid Regulatory Hurdles

India’s ascent to the top of the Global Crypto Adoption Index for the second consecutive year is no surprise. The country boasts a vast population with increasing access to the internet and smartphones. That makes it a fertile ground for crypto adoption. However, India’s crypto ecosystem operates under challenging conditions. The Indian government imposed a 30% tax on cryptocurrency capital gains and a 1% tax deducted at source (TDS) on all transactions. They also banned certain offshore crypto exchanges, like Binance and KuCoin. These regulations were implemented to curb speculative trading and increase regulatory oversight.

>>> Read more: Foreign Crypto Exchanges Return to India After AML Compliance

Despite these hurdles, India’s crypto adoption continues to thrive. The country’s tech-savvy population, coupled with a deep distrust in traditional financial institutions, is driving millions of Indians to explore decentralized finance (DeFi) platforms and peer-to-peer (P2P) trading. Use cases such as remittances, digital payments, and investments in stablecoins – pegged to traditional currencies – are becoming more prominent. They provide financial alternatives to people in regions with limited access to banking.

Nigeria: Overcoming Inflation and Financial Instability with Crypto

Nigeria ranks second on the index and has been a focal point for crypto innovation and adoption in Africa. The nation faces significant economic challenges, including persistent inflation and limited access to stable financial systems. Many Nigerians have turned to Bitcoin and stablecoins to hedge against inflation. They are protecting their wealth from the declining value of the local currency, the Naira.

Cryptocurrencies also play a crucial role in facilitating cross-border payments in Nigeria. Remittance fees remain high through traditional channels, so Nigerians turn to digital currencies as a faster, cheaper alternative to transfer funds abroad. This trend is emblematic of how crypto is becoming a necessity rather than a speculative investment in many lower-income countries.

>>> Read more: Crypto Nigeria: Quidax and Busha Gain SEC Approval

Indonesia: A Crypto Growth Engine in Southeast Asia

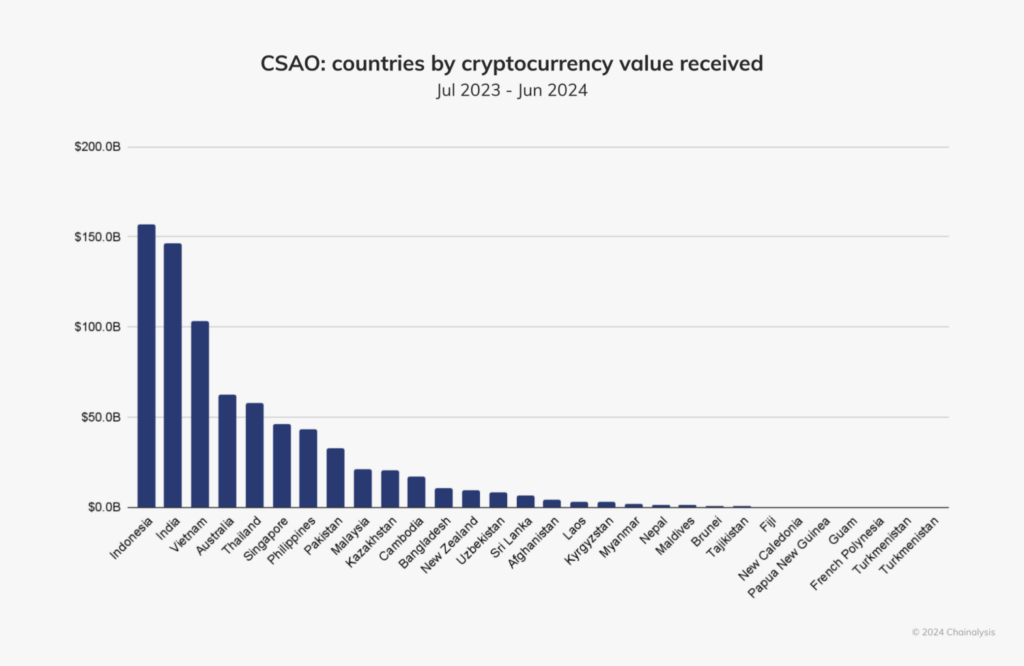

Indonesia, which secured the third spot in the 2024 index, is another emerging market where crypto adoption is skyrocketing. As Southeast Asia’s largest economy, Indonesia is experiencing rapid digitalization. A growing number of people turn to cryptocurrencies for both remittances and investment opportunities. The use of stablecoins is especially significant in this market. They offer Indonesians a stable store of value amid concerns over inflation.

The country’s regulatory framework, though evolving, has been more supportive of crypto adoption compared to some of its global peers. This regulatory environment and the rapid expansion of Indonesia’s internet access enabled the country to position itself as a key player in the global crypto economy.

>>> Read more: Indodax Hack: $22 Million Stolen in Major Crypto Heist

Crypto as a Lifeline in Emerging Markets

A common theme among India, Nigeria, and Indonesia is the essential role cryptocurrencies play in addressing financial problems unique to emerging economies. In wealthier nations, cryptocurrencies are often seen as speculative assets. In these lower-income countries, they serve practical purposes. They enable everyday transactions, protect against inflation, and reduce remittance costs. For many, crypto offers financial inclusion where traditional systems have failed.

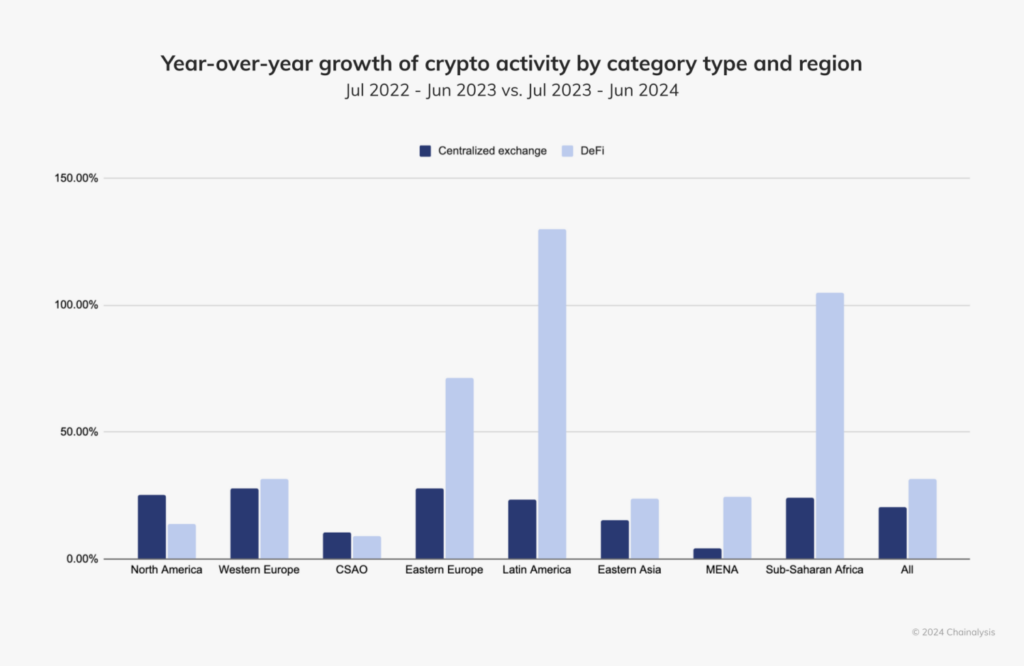

The 2024 Global Crypto Adoption Index also highlights that the trend is not limited to these three countries. Other nations in Central and Southern Asia, Sub-Saharan Africa, and Latin America are also making significant strides in crypto adoption. Seven of the top 20 countries in the index hail from Central and Southern Asia. That includes Vietnam and the Philippines, indicating a broader regional trend.

The New Crypto Frontier

As emerging economies lead the charge in cryptocurrency adoption, it’s clear that the role of digital currencies is evolving. No longer just a speculative asset, cryptocurrencies in regions like India, Nigeria, and Indonesia are becoming indispensable financial tools. In these markets, digital currencies offer solutions to real-world financial challenges, from high inflation and unstable currencies to high remittance fees and limited access to banking services. As the global economy continues to digitize, these emerging markets are proving that cryptocurrency adoption is not just a trend – it’s a financial lifeline.

Readers’ frequently asked questions

Why is cryptocurrency adoption higher in emerging economies like India, Nigeria, and Indonesia compared to wealthier nations?

Cryptocurrency adoption is particularly strong in emerging economies because these regions often face systemic challenges in their traditional financial systems. In countries like Nigeria, where inflation is rampant, and access to stable banking systems is limited, cryptocurrencies offer a viable alternative for protecting wealth. Cryptocurrencies, especially stablecoins, are seen as safer stores of value compared to volatile local currencies. Additionally, high remittance costs in countries like India and Nigeria make cryptocurrencies an attractive option for cross-border transactions. It allows people to send money to family members abroad without the high fees associated with traditional banking channels.

In contrast, in wealthier nations, traditional financial services tend to be more reliable. Therefore, cryptocurrencies are often viewed more as speculative investments rather than necessities. While crypto adoption in developed countries is growing, it’s primarily driven by investment opportunities rather than the need for everyday financial services.

How are governments in these emerging economies responding to the rise of cryptocurrency?

Governments in emerging economies have adopted a range of responses to the rise of cryptocurrencies, from stringent regulations to cautious acceptance. India, for instance, has imposed high taxes on cryptocurrency transactions – 30% on capital gains and a 1% tax deducted at source (TDS). It also banned certain foreign exchanges like Binance and KuCoin. These measures are aimed at reducing speculative trading and improving oversight, although they have not significantly dampened overall adoption. Many users have turned to decentralized finance (DeFi) platforms to avoid these restrictions.

Nigeria, while initially hesitant, has seen the government attempt to regulate the sector, primarily to curb the use of cryptocurrencies for illicit activities. However, citizens have continued to embrace cryptocurrencies for remittances and as a hedge against inflation. Indonesia, on the other hand, has been relatively more open, encouraging growth while introducing regulatory frameworks to monitor the sector. This more progressive approach has helped boost adoption rates in the country.

What role do stablecoins and decentralized finance (DeFi) play in the growing crypto adoption in these regions?

Stablecoins and decentralized finance (DeFi) platforms play a crucial role in the widespread adoption of cryptocurrencies in emerging economies. Stablecoins, which are pegged to traditional fiat currencies, provide a much-needed solution for those in countries with high inflation or volatile currencies. In Nigeria, for example, stablecoins are often used to protect savings from the depreciating value of the local naira, while in India and Indonesia, they are used for remittances and day-to-day transactions.

DeFi platforms, meanwhile, are gaining traction as they allow users to bypass centralized financial systems that may be subject to high fees, bureaucratic delays, or government-imposed restrictions. Through these platforms, users can trade, lend, and earn interest on their crypto holdings without relying on traditional banks. In India, where crypto exchanges face high taxes and heavy regulation, DeFi offers a flexible alternative for those looking to remain active in the crypto ecosystem.

Together, stablecoins and DeFi are enabling financial inclusion for millions who were previously underserved by traditional banking systems.

What Is In It For You? Action Items You Might Want to Consider

Explore Stablecoins for Risk Management

Given the rising use of stablecoins in emerging economies like Nigeria and Indonesia to protect against inflation, you should consider incorporating them into your portfolio. Stablecoins can provide a safe haven during volatile market conditions, especially if you trade in regions with unstable currencies. They offer a balance between staying within the crypto ecosystem while minimizing exposure to high market volatility. For example, holding USDC or USDT might give you stability without leaving the digital asset space.

Look Into Decentralized Finance (DeFi) Platforms

India’s growing use of DeFi platforms, particularly in response to strict government regulations on centralized exchanges, is a trend worth noting. DeFi offers you the ability to trade, lend, and earn interest on your holdings without the constraints of traditional financial institutions or centralized platforms. Explore lending protocols or decentralized exchanges (DEXs) like Uniswap or Aave to increase your exposure to crypto opportunities while avoiding high fees or heavy taxation.

Consider Emerging Markets for Crypto Investment

As emerging economies like India, Nigeria, and Indonesia lead global crypto adoption, it’s wise to monitor market movements in these regions. Keep an eye on local crypto trends, regulatory shifts, and how new platforms are developing in these areas. These markets offer unique opportunities, especially as they embrace crypto to solve real-world financial issues. Exploring investments or partnerships with projects based in these regions could give you early exposure to rapidly growing crypto sectors.

[…] Southeast Asia seeing record crypto adoption and Indonesia alone counting over 20 million crypto users in 2024, the region is no longer just […]

[…] players, the program offers entry into a large but underserved market. Pakistan is one of the top countries in crypto adoption by population. However, its market remains dominated by peer-to-peer trading and offshore platforms […]